May 31, 2022 – By Frank Corrado, CPA, CFP®, RLP

As average life expectancy has increased over time, so too has the importance for retirees to ensure that they have sufficient income or cash flow to cover their needs throughout what could be a 30-year (or longer) retirement. Most advisors will have a “favorite” preference on how to source this income requirement and advise their clients accordingly. Given the gravity of this concern, wouldn’t it be less stressful if the retiree could participate in developing a sensible retirement income strategy for their future?

Retirees cope with the financial transition from the Accumulation Phase to the Preservation Phase. The primary focus of Accumulation is on saving and increasing capital, while Preservation treats maintaining sufficient capital to fund your optimal lifestyle for your remaining years as of utmost importance. As a Financial Advisor for many years, I can unequivocally state that the Preservation Phase is more complex to navigate (technically and psychologically) and presents unique risks given the outcomes at stake.

Given the complexity and fear prevalent in the Preservation Phase, it is fertile ground for advisors to sell products to retirees that are difficult to understand and expensive to purchase. Often, they will not meet either the suitability or fiduciary standard of professionalism.

Style Factors to Determine a Retirees Income Preference

Retirement Researcher CEO Alejandro Murguía and Founder Wade Pfau have published research examining different retirement income styles that can be determined by assessing an individual’s preferences for growing and using their retirement assets. Their study identifies the two most powerful constructs that help to determine a client’s income preference style:

- Probability vs. Safety-First (PS)

- Optionality vs. Commitment (OC)

Probability vs. Safety-First (PS)

A retiree with a Probability income style is willing to gravitate toward retirement income sources that are dependent on the potential for market growth to provide a continuous and sustainable retirement income stream. These include traditional diversified investment portfolios and other assets that expect growth. They are predicated on the idea that while market growth is not ‘guaranteed’ (at all, or over any particular time frame), markets have grown over time (and the probabilities for cumulative growth tend to rise as the time horizon increases). They, thus, are considered a ‘probability-based’ approach to retirement income. Simply put, while market returns are not guaranteed, some retirees are comfortable taking the probabilistic bet.

On the other hand, retirees who prefer Safety-First retirement income sources look to incorporate contractual obligations better to secure their safety as part of their portfolio. The income provided by these sources is less exposed to market swings. A Safety-First approach may include protected sources of income such as defined-benefit pensions, annuities with lifetime income protections, or government bonds held to maturity. Though no strategy is entirely safe (i.e., even insurance companies have some probability of failing), the inclusion of contractual protections implies a relative degree of safety compared to the unknown market outcomes of probability-based income sources. Those who choose a Safety-First approach express a willingness to give up the upside potential of probability-based income sources for the relative assuredness and perceived safety of a contractual guarantee.

Optionality vs. Commitment (OC)

Optionality reflects a retiree’s preference for keeping their options open and a desire to maintain flexibility to respond to economic developments or changing personal situations. This preference aligns with retirement solutions that are easily adjusted and do not have pre-determined holding periods.

Conversely, Commitment reflects a preference for committing to one solution. The retiree does not feel the need to ‘keep their options open” and is willing to affirmatively select a particular retirement income solution, particularly one that may require an irrevocable commitment (e.g., lifetime annuitization or similar contractually binding guarantees). There can also be satisfaction from planning in advance and not leaving difficult decisions for later when a retiree’s ability to make decisions may be hampered by stress or cognitive decline.

How Retirement Income Style Preferences Can Identify Suitable Retirement Solutions

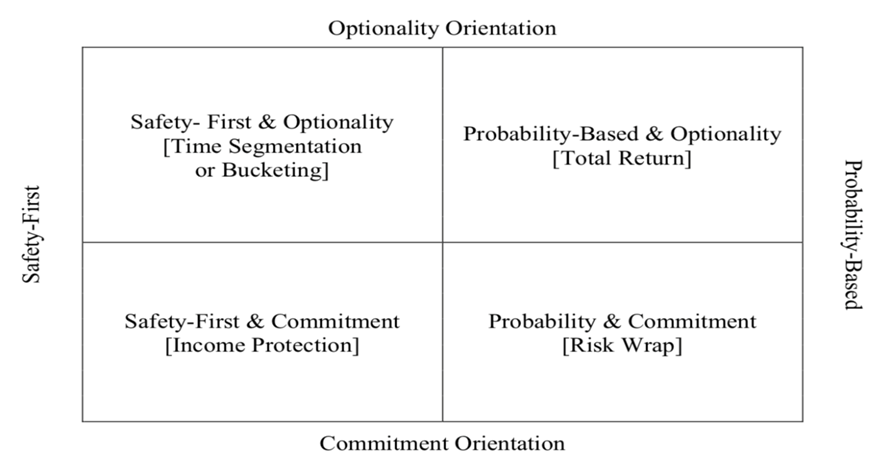

According to Murguía & Pfau, the two primary constructs of their research (PS & OC) provide a convenient framework to determine a suitable retirement strategy based on your personal preferences, known as your Retirement Income Style Awareness (RISA) profile. Discussing the RISA profile with retiree clients will provide clues to their preferences for how they desire to source retirement income.

