October 1, 2021

Good morning,

That was blistering. Recall that only two weeks ago we were commenting on how mild September was for the markets and, half way through that it was only basis points off its all time high set on the first days of the month. Two weeks later and we’re looking at this September being the worst September in a decade – this for the worst-of-the-year month to begin with. September made sure

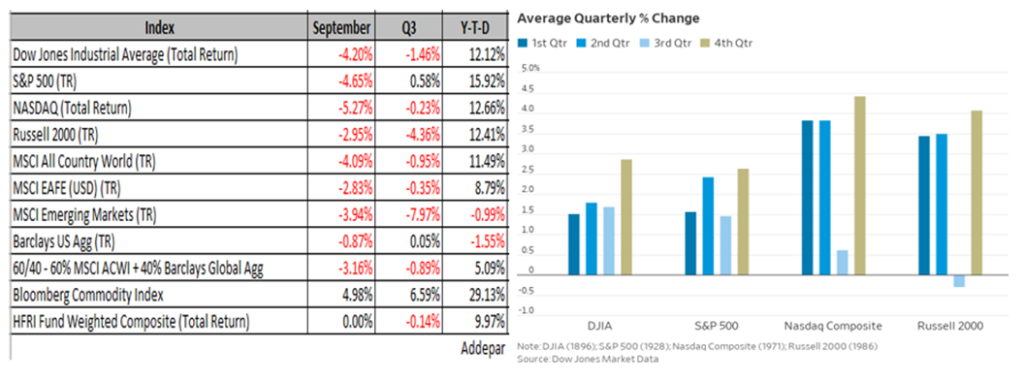

the market’s wouldn’t forget the third quarter of 2021. The exogenous Evergrande, as a catalyst, seemed to wake the market to the basket of risks it had until mid-month been willing to tolerate. The bond market shrugged off its complacency for transient inflation, a more hawkish Fed, a clearer path to tightening, and growth estimate cuts due to supply-chain bottlenecks to quickly pushed yields up a quarter of a percentage point. The equity market’s adjustment is shown on the first chart below.

Poetically it seemed, the S&P 500 registered a closing drawdown of 5% from all-time highs for the first time in a year and on the last day of September and Q3. That’s the 7th longest gap between such dips since 1928. Of the six longer gaps, four saw the market higher a month after it registered the 5% drawdown, with an average gain of 1.61%. This has been nothing average about our current bull market. While I view the long term risks as high based on current valuations and levels of debt, I have been a fully invested bear for you because of unprecedented liquidity and market data indicators that remain bullish. On average, the third quarter is the worst-performing quarter for the S&P 500, Nasdaq Composite (large cap growth) and Russell 2000 (small cap value). The second chart below does give us some reason to believe that the current, deeply short-term oversold market may rally following its first correction.

Be well,

Mike