Jeanette Garretty, Chief Economist, November 12, 2020

Only an economist would be bold—or foolish— enough to discuss the outlook for 2021 with the political and economic horizon shrouded in so much mist and fog. And yet, rare is the business that doesn’t find itself forced to forecast revenue growth, financing requirements, supply chain needs, labor force demands, and industry competition even in times of extreme uncertainty. In the spirit of camaraderie (shared misery?), it would seem to be necessary to put some economic stakes in the ground, as guideposts for the journey if not actual forecasts of the path.

For both economists and businesses, the trickiest part of forecasting is that which seems, on the surface, to be the easiest: correctly identifying and describing the starting point. Many forecasts go wrong because of an inaccurate and/or incomplete understanding of current conditions. With so many major economic indicators being backward looking, or “lagging” — quarterly GDP growth, income and wages, the unemployment rate, inflation, etc. – it is perhaps understandable that the Federal Reserve, for example, has a sizeable economics research team focused on amplifying those lagging economic indicators with a superior understanding of current economic conditions. The best known, longest-standing product of that effort is the Federal Reserve’s Summary of Commentary on Current Economic Conditions, produced eight times a year and popularly called the Beige Book for the color of the report’s cover. The Beige Book is a regional survey that collects answers to specific questions and an abundant amount of eclectic commentary on business conditions from business leaders and bankers in the twelve Federal Reserve Districts. A more recent addition to the toolbox is the Atlanta Federal Reserve’s GDPNow metric, an unofficial forecast taken from a mathematical model that seeks to update with weekly or greater frequency the same components that the Bureau of Economic Analysis (BEA) uses to calculate quarterly GDP growth.

The most recent (November 6, 2020) estimate of fourth quarter US GDP growth from the GDPNow model is an annual average 3.5% growth, slightly up from an estimate taken just a few days earlier. This is an attention-deserving number when placed against the current estimate of third quarter GDP growth of 33.1%. The Beige Book summary released on October 21 elaborated on the deceleration in activity between the third quarter and the start of the fourth quarter –“Economic activity continued to increase across all Districts, with the pace of growth characterized as slight to modest in most Districts. Changes in activity varied greatly by sector”—and included the following illuminating commentary about employment conditions:

Employment increased in almost all Districts, though growth remained slow.

Employment gains were reported most consistently for manufacturing firms,

although firms continued to report new furloughs and layoffs. Most Districts

continued reporting tight labor markets, attributing it to workers’ health and

childcare concerns, with many firms consequently offering increased schedule

flexibility; a few Districts, however, noted some firms were finding it easier to

hire workers. Wages increased slightly in most Districts, often tied to firms’

difficulty finding workers, especially for low-wage or high-demand jobs. Some

firms reported returning wages (and raises) to normal levels, but many reported

more stable wages.

Perhaps the single most-important understanding of the US economy as it enters 2021 is that the pandemic-induced recession of 2020 ended six months ago, and the economy entered a recovery phase at mid-year. In quite typical fashion, the initial months of the recovery exhibited a significant rebound in many, though not all, sectors – the service sector noticeably and understandably lagging behind the recovery in manufacturing – and now the pace of growth is slowing while remaining uneven. It is this “uneven-ness” that causes many people to be surprised by the difficulties that characterize an economic recovery (e.g. bankruptcies) and discount or disbelieve the economic growth that is occurring. For fiscal and monetary policymakers, it is also a challenging period in which to design appropriate support for businesses, industries and populations with widely differing economic needs. A “normal” economic recovery is, quite simply, a slog, and the recovery of 2020-2021 will be no different.

2021: Hope, Opportunity and Challenges

The first three months of 2021 are likely to look much like the last three months of 2020; large complex economies like that of the United States do not turn on a dime. Consumer spending will be tempered by caution about both the coronavirus and prospects for income growth but should remain strong. Unemployment rates may actually rise slightly with individuals returning to the labor force and seeking new jobs as employment prospects improve and K-12 schools move to in-person schooling. And businesses will continue to re-tool and re-structure for a “new normal” even with the near-term deployment of an effective coronavirus vaccine. Inflation should continue at a modest 1.6-1.7% and interest rates stay at rock bottom levels via the intervention of central bankers around the world. See Figure 1

The first three months of 2021 are likely to look much like the last three months of 2020; large complex economies like that of the United States do not turn on a dime. Consumer spending will be tempered by caution about both the coronavirus and prospects for income growth but should remain strong. Unemployment rates may actually rise slightly with individuals returning to the labor force and seeking new jobs as employment prospects improve and K-12 schools move to in-person schooling. And businesses will continue to re-tool and re-structure for a “new normal” even with the near-term deployment of an effective coronavirus vaccine. Inflation should continue at a modest 1.6-1.7% and interest rates stay at rock bottom levels via the intervention of central bankers around the world. See Figure 1

By mid-year, however, it can be anticipated that economic forces may begin to feel considerably different. With the advent over the last 40 years of lengthy US economic expansions has come the related phenomena of economic recoveries that contain both traditional cyclical elements, such as growth in residential construction and auto production, and structural changes that eventually emerge as the dominant influence on the next long economic expansion. At some point in 2021, thoughts and actions will shift to the preparation for that moment, maybe as soon as the fourth quarter of 2021, when the US economy enters the economic expansion phase, moving not simply back to where it was before the recession, but in fact beyond that highwater mark and into new economic territory. Fueling this development will be three fundamental influences: 1) consumer spending and growing employment, 2) plant and equipment investment to counter tight labor markets and global supply chain risk and 3) government spending. See Figure 2 and 3

