By Avi Deustch

September 22, 2022 – The release of the August inflation data this week marks a new and painful phase in the War on Inflation. It’s now obvious that the Fed was not only too late to raise interest rates, but that inflation has spread from supplies and commodities into labor costs. Without a painful increase in unemployment, wage inflation could continue for a long while. No one wants to see folks out of work, but at this point the Fed has little choice.

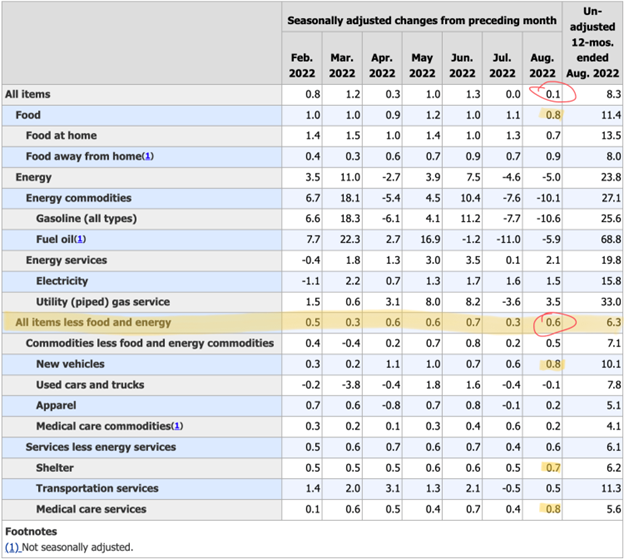

The August inflation numbers are a mixed bag. The top-line inflation number, an increase of 0.1% in prices in the month of August, annualizes well under the Fed’s inflation target of 2%. However a deeper dive into the data suggests that inflation in many sectors including food, shelter, vehicles, and medical care is still rampant. Core inflation, or inflation without food and energy, rose a disturbing 0.6% in the month of August (see Table 1).

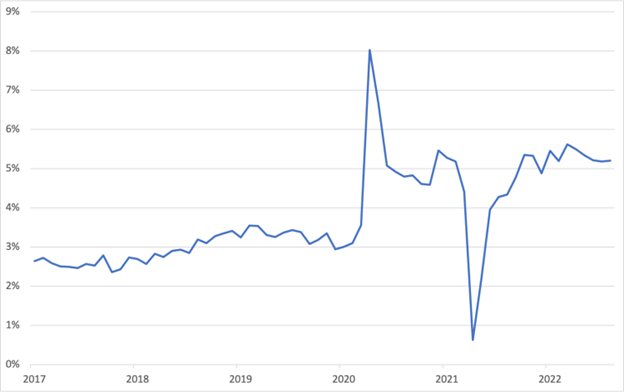

The data suggests that what may have started out as transitory inflation tied to supply chains and energy prices has morphed into wage inflation. Expectations of inflation and a tight labor market are driving workers to seek higher wages which in turn is causing businesses to raise prices. The growth in nominal wages since the beginning of the pandemic tells the story (see Chart 1). With consistent year-over-year increase north of 5% in nominal wages (including in August), an overall 8.3% inflation number is hardly surprising.

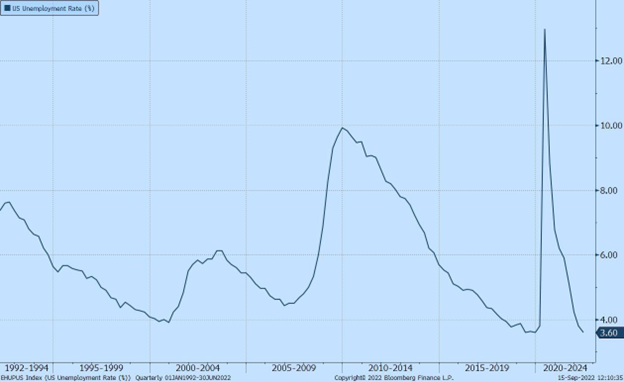

While wage growth is slowing, it isn’t slowing fast enough to bring inflation under control. The last two quarters of declining GDP put the U.S. in a technical recession, but they didn’t do enough to loosen up the labor market. With unemployment at a three decade low of 3.6% and job openings at historical highs, employees are yielding power not seen in decades.

Certainly, real wages in the U.S. are due for an aggressive upward adjustment. This is especially true for lower income and middle class earners who have seen little gains over the past 40 years. But the speed at which nominal wages are going up is feeding the inflation that diminishes any real gains. The Fed now has little choice but to raise unemployment and reduce employees’ bargaining power.

Tuesday’s inflation data was a disappointment to investors hoping the Fed’s monetary tightening could end sooner than 2023. The equity markets responded with the largest decline since June 2022 of 4.4% on the S&P 500 and 5.6% on the NASDAQ 100. Prolonged interest rate hikes not only increase the chances of a deep recession, they further strengthen the U.S. dollar against other currencies. This in turn makes U.S. exports less profitable and increases the probability of default for emerging economies with un-hedged dollar denominated debt.

Even after Wednesday’s drop the stock market remains range-bound and well above the June lows. For all of the drama caused by the headlines, price changes and inflation are a gradual process that takes time to unfold. Continued high inflation means we can expect more of the same in the months to come as we wait for the results of the Fed’s actions. Though the end of an economic cycle is a period full of anxiety, it’s important to remember that no single inflation reading has a material impact on the long term growth potential of the U.S. economy.

— AD