June 1, 2023

Good morning,

The economy and the markets are inexorably linked, just not perfectly. The imperfection is one of timing where markets move ahead of economies. Let’s talk about both today.

When it comes to the U.S. economic outlook, there are plenty of negatives to focus on. Interest rates are much higher than a year ago and the Fed has signaled that they’ll stay higher for longer. Credit conditions are tightening, inventories are still in correction mode, and leading economic indicators are screaming red. And yet, when it comes to current activity, the economy is still plodding along, albeit at a reduced pace. Q1 real GDP was revised up to a 1.3% annual rate from 1.1% in the advance estimate, which is less than half the 2.9% average growth rate in 2H 2022. Moreover, the S&P Global U.S. Composite PMI (Purchasing Manager’s Index) climbed to 54.5 in May, its highest level since April 2022.

Perhaps the second biggest surprise of this year so far, is how resilient the economy has been considering all the negatives cited above. Resiliency notwithstanding, there is a growing sense of No-Way-Out for the U.S. economy: either the economy runs too hot, prompting more rate hikes, or too cold — falling into recession. There is little room for Goldilocks in this story.

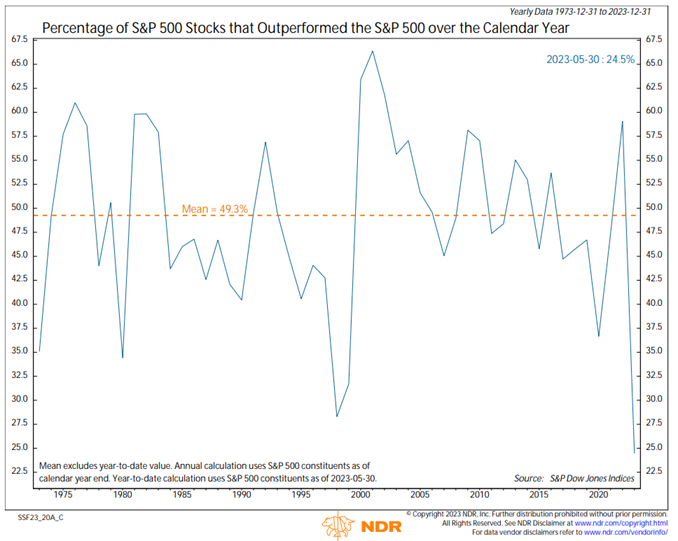

The overarching theme for the stock market so far in 2023, and the biggest surprise to investors, is the mean reversion in mega-cap stocks that underperformed in 2022. Over the past two months, the mega-cap trade has grown even more popular, to the detriment of the broad market. By most measures, the narrowness of the market has reached historic measures. The Percentage of S&P 500 Stocks that Outperformed the S&P 500 Index over the Calendar Year is at a record low (data since 1973: see NDR chart below).

Described conservatively: following previous periods of narrow leadership. S&P 500 gains have been below average, with a mix of small-cap, Value, and High-Quality outperformance a year later.

The argument for caution, despite and/or because of the runup in 5 mega-cap stocks, continues to grow.

No note tomorrow d/t the holiday-shortened week. Have a good weekend.

Be well,

Mike