By Jeanette Garretty, Chief Economist

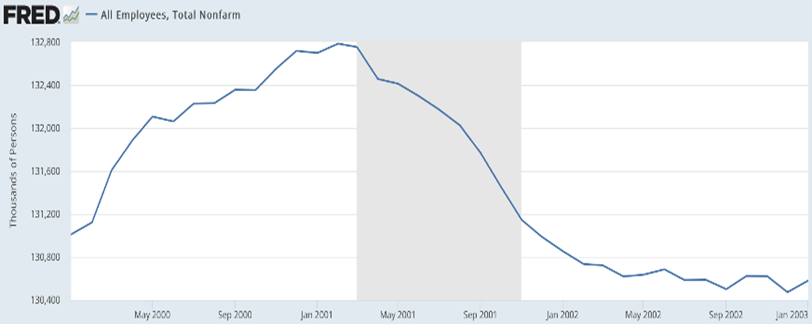

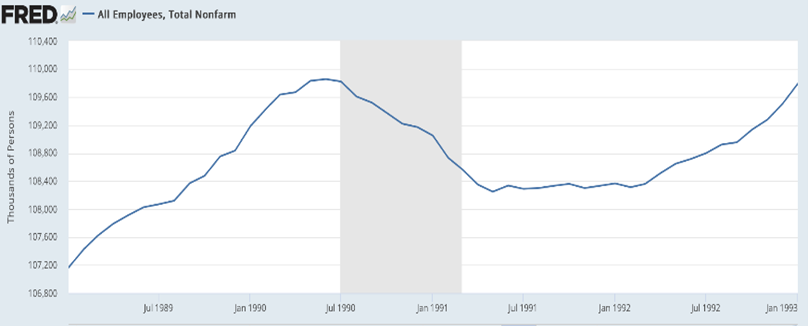

April 17, 2023 – In the same way that the arrival of Spring is heralded by a myriad of initially almost imperceptible changes – the arrival of robins, the emergence of leaf buds, the disappearance of nearly everyone to ski slopes/Bahamas/Disney (pick one or all)— so, too, recessions generally have harbingers of change. Employment growth is not one of them; most economists consider falling employment to be a lagging, or at best concurrent, indicator that conclusively signals the existence of a recession which actually was foretold sometime before the employment decline. The two charts below illustrate the typical labor market behavior for the US recession of the early 1990s and the “dot-com” recession of the early 2000s (as officially determined by the National Bureau of Economic Research (NBER) and designated by the gray bands in the charts).

Much has been written about the robust growth in US employment over the last five quarters, a trend seemingly impervious to the tightening of monetary policy and the explicit attempts by the Federal Reserve to cool down a labor market that Fed Chairman Powell once described as “unsustainably hot.” With 236,000 net new jobs reported in March 2023 and a monthly average of 334,000 net new jobs created in the last two quarters (BLS, April 7, 2023), the endless prognostications for a yet-to-arrive recession are taking on the quality of the Fed’s own infamous contribution to the Theatre of the Absurd: “transitory inflation.” No doubt to some, the recession forecasts would seem to confirm the status of economics as a dismal science.

But it is far more than just economists these days who are sounding the alarm. In fact, the people best positioned to see the early, occasionally circumstantial, signs of economic deterioration – CEOs, purchasing managers, budget heads and CFOs, HR departments and banks—are increasingly the most vocal about the likelihood for near-term negative growth. And although this Federal Reserve’s track record on forecasting anything is seriously disappointing, it is still worth noting that the recent release of the minutes of the March 2023 Federal Open Market Committee (FOMC) meeting confirmed that the Federal Reserve itself is forecasting a mild recession in the second half of 2023.

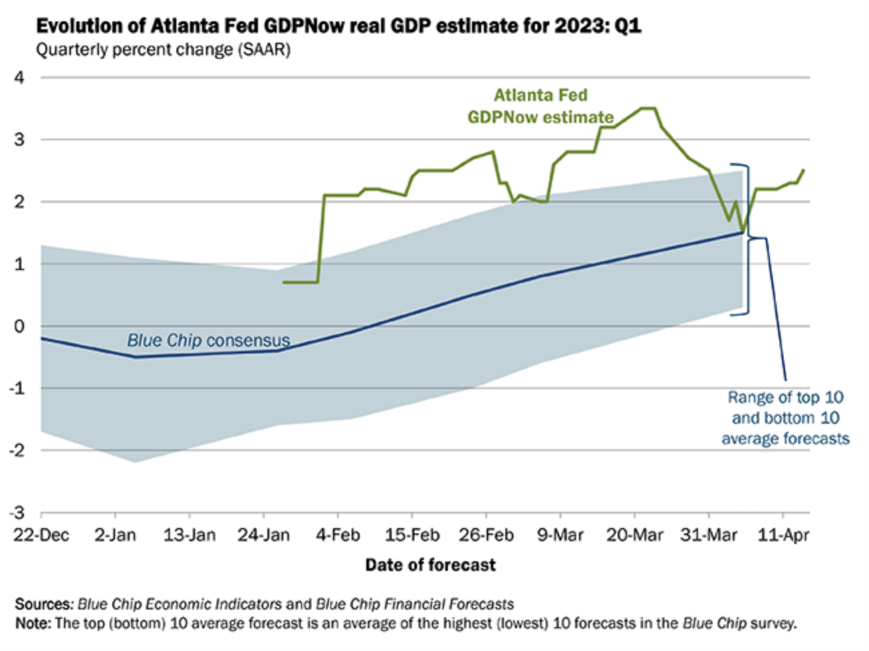

Estimates for US economic growth in the first quarter of 2023 have ranged between 0.5% and 2.5% of late, with the closely-watched Atlanta Fed GDPNow real-time measure of economic activity being unusually volatile across the quarter. Growth of 1.5%-2.0%, the mid-range of the forecasts, would be considered a “good” US number by most economists, meaning a rate of growth that creates sustained employment opportunities for an expanding population.

