By Mallon FitzPatrick, April 9, 2021

One of the perennial worries that seem to nag at investors is whether they are hemorrhaging money by living in the wrong state. Some believe, rightly or wrongly, that the tax structures of their home state cost them dearly, whether income taxes, property taxes or deductions are to blame.

Some of those investors may choose to pack up and head for another state. But without a careful comparison of tax structures—one that looks comprehensively at states’ current and pending policies in the context of living costs—it’s easy to overreact to rate changes that dominate the news.

To stick around or leave town?

Millions of Americans move to other states each year. According to the Annual 2020 United Van Lines National Movers Study, Idaho logged the highest percentage of inbound migration while New Jersey took the top outbound spot last year.

Other top inbound states include South Carolina, Oregon, South Dakota and Arizona, while other top outbound states include New York, Illinois, Connecticut and California.

The United Van Lines data indicates people moved for new jobs or job transfers, accelerated retirement plans, proximity to family, health and well-being, lifestyle changes, as well as to take advantage of remote-working flexibility in the wake of the pandemic.

A recent Pew Research Center survey indicates migrants polled last fall were more likely than those polled in the spring to have relocated due to financial strain and less likely to cite risk of infection.

It’s not clear how many of those migrations are high-net-worth investors moving in response to specific tax policies or how many investors may be comparing state tax structures as they seek new remote-working destinations, less congested communities, or living arrangements near family members due to the pandemic.

But for those that are looking for more favorable financial environments, there are a few things to consider.

Seeing the whole picture

Taxes can vary widely across geographies. Investors contemplating a move need to evaluate a state’s tax structure in the right context and adjust investment strategies accordingly.

They may, for example, overlook the impact of community property laws, which affect income calculations at the federal level for married taxpayers. In some cases, it might be better to file separate returns. [1]

The impact of the $10,000 cap on the state and local tax (SALT) deduction, which took effect in 2018 as part of the Tax Cuts and Jobs Act, may be tricky to figure out. While some investors saw their taxes rise as the Act limited the deductions on property and income taxes, others saw reduced taxes due to an overall reduction in federal tax rates, and increased limits on when alternative minimum tax (AMT) applies. Further complicating the situation, many states may also need to raise taxes in the coming years to compensate for the revenue declines and increased spending during the pandemic, as evidenced by the recent proposal in New York state.

While the SALT cap may not be a reason to flee a high property tax state, there are a host of other factors that might make a low-income tax state more attractive.

Investors have little control over federal taxes, but they do have control over state taxes by deciding where to live. Although the SALT cap may be repealed making property taxes fully deductible, higher federal taxes are generally seen as inevitable and may negate any savings.

Breaking down a hypothetical move

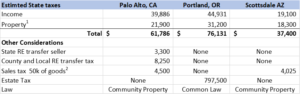

To illustrate the potential impact of taxes, we can look at a sample profile of an investor planning a move from Palo Alto, Calif. to either Portland, Ore. or Scottsdale, Ariz., with a $500,000 annual salary and net worth of $10 million, and a $3 million home in each state.

A Look at a Fictional Investor’s Tax Profile*

* Estimates assume all other costs remain the same and investor has taken only the standard MFJ deduction.

- Based on Santa Clara, Multnomah, and Maricopa County rates

- State, county and local sales tax

One might think that moving from Palo Alto, one of the highest income cities in the country, to Portland would save on state taxes. However, the above tables shows that our sample investor’s state taxes increase by 23% from about $62,000 to $76,000. Also, the move may result in exposure to almost $800,000 of estate taxes. In comparison to a move to Arizona, state taxes would be reduced by almost 39% from $61,786 to $37,400.

It’s not easy determining the total cost-benefit of a move as tax policies are fluid and complex along with many other non-financial considerations. Moving to a more desirable location doesn’t always mean lower taxes and moving to a location with lower taxes may have other disadvantages that should be explored. For example, according to a recent survey by Wallet Hub for ROI in terms taxes paid versus benefits of services California ranks 49th, Oregon 35th, and Arizona 27th. Arizona scores better than California and Oregon in terms of ROI but will you enjoy the weather?

Ultimately, when evaluating a move, investors should make sure they understand all the state tax implications and weigh them against other tangible and non-tangible advantages and disadvantages in order to avoid any potential pitfalls that may affect their wealth and quality of life.

Mallon FitzPatrick, CFP®, is a Principal and Managing Director at Robertson Stephens Wealth Management, LLC, an independent SEC-registered investment advisor that provides wealth management solutions for high-net-worth individuals and family offices nationwide.

Investment advisory services offered through Robertson Stephens Wealth Management, LLC (“Robertson Stephens”), an SEC-registered investment advisor. Registration does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. This material is for general informational purposes only and should not be construed as investment, tax or legal advice. This material is an investment advisory publication intended for investment advisory clients and prospective clients only. Robertson Stephens only transacts business in states in which it is properly registered or is excluded or exempted from registration. A copy of Robertson Stephens’ current written disclosure brochure filed with the SEC which discusses, among other things, Robertson Stephens’ business practices, services and fees, is available through the SEC’s website at: www.adviserinfo.sec.gov. © 2021 Robertson Stephens Wealth Management, LLC. All rights reserved. Robertson Stephens is a registered trademark of Robertson Stephens Wealth Management, LLC in the United States and elsewhere. A1116

[1] https://www.irs.gov/publications/p555#en_US_202001_publink100026043