May 9, 2022

Good morning,

For all the market volatility and investor angst produced last week, when the dust settled, the S&P 500 Index was little changed on the week – down 8pts (-0.20%). That isn’t case this morning. From the opening bell in Asia last night and then Europe early this morning, markets (bonds and stocks) have been down hard.

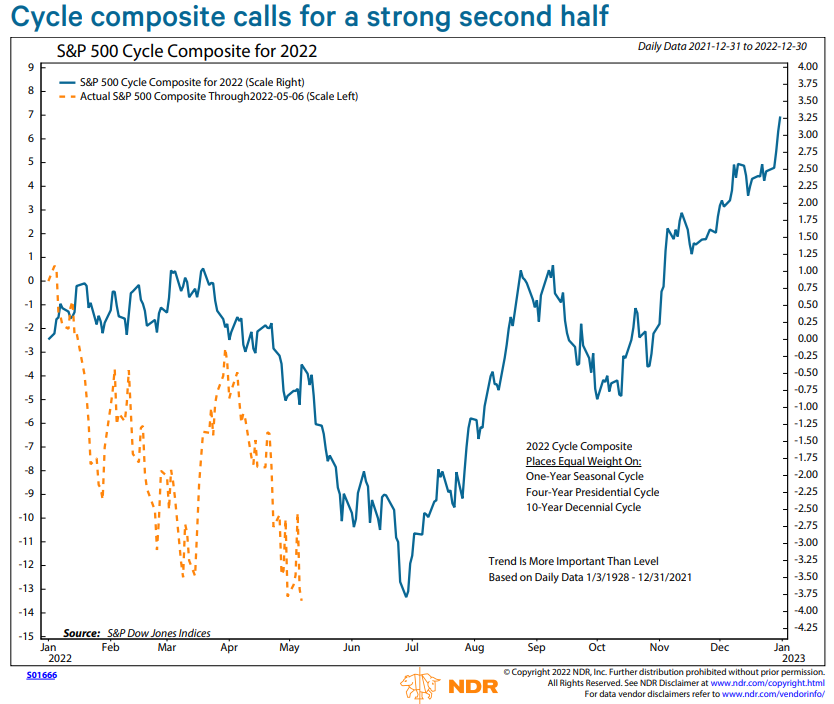

Futures (the S&P 500 kind) have been down as much as 2% at their worst levels overnight and haven’t bounced much from there as U.S. markets prepare to open. Ten-year Treasury’s hit a new reaction high in yield at 3.18% overnight. It’s too early to use the C-word (capitulation) but there is that feeling among traders this morning. Unfortunately, all this selling isn’t out of the realm of expectations – we’ve mentioned the likelihood of a soft summer a few times. The Cycles chart below makes these Morning Notes several times per year. Although cycle charts are not in the Technical/Quantitative calculus used in the models that guide portfolio allocations, they are useful to compare the past to the present periodically. As you can see, the market behavior currently isn’t out of the range of expectations set by cycle history either.

Be well,

Mike