By Avi Deutsch

February 25, 2022 – The events of the past few days mark the culmination of years of more subtle challenges to a strained world order. Thirty-two years after the end of the cold war Russia has invaded Ukraine. This was done in blatant defiance of the Western powers and in a clear challenge to the prominence of the U.S. as the world’s only superpower.

Vladimir Putin is not at this alone. He has the tacit support of China, the world’s fastest growing economy and an explicit contender for the role of the next global superpower. In some ways, the invasion of the Ukraine resembles a cold war style proxy war, with China offering a backstop for the Russian economy and moral support in the face of international condemnation. The parallels with a possible Chinese invasion of Taiwan are certainly not lost on the Chinese leadership.

On the other side of the arena stand the Western democracies, battered by internal divisions, but far from powerless and weary of appeasement.

A military response by NATO seems unlikely at this point. For a variety of historical reasons, the Ukraine is not a NATO member and has no defense pacts with its Western neighbors. Further, its remains unclear if the Western powers have the political willpower to engage troops in combat with Russian forces. It is clear now that attempts to dissuade a Russian invasion by supplying the Ukrainians with arms have failed.

An Economic Cold War

Beyond its military might the West has many more tools at its disposal, namely, its economic power and control of the global finance system. Initial U.S. sanctions placed earlier this week were relatively mild— restrictions on a few Russian banks as well as members of Putin’s inner circle (but not Putin himself).

But more serious sanctions were announced on Thursday following the ground invasion. The question Western leaders will face in the weeks ahead is how much economic pain are they willing to bear in order to punish Russia. Russia’s invasion of the Ukraine (again) dispelled the Golden Arches Theory that two countries that have McDonald’s franchises will never go to war. Still, in our globalized world this conflict is deeply complicated by energy supplies, trade, and global supply chains.

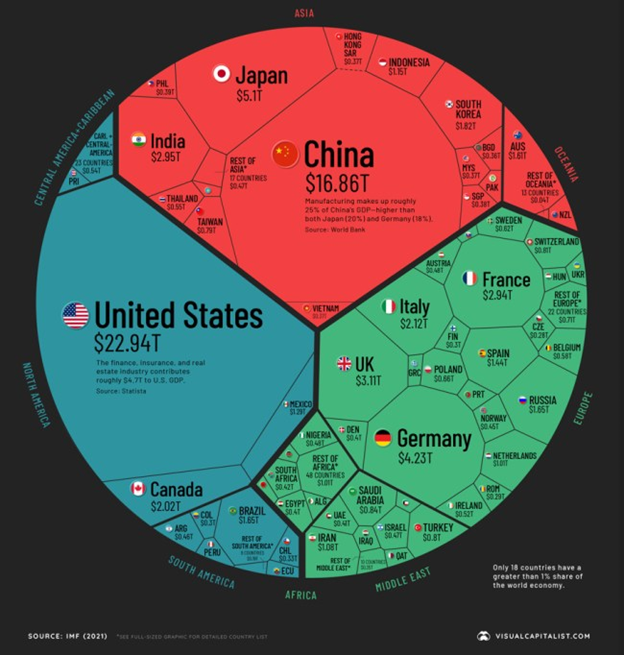

Russia is by no means an economic powerhouse. The Russian economy comprises less than 2% of the global GDP, and Russian companies make up only 0.4% of the MSCI ACWI all world stock index. Instead, Russia’s economic power lays in its natural resources, namely oil and gas.

Russia currently provides over 40% of the natural gas in the European Union, and 65% of Germany’s alone. At least in the immediate term Europe can do little to stop the flow of much needed foreign currency into Russia, money that is no doubt being used to finance the attack on the Ukraine. As the value of the Ruble continues to fall, hard currency will become increasingly important to the Russian economy.

The Natural Gas Bind

Germany’s dramatic announcement that it is halting the certification process of the Nord Stream 2, the new pipeline for Russian gas that bypasses the Ukraine has little immediate consequences. True, if operated the pipeline would be a huge economic win to Gazprom, the Russian state-owned oil company. The announcement, however, does little to end the reliance on the gas coming through Nord Stream 1.

Currently Germany and the rest of Europe have few alternatives to Russian natural gas. In the past decades, the move towards renewable energy and the closure of nuclear plants only increased this reliance, and western Europe seemed content to rely on Russia as its primary supplier. Alternatives exist, but they would be mostly in the form of Liquid Natural Gas (LNG), a more expensive alternative to pipeline gas.

Worse yet, the facilities for transporting the necessary amounts of LNG are not sufficient on either side of the supply chain. Potential suppliers like the U.S. and Qatar have limited LNG exporting capabilities, and Europe has few facilities able to accept and transport LNG. It is estimated it would take two years before significant quantities of LNG can flow into Europe.

With European gas reserves at historical lows, studies suggest that Europe could see out the winter without Russian gas— but only if temperatures remain relatively mild. What happens after that is up for debate, but shortages, price spikes, and even power outages are all possible. Natural gas prices have already jumped more than 20% since the beginning of 2022.

Other Economic Sanctions

Financial sanctions played a key role in bringing Iran to the negotiation table in 2014, and many see them as the key tool for punishing Russia. Earlier this week, and again yesterday, the U.S. and its allies began imposing sanctions on Russian banks, limiting their ability to transact in foreign currencies and freezing their assets. Other measure intended to limit Russia’s access to the financial markets include banning the tradings of Russian sovereign debt.

Global leaders appear divided on ejecting Russia from the SWIFT system, the secure messaging system used by financial institutions for international transactions. While all agree that such a step would deal a devastating blow to the Russian economy, some fear it could have unintended consequences, including damaging the energy trade and preventing the repayment of Russian debts to Europe. Some have argued that the SWIFT option should be held in reserve to address future aggressions.

