November 3, 2021

Good morning,

It’s Fed Day, <umm> Taper Day is the better moniker, and it’s finally here. There seems to be little doubt in the market that the Fed will announce a monthly taper of $15billion ($10 Treasuries / $5 MBS) beginning mid-month. What is less clear is when the Fed will actually raise rates. Markets seem keen on whether Powell addresses the recent move in short-term rates and pushes back a little on the rate rise. Good theatre but perhaps not much more than that.

There has been so much focus on Taper in the past few months that it is likely to make the day anticlimactic – such is the power of the market discount mechanism.

The S&P 500, meanwhile, has risen on 13 of the last 15 trading days, setting new highs along the way. That cannot go on indefinitely. While it is the first time since Oct ’17, I was surprised to learn that this 13 for 15 day streak isn’t all that rare – 101 of them since 1928. Even better, the hangover following such streaks, on average, is benign. The index rallies 34bps in the week after the 13-of-15 winning streak. Let’s hope Powell executes the day’s presser predictably and keeps the equity streak going.

______________________________________________________________________________________________________________________________

As customary, the following is a reprint of my monthly letter that accompanies client’s monthly performance reports out for delivery today:

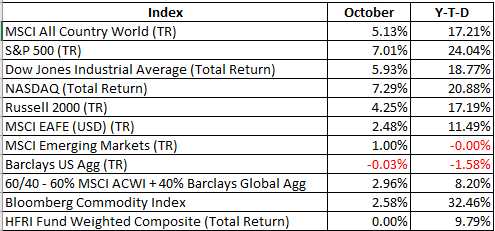

Late September’s market weakness continued unabated into the early days of October as investors seemed to struggle gauging just how transient rising inflation would not be, and what toll supply chain shortages might take on the Economic Reopening 2.0 globally. From its early September all-time high to its early October intraday low, the market (in S&P 500 terms) pulled back a little over 6% in the 5 week period. Then earnings season started. Only in retrospect can you make the following observation with any degree of confidence, but it would seem that by the time earning season officially began the second week of the month, the market had adequately discounted rising inflation and the growth of a supply constrained emerging global economy, enough to allow the cyclical bull market of 3/2020 to resume its upward climb. From the early October lows, through last Friday’s month end close, the S&P 500 Index rallied +7.6% to new all-time highs. Most other major indexes not named Nasdaq were up as well, just not as well as the S&P and Nasdaq Comp (chart below).

I know the question you’re asking silently. Down 6% in 5wks vs Up 7% in less than 3wks – what gives, isn’t fear supposed to be the stronger emotion over greed Very astute observation. Yes, bear markets and corrections typically have higher absolute values over much shorter durations vs bull market advances. What you’ve observed is likely further confirmation of the resumption of the bull market – when animal spirits trump fear.

How long this leg of the bull market lasts is everyone’s guess – no one knows for sure. It seems, given the strength of the recent advance, that the coast is clear for the rally to continue into year end. That can change quickly, but it might take a new worry that hasn’t yet been discounted. In any event, we remain on alert – cautious but fully invested on your behalf.

Be well,

Mike

Source: Addepar, Bloomberg