By Stuart Katz, Chief Investment Officer

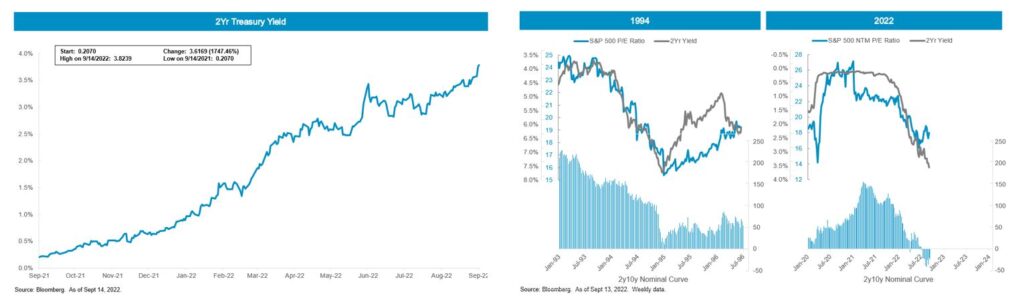

September 14, 2022 – Despite the recently reported strong earnings season, the rally from the June lows led to P/E multiple expansion. The key mantra for this cycle has been: “As the two-year yield goes, so go valuation multiples.” The 2 year US Treasury rate of 3.75% is at a 15 year high and higher than the long term average of 3.14%. Looking back to the 1994 cycle may help to provide perspective on the current environment. Valuations are unlikely to rally until the Fed is done tightening and the 2-year yield starts falling. This assumes earnings growth estimates are not materially adjusted downward in 2022 and 2023. We believe if earnings fail to grow fast enough, or if bond yields rise too quickly, markets may struggle to absorb the impact. In terms of the federal funds rate, markets now expect a 4-4.25% range by year end, up from 2.24-2.5% in early 2022. The latest reports show inflation does not follow a linear path (especially as the economy shifts from purchasing goods to services). Investors are increasingly coming to the realization that the Fed will not let up on its mission to tackle inflation: to wit, the chances of a 100-basis point hike from the Federal Open Market Committee (FOMC) next week increased from a remote possibility to 40% in ~48 hours. Since last Friday, the recession-watch 10 year-3 month US Treasury spread has narrowed 8 bps and 10 year-2 year US Treasury spread has dropped another 12 bps. The 10 year-2 year is now -37bps, and the 10 year-3 month at 17 bps is on a course heading to inversion, signaling recession. When the yield curve inverts (turns negative) long-term interest rates drop below short-term rates, indicating that investors are moving money away from short-term bonds and into long-term ones. This suggests that the market as a whole is becoming more pessimistic about the economic prospects for the near future.

Historically, equities have coped with rising yields because earnings growth is usually strong enough and/or valuations expand. None of this is particularly surprising as rising rate cycles often coincide with improving growth prospects and modest inflation, which are supportive for stock prices. The problem now is that US equities started at expensive levels on an absolute basis, meaning valuations were vulnerable to further yield increases. Although the immediate post-pandemic recovery in corporate earnings supported positive equity returns, current inflation uncertainty and rapidly increasing rates may portend risk of downward earnings revisions and further multiple compression.

In sum, we believe that equities can still generate positive performance, once investors start believing the Fed is close to reaching its destination. However, Powell recently channeled his “inner Paul Volcker” and attacked any narrative of an early exit from Fed tightening. Excerpts from his 11-minute speech at the Cato Institute contained the following statement of “We must keep at it until the job is done.”

In such an environment we think it is prudent to search for investment opportunities where portfolio allocations can be rewarded appropriately for the various rapidly changing macro regimes including stagflation, recession and soft-landing. As a result, our portfolio building blocks include…

- In fixed income, focus on municipals and investment grade credit with healthy credit fundamentals and appropriate risk adjusted yields.

- Within equity markets, we continue to favor U.S. large caps, with exposures to select high-quality growth companies, values stocks and companies growing their dividends.

- We also suggest looking beyond the traditional 60/40 equity/fixed income portfolio, using alternative strategies such as real assets including single family rentals to provide potential inflation hedges via predictable cash flows and increase exposure to private credit managers with stressed/distressed European investment expertise.

Disclosures

Investment Commentary Sources: Bloomberg and Morningstar

Investment advisory services offered through Robertson Stephens Wealth Management, LLC (“Robertson Stephens”), an SEC-registered investment advisor. Registration does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. This material is for general informational purposes only and should not be construed as investment, tax or legal advice. It does not constitute a recommendation or offer to buy or sell any security, has not been tailored to the needs of any specific investor, and should not provide the basis for any investment decision. Please consult with your Advisor prior to making any Investment decisions. The information contained herein was carefully compiled from sources believed to be reliable, but Robertson Stephens cannot guarantee its accuracy or completeness. Information, views and opinions are current as of the date of this presentation, are based on the information available at the time, and are subject to change based on market and other conditions. Robertson Stephens assumes no duty to update this information. Unless otherwise noted, any individual opinions presented are those of the author and not necessarily those of Robertson Stephens. Indices are unmanaged and reflect the reinvestment of all income or dividends but do not reflect the deduction of any fees or expenses which would reduce returns. Past performance does not guarantee future results. Forward-looking performance targets or estimates are not guaranteed and may not be achieved. Investing entails risks, including possible loss of principal. Alternative investments are only available to qualified investors and are not suitable for all investors. Alternative investments include risks such as illiquidity, long time horizons, reduced transparency, and significant loss of principal. This material is an investment advisory publication intended for investment advisory clients and prospective clients only. Robertson Stephens only transacts business in states in which it is properly registered or is excluded or exempted from registration. A copy of Robertson Stephens’ current written disclosure brochure filed with the SEC which discusses, among other things, Robertson Stephens’ business practices, services and fees, is available through the SEC’s website at: www.adviserinfo.sec.gov. © 2022 Robertson Stephens Wealth Management, LLC. All rights reserved. Robertson Stephens is a registered trademark of Robertson Stephens Wealth Management, LLC in the United States and elsewhere.