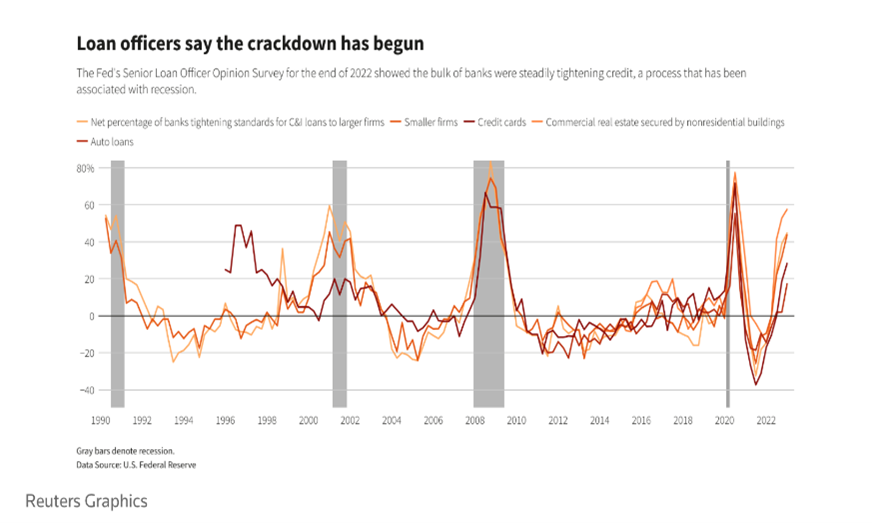

However, towards the end of the quarter and continuing into April, an economic chill seems to have been felt by many. Purchasing managers surveys have shown a persistent decline in manufacturing industries that is significant enough for the manufacturing sector to now consider itself in its own mini-recession. Service sector growth, often cited by the Federal Reserve as the problematic outlier in its attempts to slow down economic activity remains robust, but companies in the sector appear to be feeling the impact of rising costs acutely and are now taking actions to reduce employment, operational expenditures and investment in expansion. Banks that tightened their credit policies going into 2023 appear to have tightened them yet again and the small but influential extension of financing (debt and equity) to start-up companies has slowed to a trickle.

Many forecasters will choose to say something sensible at this point, like “The risk of a recession has increased.” This forecaster would rather be a bit more direct and join the camp preparing for a recession in the second half of 2023, most likely starting in June, while retaining enough sensibility to suggest that even if US economic growth remains positive or if two negative quarters fail to materialize consecutively, growth is likely to be weak enough to feel like a recession to many market participants.

A key factor in this forecast is the outlook for inflation, which is simply not coming down to levels that will reduce the pressure on the Federal Reserve to keep monetary conditions restrictive nor on businesses trying to preserve margins and boost earnings. Coupled with a few circumstances unique to the United States, such as political brinkmanship on the issue of raising the debt-ceiling and financial problems (or, at minimum, regulatory pressure) on regional banks, this all seems to be a recipe for a witches’ brew already simmering in the cauldron.

The fact that everyone has to plan around and for something is why forecast tables exist. Certainly, it cannot be because such tables are thought to embody the truth. Yet, such tables can also contribute valuable perspective, a reminder that what goes down also goes up (and vice versa in the case of inflation) and that change can and should be managed with an eye toward the probable medium-term outlook.

Disclosures

Investment advisory services offered through Robertson Stephens Wealth Management, LLC (“Robertson Stephens”), an SEC-registered investment advisor. Registration does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. This material is for general informational purposes only and should not be construed as investment, tax or legal advice. It does not constitute a recommendation or offer to buy or sell any security, has not been tailored to the needs of any specific investor, and should not provide the basis for any investment decision. Please consult with your Advisor prior to making any Investment decisions. The information contained herein was carefully compiled from sources believed to be reliable, but Robertson Stephens cannot guarantee its accuracy or completeness. Information, views and opinions are current as of the date of this presentation, are based on the information available at the time, and are subject to change based on market and other conditions. Robertson Stephens assumes no duty to update this information. Unless otherwise noted, any individual opinions presented are those of the author and not necessarily those of Robertson Stephens. Indices are unmanaged and reflect the reinvestment of all income or dividends but do not reflect the deduction of any fees or expenses which would reduce returns. Past performance does not guarantee future results. Forward-looking performance targets or estimates are not guaranteed and may not be achieved. Investing entails risks, including possible loss of principal. Alternative investments are only available to qualified investors and are not suitable for all investors. Alternative investments include risks such as illiquidity, long time horizons, reduced transparency, and significant loss of principal. This material is an investment advisory publication intended for investment advisory clients and prospective clients only. Robertson Stephens only transacts business in states in which it is properly registered or is excluded or exempted from registration. A copy of Robertson Stephens’ current written disclosure brochure filed with the SEC which discusses, among other things, Robertson Stephens’ business practices, services and fees, is available through the SEC’s website at: www.adviserinfo.sec.gov. © 2023 Robertson Stephens Wealth Management, LLC. All rights reserved. Robertson Stephens is a registered trademark of Robertson Stephens Wealth Management, LLC in the United States and elsewhere.