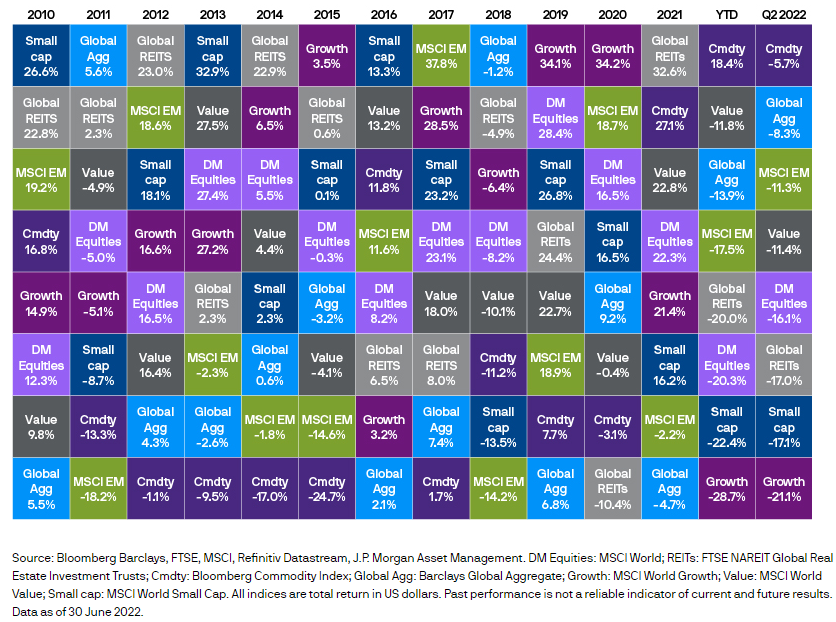

It was another difficult month and quarter for markets. This is now the worst first half of the year for developed market equities in over 50 years. To make matters worse, government bonds have also been hit hard so far this year, failing to provide the protection that investors usually look to them for. Rarer still, look at the Q2 2022 column on the Asset Class and Style Returns chart below – not a single positive return in the group. No-place-to-hide, academically described as cross-asset correlations converging on 1, is what’s behind everyone’s “feeling” that so far, 2022 has been disastrous.