Still others fear the politicization of the SWIFT tool. The Brussels-based SWIFT cooperative has historically been seen as a neutral body and only countries such as Iran and Syria have been banned from the system. Banning Russia from SWIFT could spur the development of a meaningful alternative. The banning of a major economy could be viewed by China as an opportunity to dislodge the Dollar as the world’s primary currency. One possible replacement would be a hybrid crypto currency which would eliminate the reliance on the Greenback.

Ultimately, economic sanctions can have a meaningful, if slow, impact on Russia’s economy. The immediate impact caused the Russian stock market to lose a third of its value on Thursday, with the Ruble shedding 11% since the beginning of the year for an all time historical low of 83.44 Ruble per one USD. A sustained decline in the value of the Ruble would raise the prices of all goods imported into Russia and could ultimately lead to high inflation and pressure on Putin to end the war.

Impacts on the U.S. Economy and Markets

Beyond the toll on life and the devastating damage to Ukraine, the global economic fallout from the conflict is expected to be limited to continued pressure on commodity prices and supply chains. This is especially true for the U.S., but a deeper dive into the factors that could affect the domestic economy and financial markets is merited.

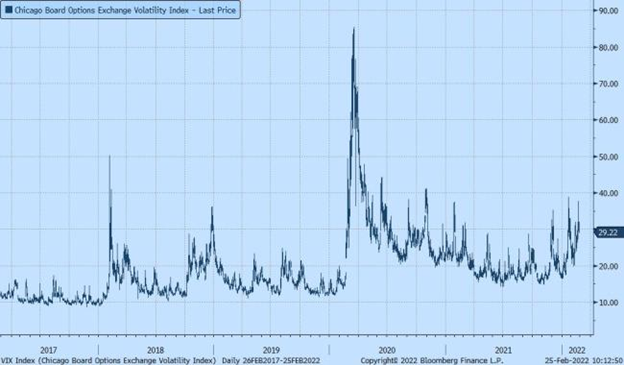

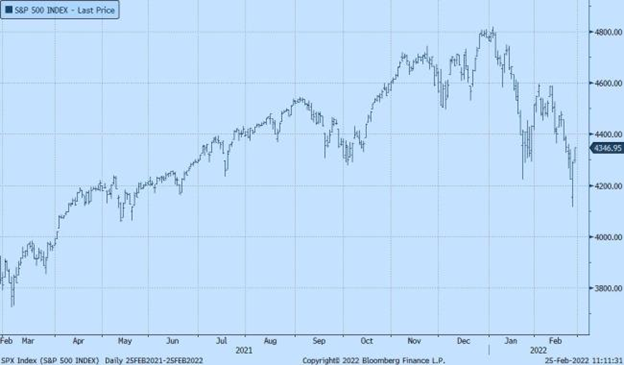

The Russian invasion caught the U.S. economy in a state of sustained tension around high inflation and expectations of monetary tightening. The added concern of a large conflict has fueled further anxiety that can be seen in the large swings in the stock market and VIX volatility measure.

Beyond natural gas, Russia is also the world’s third-largest producer of oil and titanium, fourth-largest of wheat, and fifth-largest of iron ore. Constrained supply of any of the above could worsen inflation, especially in sectors with high exposure to energy costs. The U.S. can increase its shale oil production in the face of sustained high oil prices, but this is a lengthy process.

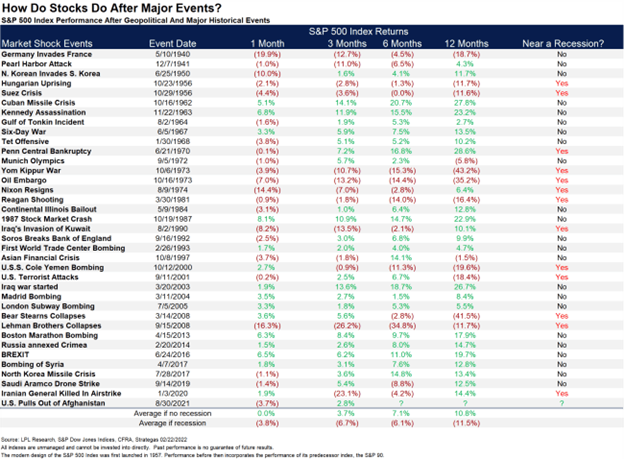

Despite this, most of the volatility in the stock market is likely driven more by headlines than any actual economic impact from the Russian invasion. U.S. companies have limited exposure to the Russian economy. As can be seen in Chart 6, historically geopolitical events have had limited impact on financial markets, with short-term volatility replaced with long performance more closely tied to the domestic economy.

The most important economic factor for the U.S. economy remains the Fed taper and unwinding of QE. Some have speculated that the Ukraine invasion may slow down the expected Fed taper, though we do not expect this to happen unless the invasion causes a slow down in demand for goods and services that eases demand-driven inflation pressure. We perceive the gravest threat to the U.S. economy to be additional inflationary pressures from high oil prices and worsening supply chains that will push the Fed to hasten its monetary tightening. In such a scenario, over-tightening and the inevitable resulting recession are a serious concern.

Excluding this worse case scenario, we do not see the Russian invasion of the Ukraine as having a large impact on the U.S. economy, with the possible exception of sustained higher oil prices. Furthermore, the current stock market volatility remains within the bounds of a healthy market pullback and does not show signs of panic. While some buying opportunities exist, we have not seen a meaningful decline from pre-invasion level to warrant additional buying.

In summary, the current situation in the Ukraine has not changed our economic outlook and does not currently warrant a shift in our strategic allocations. We continue to monitor the situation and will provide additional updates as necessary.

— AD & HC