July 19, 2023

Good morning,

There is no question now, the market is firmly in the grips of euphoria. The deftly threaded needle-soft landing narrative is so pervasive it is obscuring any other, less ideal outcome. That’s terrific; let’s enjoy watching our stock portfolios appreciate at the same time our returns on cash in our money market funds grow (the riskless rate of return). It’s all well and good, but let’s not extrapolate these conditions too far into the future.

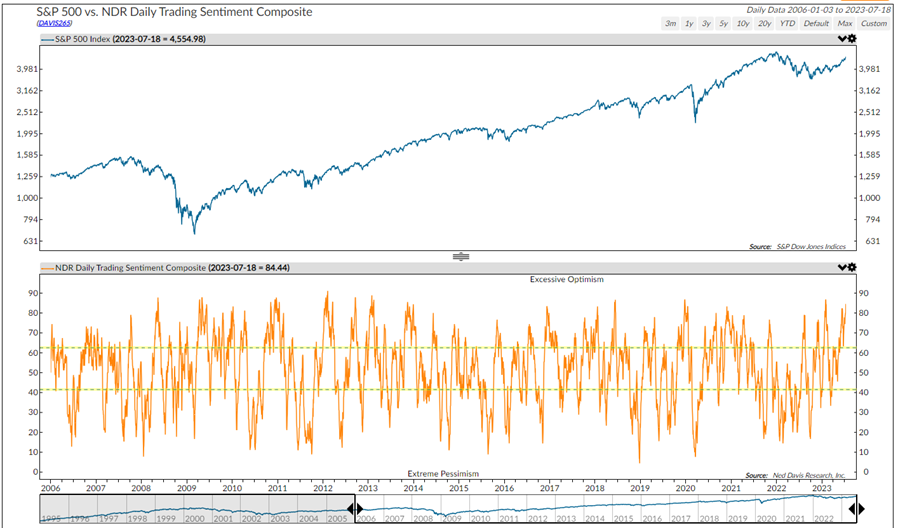

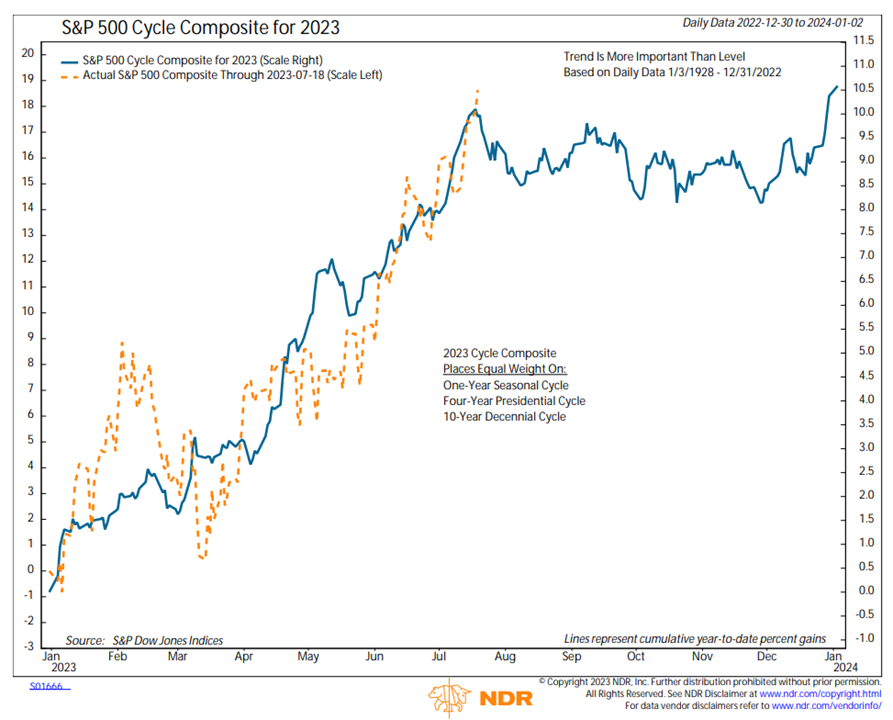

Two charts today. The first reflects that stocks have only been this overbought less than half a dozen times in over 10yrs – each incident preceded a correction. The second is the updated Cycles Chart which you’re familiar with at this point. The bottom line is that excessive optimism is a risk for the stock market. And according to the historical combination of 1yr, 4yr, and 10yr cycles, this excessive optimism comes at a time when first half strength ends.

I won’t put out a Morning Note this Friday or next Monday due to travel. I’ll adjust next week’s schedule to Tuesday and Thursday – see you then.

Be well,

Mike