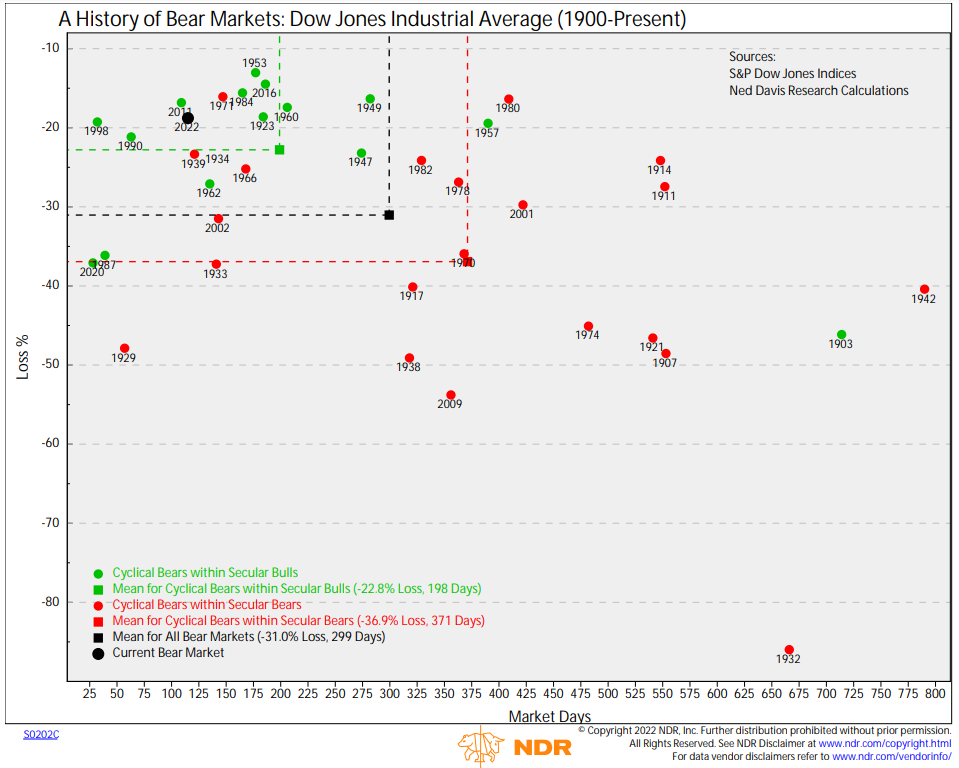

Feelings aside however, the cyclical bear market of 2022 has been relatively shallow and short, with the DJIA (Dow Jones Industrial Average) down -19% over about half a year. The DJIA because it goes back to 1900 – the longest data set of any major index by a factor of 2 at the minimum. Whether or not the market decline gets a lot worse from here may indicate whether the longer-term secular trend is still bullish or instead starting to turn bearish. See the Morning Note from 6/27 here for a definition refresher around secular and cyclical trends.

Looking at the chart below, the current bear (black dot) has thus far been consistent with the bears that have taken place within the secular bulls (green dots). The green dashed lines indicate that the mean decline within a secular bull has been a drop of -23% (Y axis) lasting 198 days (X axis). Within secular bears, the cyclical bears (red dots) have sent the DJIA lower by a mean of -37% over 371 days (red dashed lines). This is the same data, just presented differently from the 6/27 note. It is presented here again to underscore the importance of identifying a secular change as early as possible.

From a macroeconomic perspective, investors today are faced with a set of circumstances for which there is no analog. Inflation running at 8%, interest rates at 3%, the economy weakening – maybe into recession, and a Fed that is quickly sucking liquidity out of the system by simultaneously raising rates and shrinking its balance sheet (quantitative tightening). Secular bull markets are driven by liquidity and expectations for a mostly favorable economic response. Secular bear markets reflect a mostly negative economic environment of chronic inflationary or deflationary pressures, ineffective policy responses, and a lack of investor confidence in future earnings growth. Things look bleak from a macroeconomic perspective and intuitively, I am inclined to run. But we all know how poor my intuition is. The primary reason intuition fails any investor is because it is very hard gauging how much of the future is already priced into the present market.

Staying disciplined and committed to a broader market analytical methodology that includes macroeconomic analysis with Fundamental, Technical and Behavioral Analysis, we remain underweight equities and bonds (thank you Mr. Market, but not rebalancing) with a current base case that we are in a cyclical bear within a secular bull that remains intact.

If instead we are in the early stages of a new secular bear, then the current cyclical bear is far from over and subsequent recoveries will fail to produce new highs. That will be more likely if inflation continues to escalate, requiring ongoing and more aggressive tightening and sending the economy into the feared stagflation phase of sub-par real economic growth.

Be well,

Mike

Sources: Addepar, Bloomberg, JP Morgan Asset Management, Ned Davis Research

Disclosures

Investment advisory services offered through Robertson Stephens Wealth Management, LLC (“Robertson Stephens”), an SEC-registered investment advisor. Registration does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. This material is for general informational purposes only and should not be construed as investment, tax or legal advice. It does not constitute a recommendation or offer to buy or sell any security, has not been tailored to the needs of any specific investor, and should not provide the basis for any investment decision. Please consult with your Advisor prior to making any Investment decisions. The information contained herein was carefully compiled from sources believed to be reliable, but Robertson Stephens cannot guarantee its accuracy or completeness. Information, views and opinions are current as of the date of this presentation, are based on the information available at the time, and are subject to change based on market and other conditions. Robertson Stephens assumes no duty to update this information. Unless otherwise noted, any individual opinions presented are those of the author and not necessarily those of Robertson Stephens. Indices are unmanaged and reflect the reinvestment of all income or dividends but do not reflect the deduction of any fees or expenses which would reduce returns. Past performance does not guarantee future results. Forward-looking performance targets or estimates are not guaranteed and may not be achieved. Investing entails risks, including possible loss of principal. Alternative investments are only available to qualified investors and are not suitable for all investors. Alternative investments include risks such as illiquidity, long time horizons, reduced transparency, and significant loss of principal. This material is an investment advisory publication intended for investment advisory clients and prospective clients only. Robertson Stephens only transacts business in states in which it is properly registered or is excluded or exempted from registration. A copy of Robertson Stephens’ current written disclosure brochure filed with the SEC which discusses, among other things, Robertson Stephens’ business practices, services and fees, is available through the SEC’s website at: www.adviserinfo.sec.gov. © 2021 Robertson Stephens Wealth Management, LLC. All rights reserved. Robertson Stephens is a registered trademark of Robertson Stephens Wealth Management, LLC in the United States and elsewhere.