By Karen McClintock, CFA

August 8, 2022

#1 – Keeping Things in Perspective

2022 has been a uniquely volatile year – stocks and bonds are both down for only the second time in current history. I want to share some historical content about the markets to help you navigate this volatility and keep things in perspective.

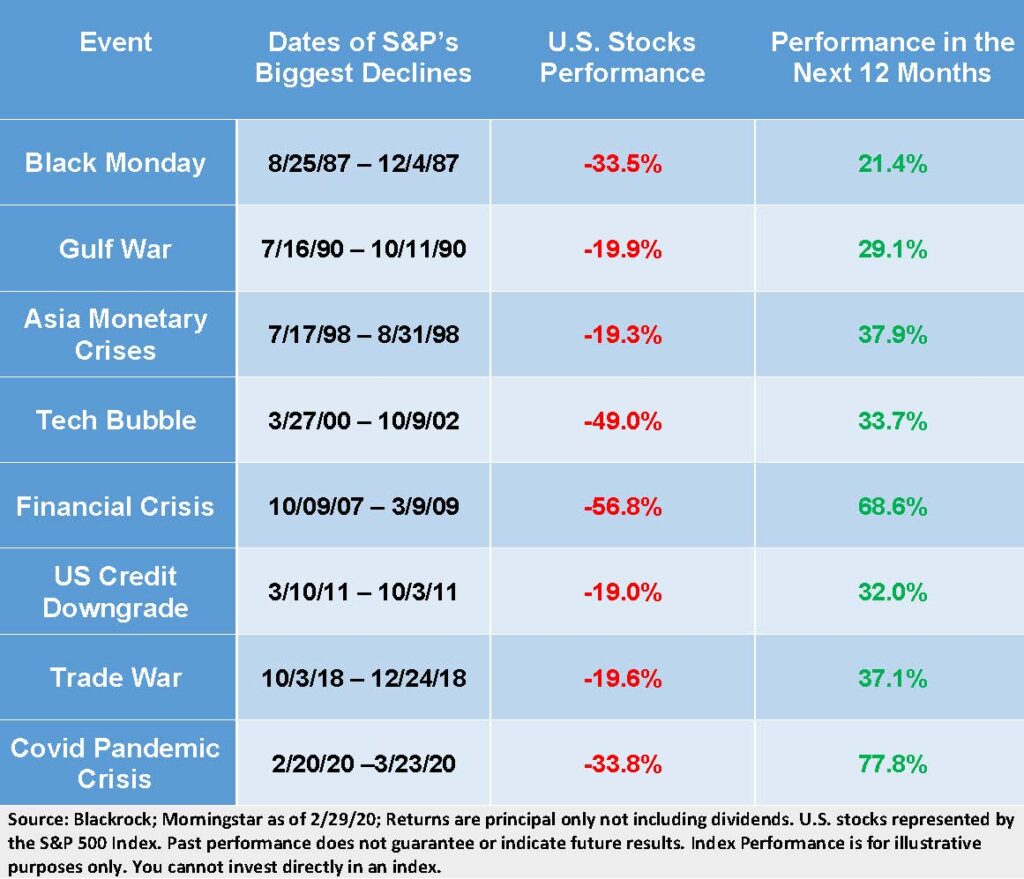

To start, I offer the table below. This table illustrates stock market outperformance (in green) 12 months following past bear markets (in red). I believe the lesson here is to stay invested!

