By Avi Deutsch

December 28, 2022 – All years are different, but some years are more different than others. For investors, 2022 falls squarely into the latter category, as many of the events that transpired represent a paradigm shift from the principles that dominated our financial markets since the global financial crisis of 2008. Whether these changes are here to stay remains to be seen (spoiler alert, probably not), but their appearance will likely impact markets and portfolios for years to come. With that in mind, here are five things investors will remember about 2022:

1. Halting the inflation tide—in an era marked by deep political divisions, few topics coalesced Americans like the need to bring inflation under control. Spurred by past inflation traumas and its mistaken prognosis that inflation was merely transitory, the Federal Reserve fought vigorously against inflation, simultaneously raising interest rates at an unprecedented rate and unwinding its balance sheet through quantitative tightening.

The Fed’s action proved effective in short order, with inflation coming down from a high of 9.1% in June to 7.1% in November[i]. The Fed deserves credit for its decisive – if late—action. However, the speed of the change suggests that transitory supply chain challenges and fluctuations in the price of oil resulting from the Russian invasion of Ukraine also played a role in the rise and fall of the consumer price index. Though inflation has stopped rising, it has only just begun to decline. The rate at which it continues to do so remains to be seen, and the path may not be linear.

The most surprising aspect of this episode is the resilience demonstrated by the labor market, and by proxy, by the economy as a whole. Without minimizing the pain of every lost job, the unemployment rate remains at a historically low 3.5%[ii], with many job cuts happening in white-collar tech companies that were due for a shakeup (more on that below). While the outlook for next year remains cloudy, 2022 will be remembered as the year that tested the historical relationship between inflation, interest rates, and unemployment.

2. The (temporary) end of cheap money— the years between 2008-2022 are indelibly marked by the ultra-expansionary monetary policies of the world’s largest central banks. With interest rates at rock bottom and the Fed coming up with ever more innovative ways of expanding its balance sheet, the availability of cheap credit affected our everyday lives in ways we are only starting to understand.

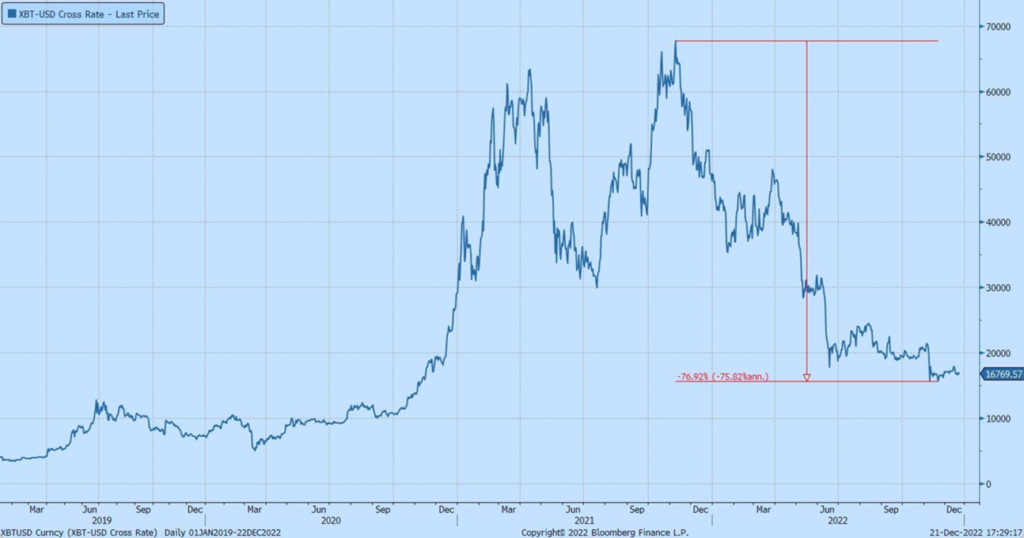

One well-known but elusive side-effect of cheap credit is the emergence of asset bubbles. Most agree at this point that the crypto token market was yet another classic asset bubble. Still, few can claim to have timed the bubble accurately or to know where crypto markets and blockchain infrastructure go from here. Concerns about asset bubbles in other areas, such as the housing market and corporate debt, could become more acute next year.

Other effects of cheap money influenced our lives as consumers and employees. Subsidized Uber rides, free food delivery services, and bloated tech companies were all made possible by the low cost of funds and the lack of safe investment alternatives. That party is over, at least for now. The turning of this tide was evident in the stock market performance of tech and other growth stocks.

