May 10, 2021

Good morning,

I’m on the road this week – all week. It will be half work, half fatherly duty – all of it a pleasure. I’ll stay attached to the markets all week but morning notes will suffer. After this morning, I’ll post if we see something alarming in the markets. The VIX is a good gauge, any spike there and you’ll here from me. On the other hand, please call, I’ll be driving most of the week and could use the company 😊.

_________________

Interesting that we had several sideways weeks to the markets to finish out April, followed by a resumption of the rise in most indexes the this first week of May (S&P +1.25% last week). This stair-step monthly pattern to the markets this year is nothing if not resilient. Market looks up at the open this morning with the overarching focus of investors on inflation – transitory or lasting.

_________________

I failed to re-print the monthly cover letter to client performance reports last week – my bad …

The trading patterns of the first four months of 2021 were unusually alike – each one sketching out a similar binary path. Each month’s first half rally was followed by a second half correction, with some of those give-back-corrections severely damaging what had been truly stellar performance in the earlier days of the period. April was binary like the others, and marked all of its gains for the month in its first two weeks. The correction phase, however, was unique relative to the preceding months. April spent its last two weeks moving sideways, losing nothing , and holding on to all of its earlier gains to close the month as the best of the four for the S&P 500 index.

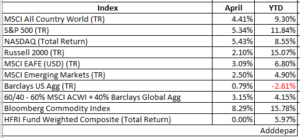

Each month, a different sub-group within the S&P took the leadership baton. As you can see below, large-cap growth (technology heavy NASDAQ Composite Index) led the various indexes in April. Looking at the small-cap/value line (Russell 2000), you can see it was the leader earlier this year and still holds a commanding lead year-to-date. Other notable returns for April were bonds (Barclays US Aggregate Index), putting in its first positive month of the year, and Commodities – still rising on rising inflation concerns.

The biggest question for markets in the second half of the year will be how much organic (unstimulated) economic growth will we see after the economic re-opening boom passes. And of course the corollary to that is to what extent the rise in inflation is “transitory,” as the Fed has pre-emptively labelled it. As mentioned in Monday’s (5/3) Morning Note, we’ll watch the organic demand (loans) and income (Disposable Personal Income) components of inflation to gauge “transitory-ness” ahead. However, we think it is highly likely that a slower growth economy, post the re-opening boom, will show up in the market’s Tape signals before it registers in the economic data. We remain on high alert.

Sources: Addepar, Bloomberg, JPM Asset Management and Ned Davis Research