October 6, 2023 – After a decade and a half of ultra-expansionary monetary policy, it’s perhaps not surprising that investors scoffed at the idea that interest rates may not return to the near-zero level we’ve gotten accustomed to. A recency bias likely played a role in this denial, as did the Fed’s reduced credibility after the ‘transitory inflation’ saga. Recently, though, investors are increasingly coming to terms with the idea that interest rates might stay higher for longer.

The primary force keeping interest rates high is sticky inflation. Though the Fed has made great progress in bringing inflation down from a peak of 9.1% in 2022 to the current 3.7% (as per August’s CPI reading), the path down to the Fed’s target of 2% may prove more challenging. The Fed might have won the initial battle against inflation, but the war could be far from over.

Today’s sticky inflation is foremost a result of a strong economy, though the recent increase in oil prices –thanks mostly to production cuts by Russia and Saudi Arabia—is also a concern. How the economy has remained resilient in the face of dramatic rate hikes is a question that will take years to answer. The massive Covid stimulus and current government spending are certainly part of the answer. A tight labor market, resulting from demographic trends and an exodus from the workforce by older employees during the pandemic, also played a role. But even accounting for these factors, the strength of the US economy has left economists scratching their heads.

One explanation increasingly heard from economists is that the US economy may be entering a period of faster economic growth as a result of onshoring, artificial intelligence, and increased investments in renewable energy. Strong economic growth combined with the retiring boomer generation could push interest rates higher for longer by raising the natural interest rate of the US economy (for more on this, see my recent market note What is a Natural Interest Rate Anyway).

Though the Fed chose to keep rates steady at its September meeting, Chairman Powell’s sighting of another possible rate hike in 2023 seems to have driven the higher-for-longer message home. Tech and other growth stocks, which are the most sensitive to interest rates, were the biggest victims. The tech heavy Nasdaq ended the quarter down 4.1%, though it remains up 26.3% year-to-date. The MSCI All World stock index lost 3.4% in Q3 and remains up 10% year-to-date. These returns remain highly concentrated in a very small number of companies, nicknamed the Magnificent Seven. Much of the quarter’s losses occurred in September, historically a bad month for stocks as summer comes to an end. The magnitude of the September selloff offers some hope of positive performance in the coming months, especially if earnings come in at stronger levels than expected.

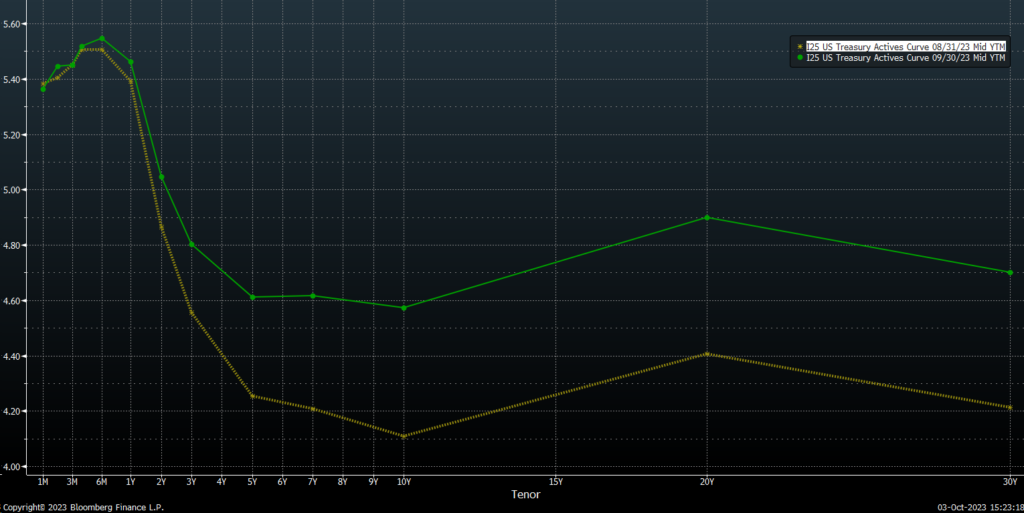

The bond market meanwhile continued to struggle in the face of higher yields, with the Barclays Global Agg down -3.6% in Q3 for a year-to-date return of -2.2%. The yield curve, the return on government bonds of different maturities, remains inverted, with short term yield higher than long term ones. However, as expectations that future rates will remain higher have spread throughout the quarter, the long end of the curve rose significantly. This steepening of the curve suggests that the bond market may be approaching a new normal, one with higher rates across all maturities.

The Outlook

Today’s strong economy has most economists projecting a soft landing through the end of the year, with a possible recession in 2024. This, of course, could change in a hurry, as we were reminded of on Friday when the federal government came within a hair of a shutdown. This self-inflicted injury by a dysfunctional congress is a reminder of the economic costs of the deep fractures in our society.

Other headwinds to the economy are ample. Rising interest rates put pressure on businesses and consumers alike. Student loans and rising gas prices could further reduce consumer spending power. The impact of the United Auto Workers’ strike is likely small in the short term but could be a harbinger of increased friction between labor and capital.

In all, though the economy remains robust, there are reasons to maintain vigilance. Higher rates challenge both consumers and businesses, and the likelihood that rates could stay higher-for-longer should be taken seriously by all borrowers. Higher rates could also challenge stock market valuations, though the immediate impact of this is hard to discern. Finally, higher rates present an opportunity for investors to introduce or increase exposure to an asset class that has been mostly ignored since 2008. In a world where fixed income offers attractive yields, the question of asset allocation takes on added importance.

Wishing you a beautiful fall and a happy holiday season to come.

— AMD