June 7 2019 – Veteran observers of the Federal Reserve (aka “Fed Watchers”) know that the lodestar of monetary policy is the Fed’s unflinching commitment to its long-established, Congressionally-directed mandate:

“ . . .to support three specific goals: maximum sustainable employment,

stable prices, and moderate long-term interest rates.”

www.federalreserve.gov

There are many times when the three goals conflict with each other, and the Federal Reserve must choose to prioritize one or two above the others. Historically, that choice has been governed by the somewhat amorphous concept of guarding the fabric and structure of the U.S. economy, which as a practical matter has tended to favor protecting employment. The actions of the Federal Reserve in the 2008-2009 financial crisis can be viewed as a reflection of this decision-making.

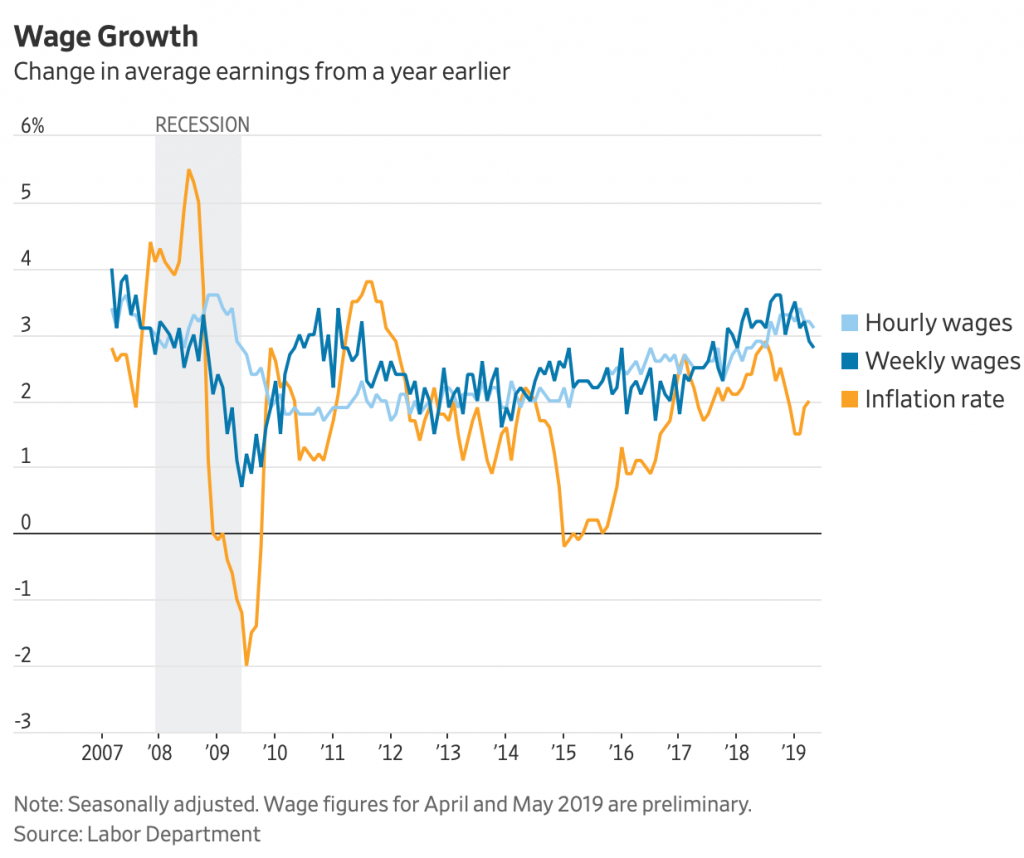

With the current (May 2019) US unemployment rate at 3.6%, inflation at 2% and the yield on a 10 Year US Treasury bond at 2.1%, it would seem that the Federal Reserve Board of Governors could declare victory and hang out for the summer in a tikki bar with a cold, flower-garnished adult beverage. Yet they seem to be instead simultaneously loading up their Starbucks cards and stockpiling Prozac.

Increasingly, Fed Chairman Jerome Powell and his fellow members of the Board of Governors are attempting to ascertain the direction of employment and prices in light of developments that have very little to do with cyclical economic issues. Tariffs and threats of tariffs are artificial, political interruptions in the natural interaction of supply and demand in the US economy. Demographic changes associated with longer life spans and lower birth rates are long term influences on growth and inflation that we have not seen before in the United States. On June 6, Federal Reserve Bank of New York President John Williams called for central bankers to “reassess their strategies, goals, and the tools they use to achieve them”, directing his remarks not just at US monetary policy-makers, but also those setting monetary policy abroad. Given the enormous controversy that erupted over the Fed’s unconventional policy actions during and after the above-referenced 2008-2009 financial crisis — “Quantitative Easing” alone caused enough hyperventilating to sustain the paper-bag industry for several years – one can only wonder what kind of reception Federal Reserve President Williams’ new tools will receive. But the real problem is that the only tool that the Fed currently has is the money supply (and its associated influence over short term interest rates) and no one seems to be certain how to use even that tool in this situation.

