By Avi Deustch

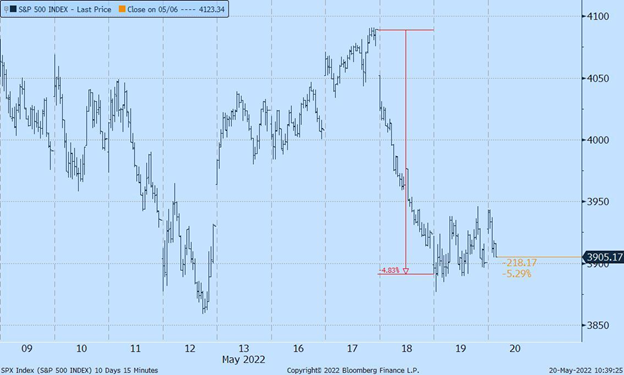

May 20, 2022 – If you’re having a hard time following what’s going on in the stock market, you’re not alone. This week it was poor financial results reported by Walmart, Target, and other retailers, that sent the stock market into 4-5% daily gyrations, leaving investors nauseated and on-edge and just barely avoiding a bear market. Once again, it appears investors allowed themselves to get carried away by the financial results of a single quarter that ended nearly seven weeks ago.

It is now beyond doubt that the U.S. economy is facing a slowdown. A cooling economy is not only inevitable, but necessary to curb inflation. But the media’s obsession with a binary outcome of either a recession or a soft-landing is a distraction from the important economic questions investors should be asking.

Whatever the outcome of the Fed’s monetary tightening, we are already well into that process. While interest rate hikes to date have been mild, the Fed is employing one of its most powerful tools, its messaging, to indicate its determination to tamp down inflation. Since expectations of inflation are a key determinate of actual inflation, convincing people that inflation is in-hand is a crucial part of the Fed’s job. Inflation is perhaps the clearest economic example of perception creating reality.

In truth though the Fed is trying to walk a very fine line, signaling resolve but avoiding overly aggressive action. Don’t expect 70s-style massive interest rate hikes. Despite the very real pain consumers are facing, and the accompanying political and media clamor, inflation is not the biggest threat the U.S. economy faces. Recognizing that historically the Fed’s tightening cure has been worse than the disease, in January the Fed announced a shift from a period-by-period inflation target to an average inflation target, thereby giving itself more room to sustain periods of higher inflation.

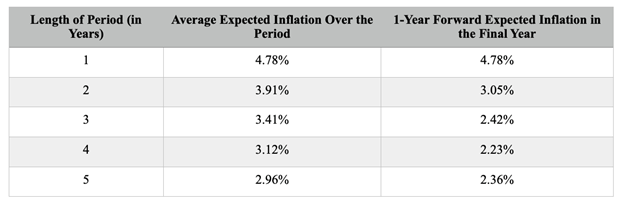

A look at the Treasury Inflation-Protected Security (TIPS) market reveals that bond-market investors, by far the investors most attuned to macro-economic trends, do not expect inflation to last very long. As can be seen in Table 1, investors expect inflation a year from today to sit at 4.8%, and come down to 3.1% in the year after that.

What happens between now and when inflation comes under control in one to two years is an open question. In the tightening phase of the economic cycle, the line between a soft landing that merely slows down the economy, and a mild recession, is finer than it appears. Instead of focusing on the Fed, investors should look for the pitfalls that can turn a mild recession into a deep one.

Throughout the 70s and early 80s, it was supply-side economic shocks that contributed to deep recessions. Oil being the primary culprit, the Ukraine crisis triggered fears of a reoccurrence of cost-push inflation. However, the diversity in oil producers and Europe’s ability to shift to other energy sources is likely to buffer the loss of the Russian oil. The disruption in supply chains following Covid are a more likely source of economic disruption, especially with China’s insistence on maintaining its Zero Covid policy.

Later recessions revolved around poor oversight of financial institutions and markets. Examples include the Savings and Loan Crisis of the 80s and 90s, the dot-com bubble of the early oughts, and culminating in the Great Recession. The contemporary equivalent is only ever obvious in hindsight. Though there are concerns about leveraged buy-outs fueled by years of cheap debt, as well as unprofitable companies that should have gone out of business years ago, it’s the unknown pitfalls that should worry us all.

One obvious candidate for the role of a recession-deepening asset bubble is crypto. Regardless of one’s sentiment about the long term viability of the crypto markets, any asset with virtually no supporting cashflows is going to be subject to extreme fluctuations. When investors lose money in one market, the losses can easily trigger selloffs in other markets as investors are forced to make margin calls and look to reduce their risk. Furthermore, the branding of crypto assets as ‘currency’ induces fear of a dreaded currency collapse, though this has no grounding in reality.

Fortunately, the crypto market remains limited in size, estimated at $3 trillion dollars before this recent selloff wiped out nearly 40% of its value. For comparison, the U.S. public equity markets are valued around $40 trillion. Furthermore, the selloff over the past week, as well as past selloffs, have not had severe consequences in other markets, possibly because institutional investors still have limited exposure to crypto.

Beyond the risk of unforeseen systemic pitfalls, investors should focus on the potential for long-term economic growth. It’s easy to forget that the U.S. has led the world in innovation and economic growth for the past fifteen years, and though it faces many challenges, it still stands out as one of the few developed economies with strong growth prospects in the years ahead.

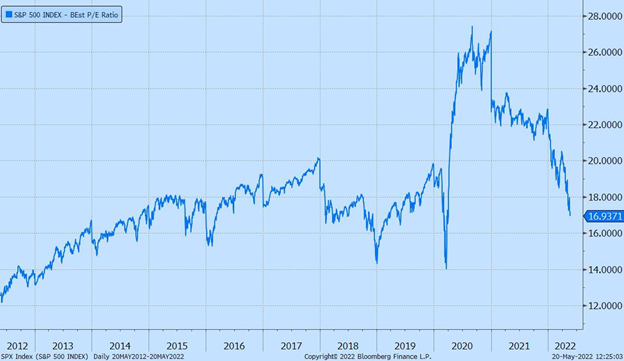

In light of this, the recent declines in the stock market could soon bring prices down to levels that are attractive to long-term investors. The price to forward-earnings ratio of the S&P500 is down to pre-Covid levels— perhaps not cheap enough yet given what could be a prolonged period of rising interest rates, but not far from it.

The months ahead promise to be bumpy at best, but as in all times of economic uncertainty, it’s important to separate the noise from the signal. An economic slowdown is necessary, and that could mean a mild recession. Unforeseen events could turn a mild recession into a deeper one, and investors’ asset allocation must account for this possibility. For long-term investors, periods of uncertainty usually mean good buying opportunities, and this time will be no different.

— AD