April 14, 2023 – The Fed’s mandate to guide the US economy through monetary policy is often likened to steering a cargo freighter, though a Rube Goldberg machine may be a more apt analogy. Between the Fed and the US economy stand a dizzying array of national and regional banks, as well as non-bank lenders. These intermediaries translate the Fed’s interest rate policy into the loans and mortgages that are the lifeblood of the economy. Though the Fed regulates these institutions in various ways, banks ultimately decide whom to lend to and how to manage their own balance sheets. As a result, trouble in the banking sector, like we saw in March, adds a whole new dimension to the Fed’s already difficult task.

Even prior to the failure of SVB and Signature Bank, the Fed was in a tough spot. On the one hand, inflation proved to be far from transitory, and its stubbornness appears routed, at least in part, in the still tight labor market. Data released on Wednesday showing that inflation slowed in March to 5% from a year earlier, the lowest in two years and slightly below economists’ expectation, is certainly a step in the right direction. Still, inflation remains well above the 2% target, and a slight increase to 5.6% in core inflation, inflation without the more volatile food or energy, is cause for some concern.

On the other hand, a growing number of economic indicators such as consumption and manufacturing data are pointing toward an economic slowdown. Stop raising rates too early, and inflation may stop its painfully slow decline or even tick back up. Raise rates too high, or wait too long to cut them, and the US economy may tumble into a recession of unknown severity. Rising rates tend to uncover pockets of financial weakness, and the first such pocket proved to be on the balance sheet of banks.

The Fed now has two fresh concerns to worry about. The first is the stability of the banking sector. This is being addressed through lending facilities for banks who are holding long-dated maturities of the kind that brought down SVB, as well as more active efforts to better capitalize at-risk banks like First Republic. These efforts appear to be bearing fruit, though a run on regional banks perceived as vulnerable remains a risk.

The second concern is that banks will cease lending or limit their lending to only the safest of borrowers, resulting in a credit crunch. Though the Fed wants less lending to slow down the economy, it does not want lending to cease altogether. Banks have already begun tightening their lending standards in the last quarter of 2022, and recent bank failures will only accelerate this trend. Overly cautious banks could send the housing market tumbling and make it difficult for businesses to access loans, two scenarios that would have severe economic impact. In its attempt to fine-tune its monetary policy for the Goldilocks soft landing, the Fed now must contend with a wild card in the form of loan officers’ risk appetite.

Quarterly Recap

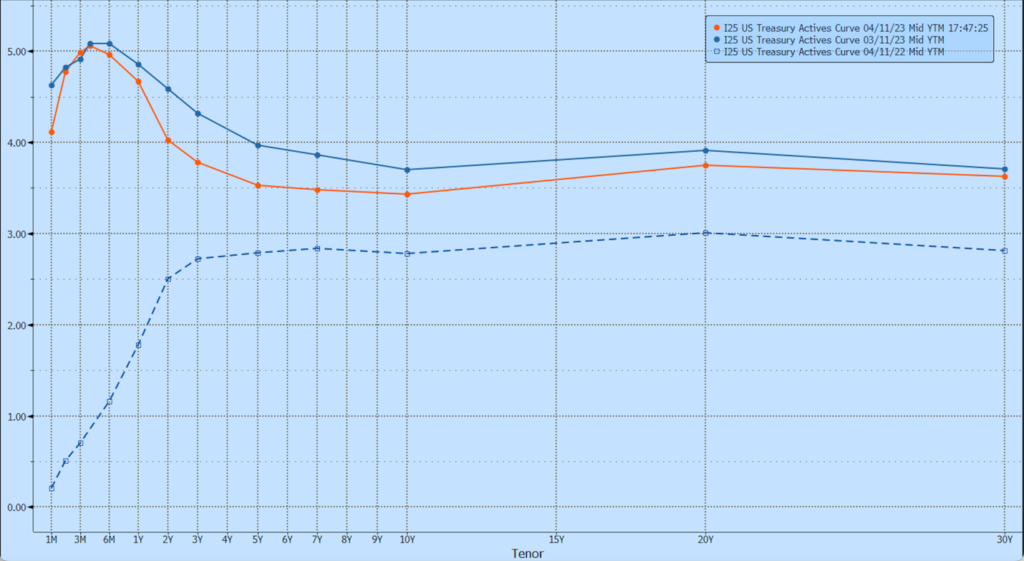

In its first meeting following the collapse of SVB and Signature Bank, the Fed continued hiking rates, signaling it resoluteness to curb inflation and its confidence that the bank crisis has been contained. The markets aren’t buying it, and bond market investors are betting that the Fed will start lowering interest rates by June or July of this year.1 As these expectations filtered through the yield curve they brought interest rates down for all maturities, with bigger shifts at the short end of the curve. Fueled by decreasing yields, the Barclays US Aggregate bond index posted a 3% return in the first quarter of the year. This is certainly a relief for investors following last year’s decline of 16.25%.