Chairman Powell addressed a Stanford Institute for Economic Policy Research conference in early March wherein he elaborated at length on the setting of inflation targets, a long-standing approach to fulfilling the mandate for price stability. In the United States and Europe, monetary authorities have generally recognized 2% inflation as desirable for a growing, thriving economy. Chairman Powell ruminated on an approach that would target an average rate of inflation over some unspecified time period, allowing the Fed to accept much higher rates of inflation if those rates followed an extended period of inflation rates well below 2%, such as what we have just experienced in the US. The goal of such an approach seems to be to be to ensure that the Fed doesn’t make a “policy mistake”, raising interest rates at the slightest whiff of 3% inflation and cutting off economic growth in the process. It was just this scenario that appeared to concern equity markets in the fourth quarter of 2018.

Jerome Powell is a businessman, not an economist, and this may be his blessing (As sung by Willie Nelson, “Mama don’t let your babies grow up to be economists”) Nevertheless, economic theory exists in part to keep policy-making from running off the rails. No one at the Fed has yet followed through on officially redefining the inflation target. It could be that Federal Reserve researchers have pointed out that utilizing an “average rate of inflation target” runs the risk of a different type of Fed mistake, a mistake that too-readily accepts price volatility, not stability, and fails to act quickly enough to address either rising inflationary expectations or corrosive deflation.

Those uninitiated in the art of Fed Watching may not understand the degree of fear deflation strikes in the hearts of central bankers, especially in light of the real-world example of Japan. Central bankers know, or think they know, how to stop runaway inflation; Paul Volcker’s credit controls in 1981 are an extreme but notable example. The effect of falling prices on Japanese final demand—causing consumers to postpone major purchases (cars, household appliances, etc.) in anticipation of lower prices in the future – and the resultant decade-long recession is what qualifies as a horror movie for monetary theorists. And the Japanese demography of an aging population and slowing labor force growth that contributed to the economic stagnation is precisely the demographic problem wearing on the minds of people like Fed President Williams.

Into all of this focus on inflation targets, politically-motivated tariffs and the possible impact on economic growth have landed on the Federal Reserve’s desk like a bento box of month-old sushi. Paradoxically, the reaction of equity markets to what appears to be an increasingly alarmed Federal Reserve suddenly focused intently on a possible trade/tariff related slowdown in US economic growth is one of glee. If the Federal Reserve truly is seeing a threat to economic growth in the next six months from trade barriers, lost foreign markets and rising production costs, what exactly are cuts in short term interest rates going to do? If the slowdown in home purchases and auto sales is because of demographics, how will declines in mortgage rates and lower-cost dealer financing change anything appreciably?

What DOES the Fed suddenly see that has moved them so rapidly from the view of just a few months ago, a view that judged interest rates to be appropriately “neutral”, i.e. neither expansionary or contractionary, as befitting an economy with a very tight labor market and approximately 3% economic growth? Could it be . . . Stagflation? “Stagflation” has become the Bigfoot of macroeconomic forecasting, a much rumored and seldom reliably seen combination of slowing economic activity and rising prices. But in April, the fuel to growth from trade appears to have been reduced: both US exports and US imports fell. In May, a much-watched IHS Markit Survey Index of US manufacturers fell to a nine-and-one-half-year low and a similar IHS survey of service industries hit a 39 month low; both survey indices remain at levels associated with growth, but the precipitous nature of the decline has caught the attention of many. At the same time, inflation has accelerated with notable price increases in products impacted by tariffs. It is quite possible that this time the Stagflation Bigfoot sighting will be verified.

Stagflation Bigfoot is much preferred to Deflation Freddy. But this still might become worthy of an extra-large bag of popcorn. And some of that Prozac.

Disclosure

Investment advisory services offered through Robertson Stephens Wealth Management, LLC (“Robertson Stephens”). Robertson Stephens is an SEC-registered investment advisor and wholly owned subsidiary of Robertson Stephens Holdings, LLC (“RSH”). RSH is majority-owned by investment funds managed by partners of Long Arc Capital, LP (“LAC”), a private equity investment firm, and receives management and strategic advisory services from LAC-related entities. The information contained within this letter was carefully compiled from sources believed to be reliable, but Robertson Stephens cannot guarantee its accuracy or completeness. This material is for general informational purposes only, does not constitute investment advice or a recommendation or offer to buy or sell any security, has not been tailored to the needs of any specific investor, and should not provide the basis for any investment decision. Information, views and opinions are current as of the date of this presentation and are subject to change. Indices are unmanaged and reflect the reinvestment of all income or dividends but do not reflect the deduction of any fees or expenses which would reduce returns. Past performance does not guarantee future results. Investing entails risks, including possible loss of principal. Robertson Stephens does not provide tax advice and any discussion of U.S. tax matters should not be construed as tax-related advice. © 2019 Robertson Stephens Wealth Management, LLC. All rights reserved. Robertson Stephens is a registered trademark of Robertson Stephens Wealth Management, LLC in the United States and elsewhere.