As published in wealthmanagement.com

By Stuart Katz, Chief Investment Officer

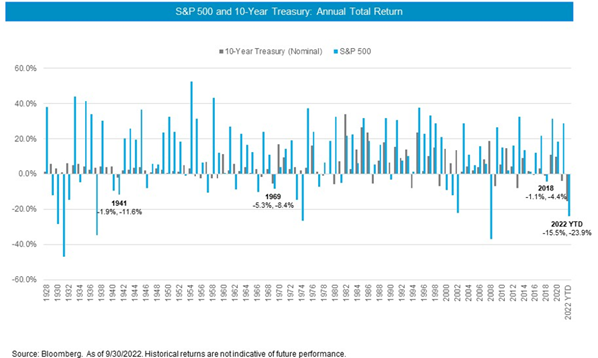

Jan 1, 2023 – Central bank monetary policy, corporate profits and investor behavioral tendencies will largely impact the path of markets over the next year. As the Federal Reserve has lifted short rates, the entire yield curve has risen, and higher interest rates have been a headwind on global equities and fixed income. Year to date few safe harbors existed as rates rose and growth slowed. Equity and bonds failed to zig and zag to each other’s performance in 2022. Since 1928, there have been only 4 years when both bonds and stocks have had negative returns. YTD September 2022 has seen the worst returns of those 4 time periods.

Over the year ahead, equities and credit will have to grapple with stagnant to declining earnings. Forward P/E equity valuations of ~18x do not provide meaningful valuation expansion opportunity. The US Fed projects rates will remain elevated as it makes clear tackling inflation, not sustaining growth, is its main focus. We believe there is a “new normal” where inflation next year will remain above its long-term trend. Financial market volatility is an inevitable consequence of this environment complicated by continued geopolitical events.

We believe the context for risky assets will become more encouraging as the year progresses as inflation and interest rates peak while growth expectations trough. As a result, we believe near term portfolio construction requires staying invested with a more defensive posture against near term downside side risk scenarios while maintaining flexibility to participate in a potential turning point to capture an upside scenario. Historically, markets start to appreciate between six and nine months prior to a bottom in economic activity and corporate profits. A turnaround for growth stocks will depend on lower inflation and an end to tighter monetary policy. The opportunity to earn more predictable risk adjusted income is attractive against this uncertain backdrop however overall credit spreads are skewed to widen. A slowing global economy means we are cautious on lower quality equities, riskier credit and underweight China during this transition period. The European equity market is at a meaningful discount to the US, but valuations are not at prior trough levels and risks remain high given the ongoing war in Ukraine, the various debt problems such as Italy and the likely shift to quantitative tightening by the ECB. Finally, with modest expected equity returns and selective diversification benefits from traditional assets the rationale strengthens for alternatives to complement public holdings. This approach may include strategies to access less correlated returns, enhanced income potential and capital appreciation-focused solutions targeting long term growth.

Portfolio Considerations

Equity Portfolio. Portfolio design should emphasize value equities including financials and capture sectors with defensive characteristics such as healthcare, energy with its inflationary “hedging” and structural underinvestment dynamics and certain technology companies with a track record of pricing power, superior free cash flow generation and capital allocation. We also believe profitable small cap and mid cap companies will disproportionately benefit in an upside scenario.

Fixed Income. We believe a backdrop of declining inflation and central banks pausing rate hikes will support high-quality bonds and municipal credit, which typically have performed well when a recession follows a pause in rate hikes. Securitized products such as mortgage-back securities may offer attractive income opportunities.

Alternatives. To capture various return and diversification benefits we believe certain equity long-short managers with modest net market exposures, distressed credit investors and private equity are worthy potential additions.

Stuart Katz is Chief Investment Officer of Robertson Stephens, a wealth management firm striving to provide comprehensive and innovative investment solutions and wealth strategies to clients through an intelligent digital platform. Learn more at rscapital.com. Investing entails risks, including possible loss of principal. Additional important information available at rscapital.com/disclosures/