#2 – Don’t Risk Missing the Market’s Best Days

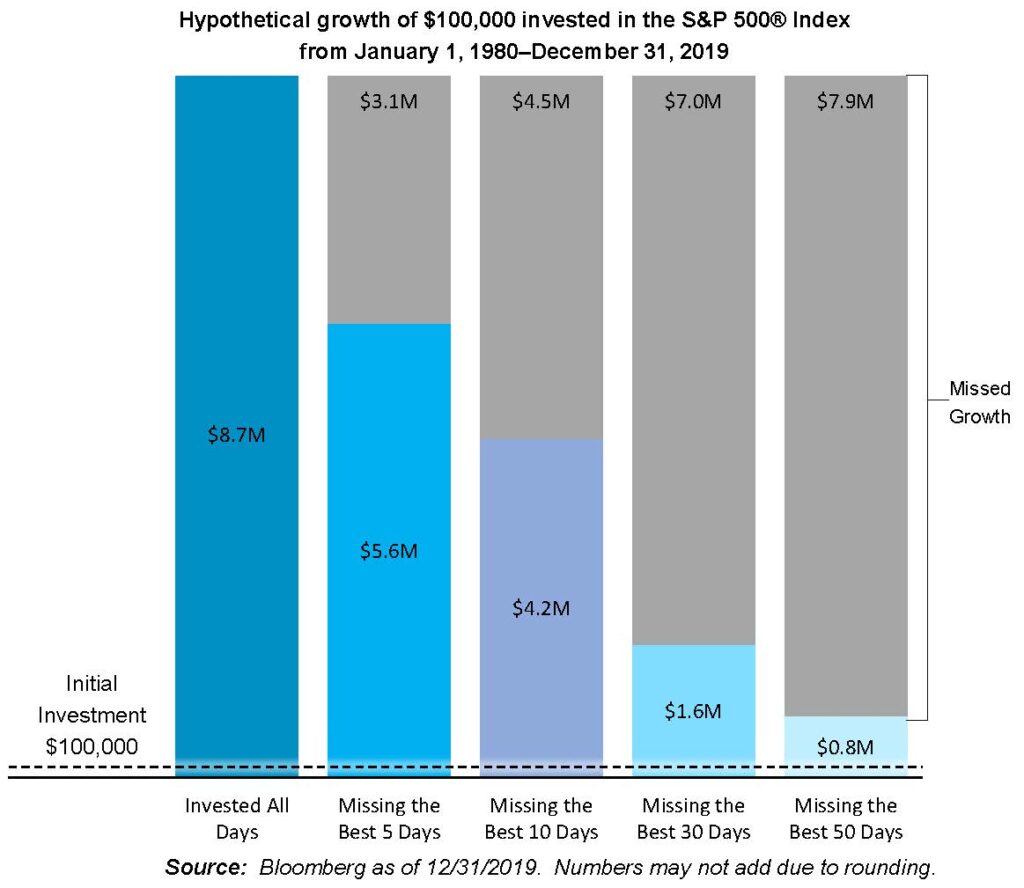

For our second reminder to “stay invested,” we look at the impact of investors pulling their money out – even for a short time. If investors miss just the best five return days over the lifetime of their investments, it could have a meaningful impact on their returns. We believe you should think long-term and stay invested through the market’s ups and downs to give yourself a better chance to reach your long-term goals.

#3 – Low and Rising Interest Rate Environment

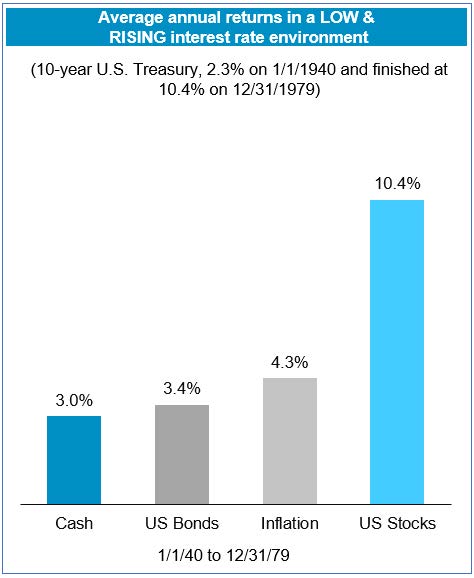

Our third reminder to “stay invested” asks the question, “Is it possible to make money when interest rates are rising?” While past performance is not an indication of future results, it is heartening to note how investments performed during the last cycle of low and rising interest rates. We believe you should think long-term and stay invested through the market’s ups and downs to give yourself a better chance to reach your long-term goals.

#4 – Diversified Portfolio Has Done Well in the Long-Term

Our fourth reminder to “stay invested” shows that a global balanced portfolio of equities and bonds has not produced a negative return over any five-year rolling period since 1979. Although there are no guarantees the future will resemble the past, history tends to favor long-term investors. We believe you should think long-term and stay invested through the market’s ups and downs to give yourself a better chance to reach your long-term goals.

Disclosures

Investment advisory services offered through Robertson Stephens Wealth Management, LLC (“Robertson Stephens”), an SEC-registered investment advisor. Registration does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. This material is for general informational purposes only and should not be construed as investment, tax or legal advice. Please consult with your Advisor prior to making any Investment decisions. This material is an investment advisory publication intended for investment advisory clients and prospective clients only. Robertson Stephens only transacts business in states in which it is properly registered or is excluded or exempted from registration. A copy of Robertson Stephens’ current written disclosure brochure filed with the SEC which discusses, among other things, Robertson Stephens’ business practices, services and fees, is available through the SEC’s website at: www.adviserinfo.sec.gov. © 2022 Robertson Stephens Wealth Management, LLC. All rights reserved. Robertson Stephens is a registered trademark of Robertson Stephens Wealth Management, LLC in the United States and elsewhere.