January 12, 2024 – I suspect few will mourn the end of 2023. The year that started with deep concerns over the economy and ended with geopolitical turmoil saw few happy headlines. Despite the turmoil, the US economy had a surprisingly strong year, even as Europe and China struggled to regain their footing. This, in turn, translated into strong stock market performance, albeit with concentrated and uneven returns rewarding the expected winners of the AI boom. What follows is a review of 2023 with an eye toward the forces that will shape the global economies and markets in 2024.

The Shaping of a World Order

For many, myself included, geo-political events dominated the end of the year. The brutal Hamas attack on October 7th, and the resulting devastating war in Gaza, are a harsh reminder of the cultural and religious fault lines that underlie our fragile globalized world. Now overshadowed by the Middle East is the Ukraine war that will mark two years in February. This brutal military conflict, more reminiscent of World War I than of the anti-guerilla warfare of the past decades, is estimated to have killed or wounded over 500,000 troops and tens of thousands of civilians.1

The above conflicts occur on a backdrop of the largest global power struggle since the end of the Cold War. On the one side stand the United States and the Western Democracies, embattled by internal divisions, economic woes (mostly in Europe), and the failure to bring democracy or prosperity to countries like Iraq and Afghanistan. They remain, however, economically and militarily dominant.

Outside of this global alliance stand China and Iran, historical empires fighting to restore their power and prestige in opposition to Western hegemony. The challenge they pose is not simply one of power, but of an entirely different values system. By their side stands Russia, a weakened giant buoyed by its sheer size and the size of its nuclear arsenal. And in the middle, uncommitted but wooed by both sides lay Turkey, the Gulf states, India, and large parts of the Far East. In a call back to the Cold War, these non-aligned countries are now the subject of intense diplomatic brinkmanship.

More than ever, we’re seeing the clash of civilizations proposed by the political scientist Samuel Huntington, play out on the global stage. Though the military clashes are still mostly proxy wars, Iran and US forces are increasingly close to direct fighting. Tensions are also at all-time highs regarding Taiwan, the technological and symbolic holdout that China wishes to control. A conflict there could bring the US and China into a devastating war with many unforeseen outcomes.

No doubt, the coming years will do much to shape the geo-political world order for years to come. Western democracies will need adept leadership and a unity of purpose to overcome the obstacles we are bound to face. If the current political climate offers little cause for hope, let us not forget that in economics and war, liberal democracies have proven to be the most successful form of political organization for hundreds of years, and they will not be easily replaced in that role.

The Recession that Wasn’t

Unlike the geo-political landscape, the US economy of 2023 is more notable for what didn’t happen than for what did. Namely, we didn’t have a recession. In fact, GDP grew over 2% in the first two quarts of the year and a whopping 4.9% in Q3.2 This is despite the sharpest interest rate hikes in 40 years. Even the collapse of Silicon Valley Bank and First Republic, in hindsight, appears to be only a speed bump.

Why the economy remained so resilient to interest rate hikes is a question economists will study for years to come. The answer will likely include changes to the economy and the financial structure that make it less sensitive to short-term rates and the tremendous amounts of fiscal and monetary Covid-era stimulus. A change in natural interest rates likely also played a role.

