August 15, 2019

Jeanette Garretty sat down to discuss financial market conditions with her colleague, Michael Zaninovich, after the close of US markets on Tuesday. The following is a transcript of their discussion.

JG: Michael, the markets are having another bout of volatility here in August. What do you see as the primary causes?

MZ: I would say the three most important factors driving volatility in the last two weeks are growth fears, ongoing concerns about the impact of US-China trade friction, and concerns over what lower interest rates mean for the economy.

On the first point, we have had weak economic data out of Europe recently, which was highlighted by yesterday’s report that German GDP actually contracted slightly in the second quarter. While the economy declined only modestly, most of it was due to a weak trade environment while domestic indicators were generally positive. Recent data out of China has been mixed but the industrial production numbers reported yesterday were on the weaker side. On the bright side US consumer spending has been solid recently as evidenced by this morning’s better-than-expected earnings report from Walmart.

As far as the US-China trade negotiations are concerned, we had some good and some bad news on Monday. On the good news side of the ledger, the administration decided to delay the 10% tariff on 60% of the targeted Chinese imports from the original start date of September 1st until December 15th. The bad news is that the other 40% of the targeted imports are now likely to take effect on September 1st per the President’s announcement on August 1st.

Lastly, the recent ‘inversion’ of the spread between the 2- and 10-year yield is receiving a lot of coverage in the financial press as a harbinger of an eminent recession. However, the predictive value of this ‘inverted’ yield curve is fairly low as it has only correctly predicted a recession three of the last ten times a recession has occurred since the 1960’s. For those seven times a recession did not directly follow the inversion, the time lag from the inversion to the onset of a recession has ranged from 8 to 22 months.[1]

JG: As you have already mentioned, Europe is contributing to the overall sense of uncertainty regarding global trade and economic growth. To what extent are you concerned about the political turmoil in Great Britain and Italy?

MZ: I think that both of those countries’ domestic political situations are cause for concern, but individually their impact is less than the other issues we discuss above. It looks like Italy will be getting another new government in the next few months. The political outlook in the UK is less certain.

JG: In the US, equity market volume is always notoriously low in August (supposedly because of summer vacations), serving to exacerbate market swings. Has that been the case this year and, if so, why does it lead to an increase in volatility? (And what do you expect in September when volume returns to a more normal level?)

MZ: That’s a great point Jeanette. Trading volume is historically much lower in August and early September than other months which can magnify market swings both up and down. Historically August and September also have lower returns than other months. As they say in the investment business: “the summer doldrums”.

JG: Does the current environment remind of you of any other periods of high volatility? If so which ones and how did the markets perform?