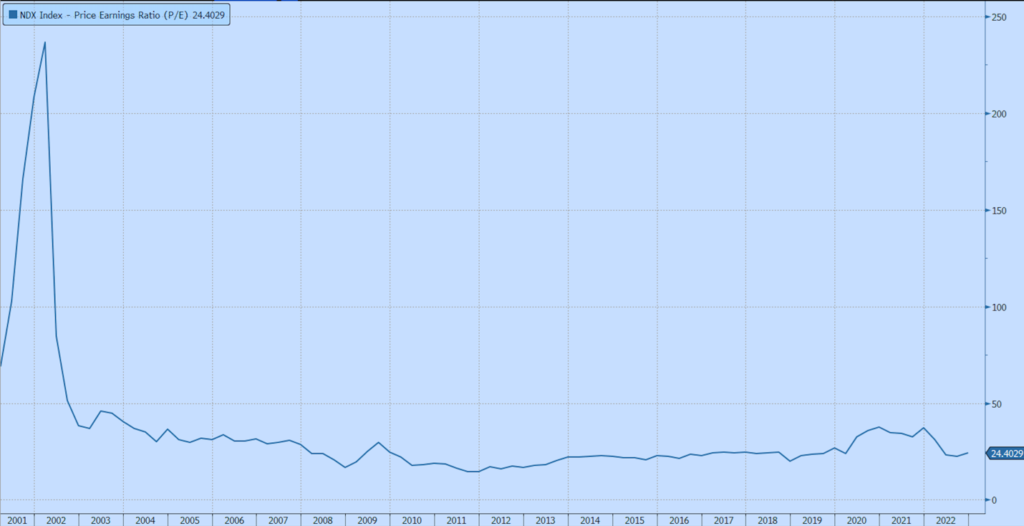

3. Tech stocks lose their shine — for over 20 years now, tech stocks have dominated the growth of the stock market, going from 14% of the S&P 500 in 2002 to 29% in 2021[iii]. The maturing internet, aided by technological innovations such as smartphones and fueled by cheap credit, drove tech earnings to new heights. This, in turn, caused investors to pour money into the sector, driving the always ambitious valuations of tech stocks to heights not seen since 2008.

The turn against tech stocks was swift and vicious. While the industrial sector is down 6.55% year-to-date[iv], the tech-heavy Nasdaq 100 is down 31.73%[v]. A general risk-off attitude in the face of economic and monetary uncertainty, paired with the highest yields on safe assets such as government bonds seen in over a decade, quickly turned yesterday‘s winners into today’s losers.

Still, tech stocks are not crypto tokens. The former are backed by actual companies, some of which will produce positive cashflows for years . Whether tech stocks have been over-sold, or still have a lot more room to come down, will depend on investor sentiment more than anything else. What is clear is that the tech party is over—this generation of tech companies is likely to be held to higher standards by investors, which means changes for both consumers and tech workers.

4. The bond market collapse – though the stock market gets most of the headlines, it’s the bond market that did the unbelievable this year. The Bloomberg US Agg, a commonly used bond index that is made up of 43.02% of U.S. government bonds[vi], is down 13.24% for the year[vii]. Corporate bonds fared even worse. The primary cause is the rising interest rates, though other macro-financial events also played a role.

The decline in the stock market flies in the face of many financial theories of diversification that hold that stocks and bonds are negatively correlated and should move in opposite directions. Worse, poor performance in the bond market hurts investors with lower risk tolerances who are invested in ‘safer’ bond-heavy portfolios.

There are few silver linings in a collapsing bond market. Longer term individual bond holdings should regain value as they approach their maturity date. The same is true for funds that hold bonds to maturity. Many bond funds however are forced to sell holdings as investors liquidate their positions, harming their ability to recoup losses. These events will be studied closely and could affect how portfolios are constructed in the years ahead.