The graphic below illustrates a RISA Matrix. We can separate and identify four distinct retirement income strategy quadrants by aligning the PS scale horizontally and the OC scale vertically.

Probability-Based & Optionality Factors: Total Return Strategy

Landing on the top-right quadrant of the RISA Matrix indicates that an individual’s preferences lean toward a strategy involving Probability-Based income sources and Optionality, which means they will likely prefer to draw income from a diversified investment portfolio, rather than using less flexible contractual sources like fixed-income annuities to fund their retirement expenses. Accordingly, this quadrant identifies strongly with the Total Return Approach, which embraces market probability-based upside growth potential. It remains liquid and flexible with the option to change strategies in the future.

Portfolio growth would be expected to support a sustainable spending rate. In addition, the retiree wouldn’t mind the inherent variability of drawing income from investments that will fluctuate in value and would be willing to be flexible around an unknown income stream.

Safety-First & Commitment Factors: Income Protection Strategy

The lower-left quadrant reflects individuals with a Safety-First and Commitment orientation. This reflects the Income Protection approach, which calls for immediate and deferred annuitization to support greater downside spending protection by relying on contractually guaranteed lifetime income. The individual is willing to commit to a strategy that provides the utmost safety for their retirement income.

In practice, this quadrant may also include fixed-index annuities with living benefits. These characteristics align with retirement income strategies that provide a contractual lifetime income floor for essential or core retirement expenses and then use a diversified investment portfolio for discretionary expenses.

Probability-Based & Commitment Factors: Risk Wrap Strategy

The remaining two quadrants reflect more hybrid approaches. Shifting to the lower-right quadrant of the RISA Matrix, we find individuals whose RISA Profile shows both a Probability-Based and Commitment orientation. While these people are likely to maintain a Probability-Based outlook with a desire for market participation, they also have a greater desire to commit to a solution that provides an underlying safety net for a structured income stream.

We characterize these preferences as reflecting a Risk Wrap strategy, which provides a blend of investment growth potential with guaranteed lifetime income benefits, generally through a variable annuity, a registered index-linked annuity, or a fixed-index annuity with some guaranteed withdrawal or annuitization rider attached. Such tools can be designed to offer upside growth potential, coupled with secured lifetime spending if markets perform poorly.

The associated market exposure satisfies the Probability-Based dimension. Purchasing a more structured and secured retirement-income guardrail, through the lifetime income benefit, addresses the Commitment dimension present in this quadrant.

Safety-First & Optionality Factors: Time Segmentation Strategy

Finally, the upper-left quadrant reflects another hybrid case. Those who fall into this quadrant prefer both Safety-First and Optionality. They like investments that may have contractual protections, but don’t like sacrificing flexibility with a contractual commitment for how the dollars are allocated into the strategy itself.

For example, one strategy is an investment-based Time Segmentation approach where individuals divide their money into different categories, such as a short-term bucket (earmarking assets for spending immediately), an intermediate-term bucket (for spending that is soon but not immediate), and a long-term bucket (for spending that won’t come until much later).

In such cases, contractually protected instruments (e.g., cash equivalents or government-issued securities) are often effective for shorter to intermediate-income needs, bond ladders are often a good solution for intermediate-term buckets as well, and a diversified investment portfolio fulfills the longer-term expense needs. Over time, the longer-term portfolio can gradually replenish the short-term buckets as these are used to cover retirement expenses.

Some people may also lump Time Segmentation together with the idea of holding additional cash reserves outside the investment portfolio to manage market volatility or to fund unexpected expenses. These strategies address the need for asset safety by including short-term contractual protections while maintaining a high degree of optionality for other investment assets.

Conclusion

While there are countless ways to approach managing a portfolio of assets in retirement, four broad strategies include total return (spending systematically from a diversified investment portfolio focused on total returns), income protection (building a lifetime income floor), risk wrap (building a lifetime income floor with deferred annuities offering lifetime withdrawal benefits wrapped around a risk-based portfolio), and time segmentation (bucketing strategies that use less volatile assets for shorter-term expenses and more volatility assets offering higher growth potential for future expenses).

These credible approaches emphasize an individual’s distinct personal retirement income preferences. As a financial advisor, the starting point to help clients who choose to pursue any retirement portfolio strategy begins with identifying the client’s retirement income style.