Chart 1: US Treasury Yield Curve, April 11, 2023, March 11, 2023, and April 11, 2022. Yields for maturities ranging from 2-5 years saw the largest decline following the March banking crises. Source: Bloomberg Finance

Equity investors seemed less daunted by the recent bank failures, and the S&P 500 ended Q1 up 7.5%, and the tech heavy Nasdaq soared 10%. However, these results are hardly uniform across publicly listed companies, with just five companies (Apple, Microsoft, Amazon, NVIDIA, and Tesla) accounting for 80% of the total S&P 500 return.2

Chart 2: S&P 500 and Nasdaq Composite from January 1, 2022 to March 31, 2023. Both indices enjoyed a strong start to 2023, though they remain well below the 2022 highs. Source: Bloomberg Finance

The positive results extended to the European markets, with the EURO STOXX 50 posting an 8.93% return in Q1. Europe appears to have avoided a massive economic slowdown after a mild winter and rapid action to refill oil and gas reserves helped the continent overcome the fallout from the Russian invasion of Ukraine.

The next test for the markets will be the earning reports, starting as soon as this Friday with US banks. Though Q1 earning reports will only show a few weeks of post-SVB results, CEOs commentary will reveal much of their expectations for what lays ahead.

The Outlook

The outlook for the remainder of the year remains murky at best. A recession in the first half of 2023 seems increasingly unlikely. The Atlanta Fed GDP Now estimate is projecting just over 2% annualized GDP growth in Q1, slightly above the Blue Chip consensus of 1.5%.3 The job market also remained strong, and though hiring slowed in March to 236,000 jobs, down from 326,000 in February, unemployment remained at the historically low 3.5%. At the same time, other indicators, including the yield curve inversion, decreased lending by banks, weakening consumer balance sheet, and a slowdown in business spending suggest a recession remains on the horizon.

Although much happened in Q1, we still have little clarity about the depth of the economic slowdown ahead. The line between a slowdown and a shallow recession might be mostly academic, but the line between a shallow recession and a deep one can be very significant. So far, rising interest rates have uncovered one systemic weakness in the form of bank balance sheets. Where the next pitfall lays and how deep it goes remains to be seen.

Equity markets seem to have mostly shrugged off the banking crises, or perhaps it was the belief that bad news is good news if it leads to the Fed lowering interest rates sooner. Either way, the stock market remains close to historical price-to-earnings ratio averages, meaning, stocks are not on sale and more volatility should be expected. Still, long-term investors should not let market sentiment dictate their investment decisions. While tactical adjustment may be merited, long-term strategic asset allocation should always be driven by investors’ financial goals and risk tolerance.

Disclosures

Investment advisory services offered through Robertson Stephens Wealth Management, LLC (“Robertson Stephens”), an SEC-registered investment advisor. Registration does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. This material is for general informational purposes only and should not be construed as investment, tax or legal advice. It does not constitute a recommendation or offer to buy or sell any security, has not been tailored to the needs of any specific investor, and should not provide the basis for any investment decision. Please consult with your Advisor prior to making any investment decisions. The information contained herein was compiled from sources believed to be reliable, but Robertson Stephens does not guarantee its accuracy or completeness. Information, views and opinions are current as of the date of this presentation, are based on the information available at the time, and are subject to change based on market and other conditions. Robertson Stephens assumes no duty to update this information. Unless otherwise noted, any individual opinions presented are those of the author and not necessarily those of Robertson Stephens. Performance may be compared to several indices. Indices are unmanaged and reflect the reinvestment of all income or dividends but do not reflect the deduction of any fees or expenses which would reduce returns. A complete list of Robertson Stephens Investment Office recommendations over the previous 12 months is available upon request. Past performance does not guarantee future results. Forward-looking performance objectives, targets or estimates are not guaranteed and may not be achieved. Investing entails risks, including possible loss of principal. Alternative investments are speculative and involve substantial risks including significant loss of principal, high illiquidity, long time horizons, uneven growth rates, high fees, onerous tax consequences, limited transparency and limited regulation. Alternative investments are not suitable for all investors and are only available to qualified investors. Please refer to the private placement memorandum for a complete listing and description of terms and risks. This material is an investment advisory publication intended for investment advisory clients and prospective clients only. Robertson Stephens only transacts business in states in which it is properly registered or is excluded or exempted from registration. A copy of Robertson Stephens’ current written disclosure brochure filed with the SEC which discusses, among other things, Robertson Stephens’ business practices, services and fees, is available through the SEC’s website at: www.adviserinfo.sec.gov. © 2023 Robertson Stephens Wealth Management, LLC. All rights reserved. Robertson Stephens is a registered trademark of Robertson Stephens Wealth Management, LLC in the United States and elsewhere.