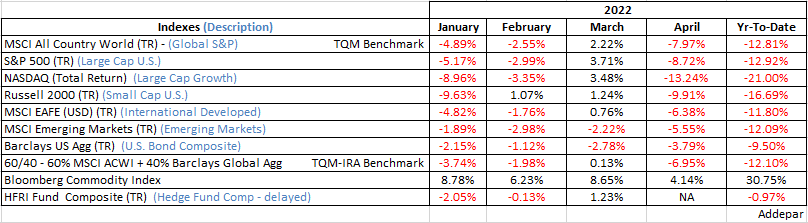

Let’s get through the sea of red first, you already know from morning notes that the first 4mo of this year is the worst start of a year since 1939. And as unfair as asymmetry can feel in any area of our lives, it just doesn’t matter that about half of April’s crushing losses all occurred on the last day of the month. No pictures on the scorecard – just data.

With that ugliness out of the way, let’s look ahead. Let us hope that the concerns overhanging the market currently have all been laid to bear. Inflation is running at its highest level since 1981, the Fed has begun, what appears to be, the most aggressive tightening cycle since at least 1994, the U.S. economy shrank in Q1, earnings growth is slowing at the fastest rate since 2011, Chinese lockdowns are threatening global supply chains, and the Russia-Ukraine War has pushed commodity prices to record highs. These are the known unknowns and are the only things a risk manager can gauge. If any unknown unknowns suddenly appear on the horizon, it will likely render the following analysis more worthless (grammatically wrong, sentimentally correct – it’s a humbling business).

As a discounting mechanism, markets are constantly looking ahead and pricing-in future events probabilistically. There appears to be two scenarios for the market to follow in the coming months: one bullish, the other bearish. The fulcrum question in between these two scenarios: is the economy strong enough today to handle the higher rates needed to tame inflation, without running into a recession. Chair Powell believes the answer is yes. The market? – maybe not so much.

Possible bullish scenario – upcoming inflation numbers would suggest that inflation is peaking, or at least stabilizing. Bond prices would move higher from their levels of excessive pessimism, and Fed rate hike expectations would moderate. Equities would likely rally on relief that the bond yield rise and Fed hiking initiatives would not be as aggressive as expected.

Possible bearish scenario – inflation numbers might surprise on the upside, leading to more hawkish Fed rate hike sentiment and rising expectations of a resulting recession. With a recession on the table, the probability of a cyclical bear market and more declines in equities would rise (-20% is the threshold definition of a bear market).

Inflation’s rate of change is the lynchpin to both these scenarios. Getting a line of sight on that number is likely to be weeks away, at best. While a recession remains a low probability based on what we know today, data-wise, the weeks ahead will likely remain highly volatile as the market vacillates between believing in either scenario above.

Be well,

Mike

Sources: Addepar, Bloomberg, Ned Davis Research

Disclosures

Investment advisory services offered through Robertson Stephens Wealth Management, LLC (“Robertson Stephens”), an SEC-registered investment advisor. Registration does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. This material is for general informational purposes only and should not be construed as investment, tax or legal advice. It does not constitute a recommendation or offer to buy or sell any security, has not been tailored to the needs of any specific investor, and should not provide the basis for any investment decision. Please consult with your Advisor prior to making any Investment decisions. The information contained herein was carefully compiled from sources believed to be reliable, but Robertson Stephens cannot guarantee its accuracy or completeness. Information, views and opinions are current as of the date of this presentation, are based on the information available at the time, and are subject to change based on market and other conditions. Robertson Stephens assumes no duty to update this information. Unless otherwise noted, any individual opinions presented are those of the author and not necessarily those of Robertson Stephens. Indices are unmanaged and reflect the reinvestment of all income or dividends but do not reflect the deduction of any fees or expenses which would reduce returns. Past performance does not guarantee future results. Forward-looking performance targets or estimates are not guaranteed and may not be achieved. Investing entails risks, including possible loss of principal. Alternative investments are only available to qualified investors and are not suitable for all investors. Alternative investments include risks such as illiquidity, long time horizons, reduced transparency, and significant loss of principal. This material is an investment advisory publication intended for investment advisory clients and prospective clients only. Robertson Stephens only transacts business in states in which it is properly registered or is excluded or exempted from registration. A copy of Robertson Stephens’ current written disclosure brochure filed with the SEC which discusses, among other things, Robertson Stephens’ business practices, services and fees, is available through the SEC’s website at: www.adviserinfo.sec.gov. © 2021 Robertson Stephens Wealth Management, LLC. All rights reserved. Robertson Stephens is a registered trademark of Robertson Stephens Wealth Management, LLC in the United States and elsewhere.