By Avi Deutsch

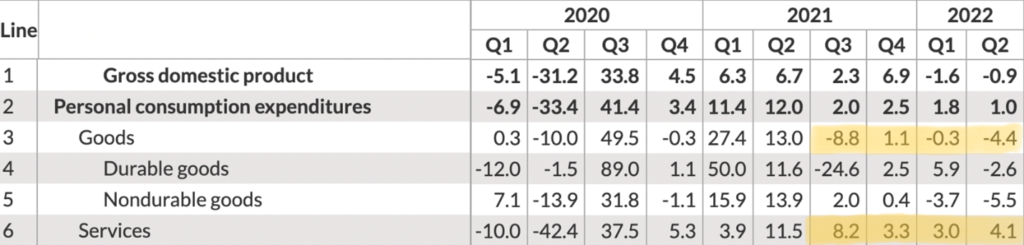

July 29, 2022 – It was only the summer of 2020, two years ago, that going to the supermarket felt like a risky undertaking and flying was reserved for emergencies. The economy shrank by 5% in Q1, and then by 31% in Q2, before bouncing back with 34% growth in Q3.

But the economy of late 2020 and 2021 was not the pre-Covid economy, or for that matter, the economy we’re in today. The Covid economy was marked by outsized demand for goods, especially durable ones, and fueled by $4.5 trillion in government spending and an additional $4.8 trillion expansion in the Fed’s balance sheet. Hardly a normal reality.

If the goal of the U.S. government was to protect the population from the economic impact of Covid, it succeeded. By the end of 2020 unemployment was down to 6.4% and real disposable personal income rose every quarter until mid 2021. The economic impact was certainly not equally buffered, hitting low-income communities harder than most, but the effort deserves merit.

But as the world returns to what we might think of as a new normal, a painful re-adjustment of supply and demand is unfolding before our eyes, with the Fed playing the role of a beleaguered mediator.

On the supply side, a year of outsized demand for goods were replaced by the massive pent up demand for services— think restaurants and travel. As can be seen in Table 1, although GDP fell in the first two quarters of 2022, and consumer demand for goods has fallen consistently since mid 2021, demand for services continued to rise throughout.

While consumers can be quick to shift their demand patterns, the same is not true for businesses’ ability to meet said demand. Airlines who let go of staff in 2020 and 2021 are now struggling to rehire and retrain employees. The same is true for restaurants, car rental agencies, hotels, summer camps, and more.

Changes in demand are greatly complicated by the dramatic changes in the workforce. The shift to remote work, massive government aid, and new life priorities following Covid led to the Great Resignation and continue to wreak havoc on businesses’ ability to hire and retain employees. Coupled with energy inflation caused by the Ukraine war and snarled supply chains from China’s Covid response, and you arrive at the perfect storm.

But there are signs that supply and demand are starting to converge again, both because consumers are adjusting their behavior to higher prices and less government assistance, and because businesses are catching up. The Fed’s rate hikes and strong guidance on inflation also seem to be helping.

The GDP figures released on Thursday put the U.S. in a technical recession, marked by two consecutive quarters of decline in growth. However, quarterly GDP numbers are susceptible to vagrancies in data reporting and are often adjusted multiple times over the ensuing quarters. Ultimately the National Bureau of Economic Research will decide if the U.S. is currently in a recession, though it’s clear to all that we are facing an economic slowdown.

While price inflation remains a concern, recession fears now dominate the conversation, with the majority of investors predicting low inflation and a possible Fed rate cut in early 2023. Price growth is expected to slow and even reverse as slower demand is forcing retailers to lower prices to reduce inventories. The housing market has already begun to cool, and though the job market remains tight, there are signs of a slowdown driven by hiring freezes and layoffs.

All eyes now are on the Fed. After mistakingly predicting that inflation would not exceed acceptable levels, there’s reason to fear that the Fed’s models are struggling to account for the changed economy. Having waited too long to raise rates, let’s hope the Fed doesn’t wait too long to stop raising them, turning a slowdown into a deep recession.

The apparent convergence of supply and demand suggests that the U.S. economy may be entering the post-Covid normal, a new economic reality that is being shaped by the (likely) defining event of multiple generations. This adjustment has been painful, but there’s cause for hope, as long as the Fed keeps its cool.

— AD