May 24, 2021

Good morning,

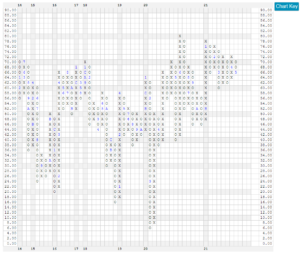

The market has been moving sideways of late and a chartist would tell you that a pennant is forming. Pennant – a type of continuation pattern formed by a consolidation period with converging trend lines (I know I’ve lost most of you already but hang in there for a minute). Typically, the next move following the period of consolidation is signaled by the direction of the breakout – up or down. See the two charts below.

Watching patterns form and the signals they may generate do not by themselves generate investment decisions but they are often useful helping to fill in color around a market narrative defined technically by the Tape, the Fed and Sentiment (the three technical legs of Technical/Quantitative Analysis).

So, we have a pennant forming and by definition, converging trend lines must be broken at some point. If broken to the upside, it might suggest a continuation of the bull market’s climb following this period of consolidation. If broken to the downside it might lend more evidence to a Tape that has been showing signs of deterioration without crossing that line in the sand to say it has turned bearish. Let’s be clear this morning, the tape still leans bullish mathematically. It is just not as bullish as other times in the past year.

Market prognostication is the business of looking forward. The breakout from a consolidation period is coming, if it is to the downside it will be another small piece of evidence placed on the risk-off side of the market risk scale. No change in view from here but just know we’re on alert and considering as much as possible