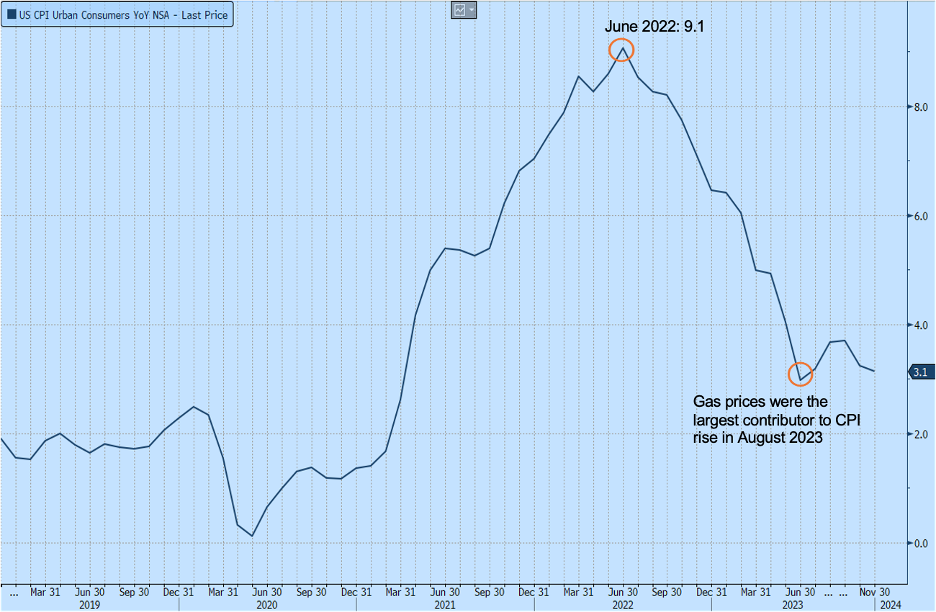

Regardless of the reasons, Chairman Jerome Powell has many reasons to be happy with this outcome. November’s 3.1% inflation number is still a full percentage point above the Fed’s target of 2%, but it’s a long way down from June 2022’s 9.1% number. To achieve this with an unemployment rate of 3.7% as of November puts the Fed on a path to achieving its dual mandate of stable inflation and full employment.

Chart 1: US Consumer Price Index (CPI) Urban Consumers YoY from January 1, 2019 to January 3, 2024. November’s 3.1% inflation number is still a full percentage point above the Fed’s target of 2%, but it’s a long way down from June 2022’s 9.1% number. Source: Bloomberg Finance.

Concentrated Equity, Confused Debt

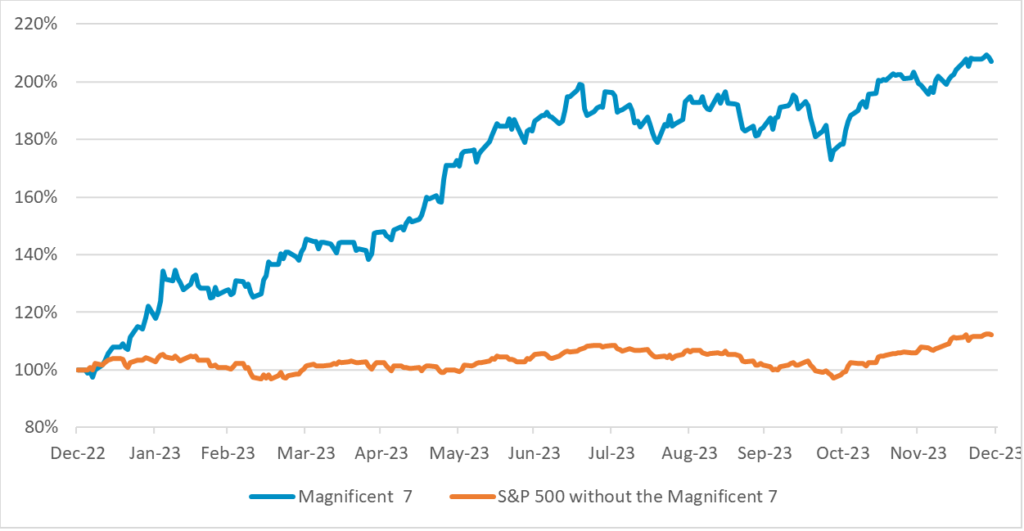

It is perhaps the hope that the Fed achieved a soft landing for the economy that caused 2023 to be a wildly successful year for the equity markets. Beating all expectations for the year, the MSCI All World Stock Index ended the year up 22.2%. US large cap stock, and especially the tech sector, did even better. However, these numbers hide a more complicated dynamic that played out in the stock market this year as a handful of companies nicknamed the Magnificent Seven accounted for the vast majority of the stock market returns. As can be seen in chart 2, the S&P 493, meaning the S&P 500 without the Magnificent Seven, rose only 12% for the year, while the Magnificent Seven more than doubled.

Chart 2: Performance of the Magnificent 7 and the S&P 500 without the Magnificent 7 from January 1st, 2023 to December 31st, 2023. The S&P 493, meaning the S&P 500 without the Magnificent 7, rose only 12% for the year, while the Magnificent 7 more than doubled. Source: Bloomberg Finance.

