As seen in the WealthManagement 2020 MidYear Outlook

Jeanette Garretty, Chief Economist, August 2020

Three enormously expensive and challenging projects confront the United States and the major developed economies in the next 18 months: 1) the repair and support of fragile economies and an ageing labor force, 2) the rebuilding of supply chains for strength and security in times of crisis and 3) ensuring public health, now and in the future. Longer term, the project that will dominate most, if not all, of this decade is debt reduction; massive deficits caused by falling tax revenues and ballooning government expenditures will need to be addressed without draconian actions that would damage and delay economic growth. Loosening trade barriers selectively may prove to be possible and beneficial – if political pressures do not stand in the way. The economic demands of this third decade of the 21st century are daunting. At the same time, opportunities abound for innovative actions that burst through the constraints of the 20th century, taking us to economic heights not previously experienced.

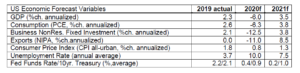

At present, there is broad agreement that we are witnessing a quicker than expected rebound in economic activity and consumer demand in the United States. Nevertheless, we believe that selective coronavirus-related closures of business operations should be expected throughout 2020, potentially leaving the US economy at the beginning of 2021 6-7% below the level of January 2020. The reverberations from the decline in US – and Chinese – economic growth make a sustained rise in global business all the more difficult. Poorly controlled virus outbreaks in Latin America, Africa, and India will likely have spillover effects on supply chains and could further depress growth in international trade.

Massive amounts of fiscal and monetary stimulus have been and should continue to be devoted to preserving vital economic structure. Continual disinflation and/or economic threats from bankruptcies and weak consumer demand will encourage the Federal Reserve to maintain short term interest rates near zero (There is considerable debate as to the true value of negative interest rates, and it is therefore unlikely there will be widespread future use of such rates as an economic tool). More significantly, the Federal Reserve can be expected to provide high levels of liquidity to credit markets and US businesses throughout 2020 and well into 2021. We can anticipate that central bankers around the world will follow the Federal Reserve’s lead on interest rates and do their best to adapt its liquidity strategies for domestic markets.

Business Investment is expected to decline throughout 2020; business expenditures are predicted to be reduced to the absolute necessary for re-opening and operation at less than full capacity. However, in 2021, businesses are expected to increase investment in technology and equipment aimed at sustaining profitability in the face of a reduced labor force and ongoing pandemic threats. Health care industry investments in a variety of areas are likely to expand, as the search for a virus cure/treatment spurs innovation in many medical fields.

Finally, the collapse of oil markets in the second quarter of 2020 has been somewhat overshadowed (understandably) by the broader issues of globally high unemployment and reduced wage growth. Oil prices will most likely recover as economies open and grow, but oil demand will likely continue to be weak, partly in response to environmental concerns. The negative impact on the budgets of oil producing countries will force a number of wrenching economic and political adjustments – one more signal that it is a whole new world out there, irrefutably changed by the coronavirus pandemic.

Disclosures

Investment advisory services offered through Robertson Stephens Wealth Management, LLC (“Robertson Stephens”), an SEC-registered investment advisor. This material is for general informational purposes only. It does not constitute investment advice or a recommendation or offer to buy or sell any security, has not been tailored to the needs of any specific investor, and should not provide the basis for any investment decision. The information contained herein was carefully compiled from sources believed to be reliable, but Robertson Stephens cannot guarantee its accuracy or completeness. Information, views and opinions are current as of the date of this presentation, are based on the information available at the time, and are subject to change based on market and other conditions. Robertson Stephens assumes no duty to update this information. Unless otherwise noted, the opinions presented are those of the author and not necessarily those of Robertson Stephens. Indices are unmanaged and reflect the reinvestment of all income or dividends but do not reflect the deduction of any fees or expenses which would reduce returns. Past performance does not guarantee future results. Forward-looking performance targets or estimates are not guaranteed and may not be achieved. Investing entails risks, including possible loss of principal. Any discussion of U.S. tax matters should not be construed as tax-related advice. This material is an investment advisory publication intended for investment advisory clients and prospective clients only. © 2020 Robertson Stephens Wealth Management, LLC. All rights reserved. Robertson Stephens is a registered trademark of Robertson Stephens Wealth Management, LLC in the United States and elsewhere.