May 16 2019 – In 1942, George Balanchine asked his friend Igor Stravinsky to compose a ballet for the Ringling Bros. and Barnum & Bailey Circus elephants. The “Circus Polka: For a Young Elephant” was performed in the Spring of 1942 – to great acclaim — by fifty elephants in pink tutus and fifty ballerinas. It is said that contemporary reviews directed most of the praise to the elephants, not Balanchine’s ballerinas.

This precedent of dancing elephants provides some hope for the choreographic efforts of two modern-day elephants: the United States and China. On the world stage, the United States’ share of global exports in 2017 was 8.72% , and the share of global imports was 13.37%, ranking the U.S second in the world in the absolute value of global exports and first in the world in global imports. For the same time period, China’s world share of exports was 12.77% and world share of imports was 10.22%, or first in exports in absolute dollars and second in imports (all numbers provided by the World Trade Organization Country Profiles, 2019). The image of these two countries as elephants is not without merit: both economies are hard-working beasts of burden upon which the development and growth of the global economy is dependent. And like elephants, while they are huge and lumbering, there is considerable grace and beauty in their rhythmic sway to the music of growing populations, rising incomes and changing technologies. Unlike some reviews of the Circus Polka, however, it is important to acknowledge the “ballerinas” that establish the character of the economy, especially in the United States – dynamic small businesses, high tech (including robotics and AI), medical research and innovation, financial industry advancements and Steph Curry.

The question has now arisen as to whether these elephants want to dance together, and what the implications are for the global economy if they choose to take their tutus and go home. The very appearance of this question is so unexpected, so counter to the conventional wisdom of the past 50 years, that it is completely appropriate to observe that there may not be reliable answers, although there will be no shortage of answers proffered. Economic arguments that usually describe the choreography of negotiation and the beauty of the dance partnership may not be the defining elements this time around.

On both sides of the Pacific Ocean, decisions are being heavily influenced by nearer term populist goals and long-term positioning for regional power. In China, government advisors advocating for actions consistent with national pride have a louder voice than ever before. Furthermore, well-known Chinese intentions to expand economic influence in Eastern Asia and the Middle East may appear more consistent with walking away from the negotiating table than concluding a trade deal defined by US demands. Thus, while the answers everyone wants are economic answers, the decisions are potentially driven by policy and ideology. For investors everywhere, this is a brave new world where dynamic risk assessment, flexibility and a nuanced understanding of policy formation is more valuable than economic models and spreadsheet analyses.

What are some of the more significant risks of the current US and China impasse on trade, with a particular focus on the contrary view that NO trade deal happens?

Slower economic growth in both the United States and China. The business “friction” associated with the necessity to adjust business operations to new tariffs, new geographic end-markets and new operational locations has a medium-term economic cost, representing anywhere from two-tenths to half a percentage point of GDP. In both countries, there is an ability to mitigate this slowdown through fiscal spending—in the United States using infrastructure spending and farm subsidies and in China using government projects and easy credit. It is a common thought that US businesses choosing to bring supply and production back to the United States to avoid tariff costs will generate employment growth to offset an economic slowdown, but this may not be useful solace; firms moving production back to the United States are likely to increase their use of automation to keep costs low and avoid the current tight labor market.

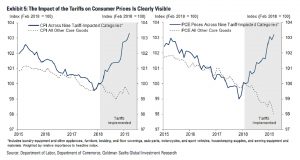

Challenges to business earnings growth. Tariffs raise production costs in both countries, a development that can be especially problematic if sales growth slows at the same time. Given the current strength of the US economy, final product prices for many goods can be raised in the short term to protect earnings, although not in highly competitive commodity industries. As shown in the chart below, there is existing evidence that tariffs do serve to raise consumer prices. If consumers respond by curtailing their expenditures, economic growth slows further, with a follow-on impact on earnings.

Rising budget deficits. Strong political motivation to avoid popular dissatisfaction with unemployment and inflation (in China it would be incorrect to call this electorate unrest, but the unrest is still a political concern) will be addressed with fiscal spending, as mentioned above. In the longer term, this will lead to financial instability – problems in China’s notoriously fragile banking industry, rising interest rates or intractable budget fights in the United States. It is a well-know truism that budget deficits inflict their pain on subsequent generations, and this is likely to be the case in this situation as well.

Re-structured global economic and political power. To preserve growth and prestige, China will increase and intensify its efforts to establish trade partnerships in Eastern Asia, the Middle East (including Iran), Africa, South America and parts of Europe. The United States will become more dependent on trade relationships with Canada, Mexico and Europe, despite the friction with these trading partners over the last two years. And it is sad but true that issues of economic power historically have correlated with direct and/or indirect military activities.

Hold onto your hats, ladies and gentlemen. The performance of the dancing elephants is unlike any seen in a great long while and may take your breath away. Let’s hope the choreography doesn’t lead to the US ballerinas getting crushed. Thank goodness for Steph Curry.

“The Greatest Show On Earth”, indeed.

Disclosure

Investment advisory services offered through Robertson Stephens Wealth Management, LLC (“Robertson Stephens”). Robertson Stephens is an SEC-registered investment advisor and wholly owned subsidiary of Robertson Stephens Holdings, LLC (“RSH”). RSH is majority-owned by investment funds managed by partners of Long Arc Capital, LP (“LAC”), a private equity investment firm, and receives management and strategic advisory services from LAC-related entities. The information contained within this letter was carefully compiled from sources believed to be reliable, but Robertson Stephens cannot guarantee its accuracy or completeness. This material is for general informational purposes only, does not constitute investment advice or a recommendation or offer to buy or sell any security, has not been tailored to the needs of any specific investor, and should not provide the basis for any investment decision. Information, views and opinions are current as of the date of this presentation and are subject to change. Indices are unmanaged and reflect the reinvestment of all income or dividends but do not reflect the deduction of any fees or expenses which would reduce returns. Past performance does not guarantee future results. Investing entails risks, including possible loss of principal. Robertson Stephens does not provide tax advice and any discussion of U.S. tax matters should not be construed as tax-related advice. © 2019 Robertson Stephens Wealth Management, LLC. All rights reserved. Robertson Stephens is a registered trademark of Robertson Stephens Wealth Management, LLC in the United States and elsewhere.