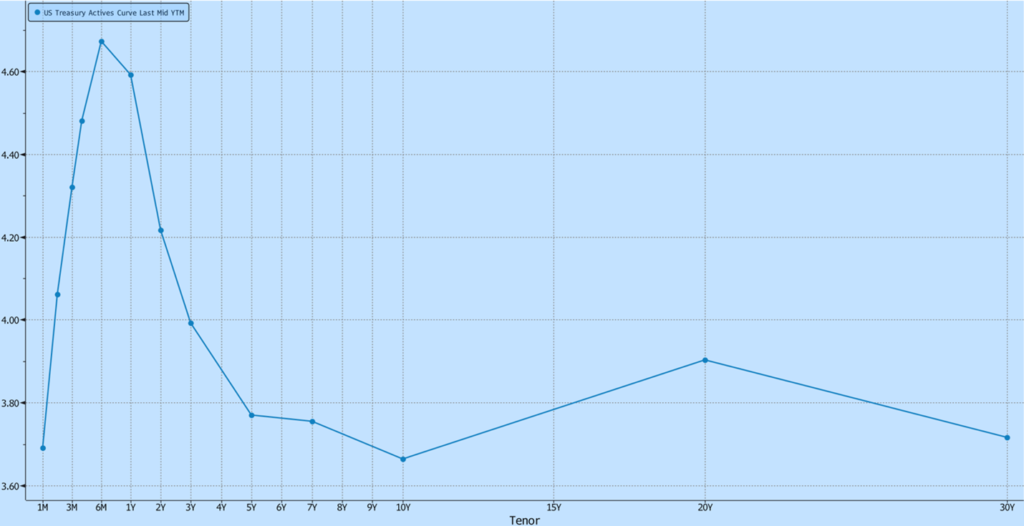

5. The deepest inversion in the modern history of the yield curve — closely tied to the collapse of the bond market is the deep inversion of the yield curve, or more accurately, multiple inversions at different point of the curve. As a reminder, the yield curve represents maturities on government bonds for different maturities. Typically the longer an investor agrees to hold a bond, the higher the yield they will receive (learn more about the yield curve).

This year however, the yields on bonds that mature in 1-3 years far exceed those on bonds that mature in 10-30 years. This unlikely scenario has only happened a handful of times in recent history and never for such an extended period. An inverted yield curve typically signifies a coming recession as investors seek safety in the longer end of the curve (driving prices up and hence yields down) and shun shorter maturities.

The current yield curve incorporates fears of a coming recession but is heavily influenced by two additional dynamics. On the short end of the curve, inflation has driven central banks to raise interest rates at the highest rate since 2008. While the inflation tide appears to have been stemmed, it remains to be seen for how long the Fed will keep short-term rates elevated to bring inflation back to its target. The long end of the curve meanwhile suggests that high interest rates are not here to stay and that the coming decades will see a return to the low interest rate environment. This, in turn, suggests slow economic growth in years to come resulting from the abundance of capital, low demographic growth, and the lack of technological breakthroughs.

Together, the above events paint a complex picture of an economy at a crossroads. Inflation has been halted but still needs to be brought down to target and the impact this will have on the economy remains to be seen. Tech companies are facing a long overdue reckoning but are likely to emerge stronger, albeit less generous towards consumers and employees.

In the markets all eyes remain on the Fed, which continues to talk tough on inflation, but whose remarks should also be viewed as an attempt to continue tamping down expectations of inflation. Investors agree that interest rates will come down, the question is when. In two or three years, we believe, the markets are likely to resemble those of the past decade; what path we take to get there remains to be seen.

— AD

[i] Bloomberg Finance, US CPI Urban Consumers YoY YTD, December 20, 2022

[ii] Bloomberg Finance, U-3 US Unemployment Rate Total in Labor Force Seasonally Adjusted, December 20, 2022

[iii] Bloomberg Finance, Member Weightings Group by Index Sectors of S&P 500 Index, December 21, 2022

[iv] Bloomberg Finance, Sector total return performance in S&P 500 Index, using SPY ETF for performance calculation, December 21, 2022

[v] Bloomberg Finance, NASDAQ 100 Stock Index YTD Line Chart, December 21, 2022

[vi] Bloomberg Finance, iShares Core U.S. Aggregate Bond ETF Allocations by Assets, December 21, 2022

[vii] Bloomberg Finance, iShares Core U.S. Aggregate Bond ETF Performance, December 21, 2022

Disclosures

Investment advisory services offered through Robertson Stephens Wealth Management, LLC (“Robertson Stephens”), an SEC-registered investment advisor. Registration does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. This material is for general informational purposes only and should not be construed as investment, tax or legal advice. It does not constitute a recommendation or offer to buy or sell any security, has not been tailored to the needs of any specific investor, and should not provide the basis for any investment decision. Please consult with your Advisor prior to making any investment decisions. The information contained herein was compiled from sources believed to be reliable, but Robertson Stephens does not guarantee its accuracy or completeness. Information, views and opinions are current as of the date of this presentation, are based on the information available at the time, and are subject to change based on market and other conditions. Robertson Stephens assumes no duty to update this information. Unless otherwise noted, any individual opinions presented are those of the author and not necessarily those of Robertson Stephens. Market performance may be represented by several indices. Indices are unmanaged and reflect the reinvestment of all income or dividends but do not reflect the deduction of any fees or expenses which would reduce returns. Past performance does not guarantee future results. Forward-looking performance objectives, targets or estimates are not guaranteed and may not be achieved. Investing entails risks, including possible loss of principal. This material is an investment advisory publication intended for investment advisory clients and prospective clients only. Robertson Stephens only transacts business in states in which it is properly registered or is excluded or exempted from registration. A copy of Robertson Stephens’ current written disclosure brochure filed with the SEC which discusses, among other things, Robertson Stephens’ business practices, services and fees, is available through the SEC’s website at: www.adviserinfo.sec.gov. © 2022 Robertson Stephens Wealth Management, LLC. All rights reserved. Robertson Stephens is a registered trademark of Robertson Stephens Wealth Management, LLC in the United States and elsewhere.