One explanation for this phenomenon, as well as for the surprising stock market returns, is the increasing growth and prevalence of AI tools. Many of the Magnificent Seven—Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta, and Tesla— are seen as possible winners in the AI race. This theory remains to be tested, but there’s no doubt that the coming years will see large productivity gains driven by AI tools. How the profits from these gains are distributed is an open question.

The bond market also enjoyed a strong 2023, with the Global Aggregate Index notching a 5.72% gain for the year. This was a welcome reprieve to fixed-income investors after several hard years. Again, though, this number hides much of the volatility that rocked the normally sleepy bond market throughout the year. The yield on US 10-year treasury bond saw multiple peaks and touched the 5% range before settling around 3.9%, close to where it started the year, as investors struggled to determine where interest rates are headed in the coming decade.

Chart 3: 10-Year Treasury Yield from January 1, 2023 to December 31, 2023. The yield on US 10-year treasury bond saw multiple peaks and touched the 5% range before settling around 3.9%, close to where it started the year. Source: Bloomberg Finance.

The Outlook: Votes, Robots, and Rates

The uncertainty that plagued 2023 is unlikely to relent in 2024. On top of the geopolitical events mentioned earlier, domestic politics are likely to dominate the headlines, starting with the funding deal required to keep the government funded past January 19th, through impeachment and primary battles, and ending with the election in November.

While all these events are sure to generate noise, their impact on the economy, perhaps except for a long government shutdown or a breakdown of our political system, is likely small. While we keep an eye on these events, we’ll pay closer attention to the Federal Reserve who remains the most dominant government actor in the economy and financial system.

The question on the minds of many as we enter 2024 is when interest rates will start to come down. Investors are currently pricing in a 65% probability that the Fed will cut rates as soon as March, and a 100% probability that rates will be below 5% by December.3 While these predictions are more optimistic than the Fed’s own predictions, the prevailing sense is that rate cuts are coming. This would suggest that the economy continues to slow in 2024, though economists are split about the chances of a slowdown turning into a recession. Those who do predict one mostly expect a shallow recession. Sadly, the global picture is bleaker, and we’ll be closely monitoring developments in Europe and in China, which could impact the US economy and stock markets.

One group of investors who would welcome interest rate cuts are bond market investors. The current inverted yield curve, in which short term rates are higher than long term rates, is already one of the longest in modern history and has caused much disarray in this normally sleepy market. Lower short-term rates could un-invert the yield curve, and be a boon to investors who took on more duration risk by holding longer-dated bonds. As can be seen in Chart 4, downward movement throughout the year in durations between two and 10 years suggests the curve is on its way back to its normal upward slope.

Chart 4: US Treasury Active Curve from December 31, 2022 and December 31, 2023. Downward movement throughout the year in durations between two and 10 years suggests the curve is on its way back to its normal upward slope. Source: Bloomberg Finance.

The stock market has also historically benefited from lower rates, though to what extent rate cuts are already priced into the stock market is an open question. Following the massive bull market that closed 2023, the stock market sits close to all-time highs and well above its historical average price-to-earnings ratio. In addition to rate cuts, these levels would also suggest no recession and double-digit earnings growth, an optimistic outlook at best.4 On the other hand, the factors that drove the stock market in 2023, namely excitement about AI, re-shoring, and clean energy, could continue to drive the market in 2024. If there is a lesson to be learned from 2023’s surprising stock market returns, it’s that investors are wise to remain humble and stay invested.

Despite the difficult news from around the world and within, there are reasons to stay optimistic. The US economy has outperformed globally over the past year, and a soft landing seems like the probable scenario; AI is well on its way into the mainstream, bringing with it increased efficiency and productivity, and; the global energy transition to green fuels is continuing at a rapid pace. Let’s hope that these and other positives will drown out bad news in 2024. As always, we continue to monitor the global economies and markets, and we look forward to sharing our insights with you throughout the year.

Wishing you, your family, and your loved ones a peaceful and happy 2024.

– AMD

1 https://www.nytimes.com/2023/08/18/us/politics/ukraine-russia-war-casualties.html

2 https://www.bea.gov/news/2023/gross-domestic-product-third-estimate-corporate-profits-revised-estimate-and-gdp

3 Retrieved on 1/8/23 from https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html.

4 Based on Robertson Stephens Investment Office Analysis