September 19, 2022

Good morning,

U.S. equity futures are off almost -1% this morning premarket as investors await Wednesday’s Fed meeting results, expected to be another +75 basis points rate hike. This is after after equities notched their worst week last week (-4.77% on the S&P 500) since hitting this year’s low in June.

Speaking of the market’s June lows, the S&P 500 Index is now about 6% away from those lows and testing that low in the days ahead seems like a high probability expectation. The market is not yet very oversold following the summer rally, so the sentiment isn’t offering much hope for bulls currently.

Perhaps selling is building to a crescendo of sorts for Wednesday’s Fed meeting. If so, it almost feels inevitable that the market tries to bounce after the FOMC announcement – regardless of what might be said. The durability of any bounce is an open question and anyone’s guess.

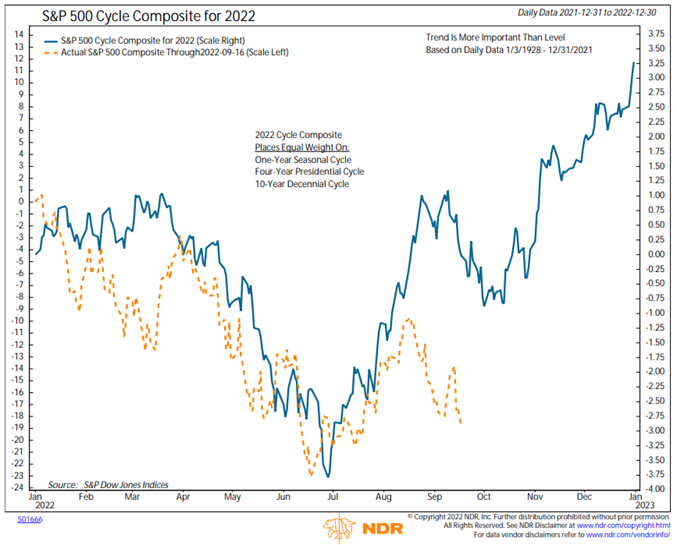

Looking at the Cycles Chart again for some sense of possible mapping of the market this year, it appears that the seasonally weak period ends in October.

Be well,

Mike