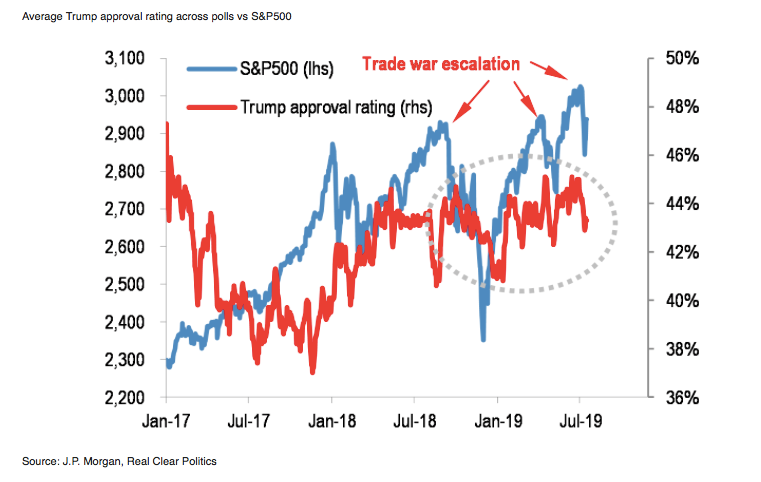

MZ: I actually think that the current markets are not dissimilar to other market sell-offs we have seen since 2015. If you look at 2015 and 2016, the global economy slowed down due to the crash in oil prices, a devaluation of China’s currency, and uncertainty about the US elections. In reaction to declining global growth and volatile stock markets the Federal Reserve paused in raising interest rates and global growth eventually recovered right around the time of the US election. This in turn catalyzed a strong global equity market rebound in 2017. This time many of those factors are the same. But, for me, there are two major differences between 2019-2020 and 2015-2016: 1) the deterioration of US-China relations and the debilitating impact on global trade; and 2) the fact that the business cycle is four years older and one of the longest on record. I believe that the chances of a recession this time around are higher than fours year ago, but most economists still believe the US economy will grow between 1.5-2% next year. Of course, much still depends on how long it takes the US and China to agree on a new framework for trade relations, and whether the Federal Reserve is proactive in safeguarding growth by lowering interest rates. These are the two most important issues we are monitoring when we consider how to adjust client portfolios. In the last year, extreme market volatility has caused the President to back off on his trade rhetoric. We will see if the markets force him to back off again this time around. (See Exhibit 1 below)

Exhibit 1

JG: How about corporate earnings? How have they held up in this volatility?

MZ: Earnings have been interesting in the second quarter. They have generally been better than expected, but that is typical; executives deliberately set the bar low for themselves—especially during this uncertain environment — during the quarter, making it easier to exceed expectations when they report. Under the surface it is clear that companies who manufacture globally traded goods are doing much worse than companies who are domestically focused and in the service sector. According to Factset, companies generating greater than 50% of their revenues domestically saw their earnings increase 3.2% in the second quarter. Conversely companies who generated less than 50% of their revenues from the US saw their earnings decline 13.2%.[2] This is why our portfolios are largely tilted towards US companies that have more stable growth and are domestically focused. Analysts currently expect earnings growth to be relatively flat in the 3rd quarter and then resume growing again in the fourth quarter. For 2020, the expectations in the market are for 9% earnings growth. We think this number may be a little optimistic and would expect some downward revisions as we move through the third quarter.

JG: Are stock prices overvalued given that the market is still close to all-time highs?

MZ: As a general comment equity markets around the world are close to their five-year and 10-year average valuations on most metrics. On the whole international markets are cheaper than the US but also carry more risk in the current environment. Most parts of the fixed income market, on the other hand, are very overvalued based on historical interest rate levels. Unless we go into a recession in the next year, we would expect the return on high quality bonds to be relatively low reflecting the current historically low bond yields.

Sources

[1] “Yield Curve Inversion: A Sheep in Wolf’s Clothing”, Goldman Sachs Research, August 2018

[2] Factset Earnings Insight, July 29th, 2019

Disclosure

Investment advisory services offered through Robertson Stephens Wealth Management, LLC (“Robertson Stephens”), an SEC-registered investment advisor. The information contained herein was carefully compiled from sources believed to be reliable, but Robertson Stephens cannot guarantee its accuracy or completeness. This material is for general informational purposes only, does not constitute investment advice or a recommendation or offer to buy or sell any security, has not been tailored to the needs of any specific investor, and should not provide the basis for any investment decision. Information, views and opinions are current as of the date of this presentation and are subject to change. Indices are unmanaged and reflect the reinvestment of all income or dividends but do not reflect the deduction of any fees or expenses which would reduce returns. Past performance does not guarantee future results. Forward-looking performance targets or projections are not guaranteed and may not be achieved. Investing entails risks, including possible loss of principal. Robertson Stephens does not provide tax advice and any discussion of U.S. tax matters should not be construed as tax-related advice. © 2019 Robertson Stephens Wealth Management, LLC. All rights reserved. Robertson Stephens is a registered trademark of Robertson Stephens Wealth Management, LLC in the United States and elsewhere.