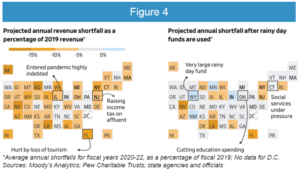

Constraining the move into the next expansion will be several unresolved problems: 1) state and local government budget cuts necessitated by the costs of fighting the pandemic, 2) global trade tensions, especially with China and 3) the sharp increase in the US budget deficit and US national debt. See Figure 4

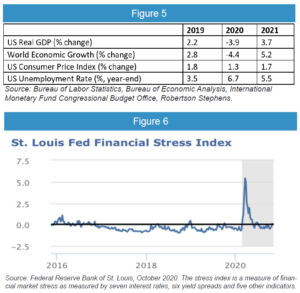

Unlike 2020, which experienced an approximate 4% loss in economic activity despite the sharp rebound in the third quarter, 2021 should be a year of approximately 3.5%-4.0% economic growth and embody the resolution of many of the difficulties that became the hallmark of its predecessor year. Leisure and hospitality industries are expected to expand (although many individual businesses may not return) and consumer spending on services likely will return to a dominant role in economic growth, regionally and nationally. Urban cores and associated real estate infrastructure also should recover occupancy and economic energy, albeit with the help of lower lease rates that may cause financial pain for some investors. See Figure 5

There also must be a nod to the importance of liquidity in this entire economic discussion. The US economy would be entering 2021 with far less promise if it had not been for the preservation of well-functioning financial markets by the Federal Reserve, including injections of liquidity into various markets at critical junctures, and the Federal Government dollars supporting businesses and individuals during the darkest months of the pandemic. The resilience of the global banking system has proved to be of immeasurable positive consequence. With short term interest rates expected to remain close to zero for much of 2021 – and longer-term interest rates exceptionally low – there should be plentiful liquidity available to support the ongoing economic recovery of 2021. It is not unheard of, however, for such an abundance of liquidity to create its own unforeseen problems; when coupled with the insidious behavioral tic known as “stretching for yield”, it seems almost inevitable that mistakes will be made. See Figure 6

There also must be a nod to the importance of liquidity in this entire economic discussion. The US economy would be entering 2021 with far less promise if it had not been for the preservation of well-functioning financial markets by the Federal Reserve, including injections of liquidity into various markets at critical junctures, and the Federal Government dollars supporting businesses and individuals during the darkest months of the pandemic. The resilience of the global banking system has proved to be of immeasurable positive consequence. With short term interest rates expected to remain close to zero for much of 2021 – and longer-term interest rates exceptionally low – there should be plentiful liquidity available to support the ongoing economic recovery of 2021. It is not unheard of, however, for such an abundance of liquidity to create its own unforeseen problems; when coupled with the insidious behavioral tic known as “stretching for yield”, it seems almost inevitable that mistakes will be made. See Figure 6

Included in the outlook for 2021 is a sense that the US economy will be guided by the confidence gained through terrible and terrifying trial-and-error in 2020. And a hope that unfortunate and disruptive bravado will be kept to a minimum. Yet, for all that plan — and forecast– because they must, there is a Yiddish phrase to remember: “Der Mentsh Drakht un Got Lakht” (“Man plans and God laughs”.)

Disclosures

Investment advisory services offered through Robertson Stephens Wealth Management, LLC (“Robertson Stephens”), an SEC-registered investment advisor. Registration does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. This material is for general informational purposes only and should not be construed as investment, tax or legal advice. It does not constitute a recommendation or offer to buy or sell any security, has not been tailored to the needs of any specific investor, and should not provide the basis for any investment decision. Please consult with your Advisor prior to making any Investment decisions. The information contained herein was carefully compiled from sources believed to be reliable, but Robertson Stephens cannot guarantee its accuracy or completeness. Information, views and opinions are current as of the date of this presentation, are based on the information available at the time, and are subject to change based on market and other conditions. Robertson Stephens assumes no duty to update this information. Unless otherwise noted, the opinions presented are those of the author and not necessarily those of Robertson Stephens. Indices are unmanaged and reflect the reinvestment of all income or dividends but do not reflect the deduction of any fees or expenses which would reduce returns. Past performance does not guarantee future results. Forward-looking performance targets or estimates are not guaranteed and may not be achieved. Investing entails risks, including possible loss of principal. Alternative investments are only available to qualified investors and are not suitable for all investors. Alternative investments include risks such as illiquidity, long time horizons, reduced transparency, and significant loss of principal. This material is an investment advisory publication intended for investment advisory clients and prospective clients only. Robertson Stephens only transacts business in states in which it is properly registered or is excluded or exempted from registration. A copy of Robertson Stephens’ current written disclosure brochure filed with the SEC which discusses, among other things, Robertson Stephens’ business practices, services and fees, is available through the SEC’s website at: www.adviserinfo.sec.gov. © 2020 Robertson Stephens Wealth Management, LLC. All rights reserved. Robertson Stephens is a registered trademark of Robertson Stephens Wealth Management, LLC in the United States and elsewhere.