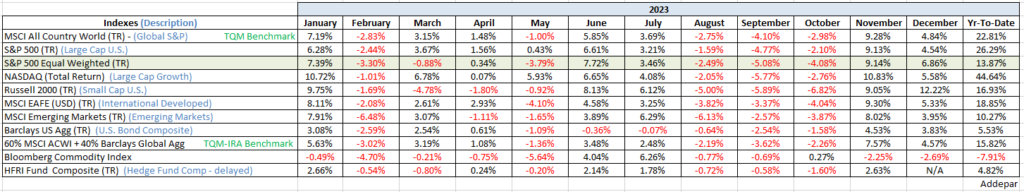

All years have surprises for the financial markets, in addition to what I’m hoping for you, I also hope that there are fewer surprises for markets this year than last. 2023 surprises were harder than usual on investment managers and consequently, fewer managers than usual were able best their benchmark indexes. There was the recession that never came, The Magnificent Seven stocks that accounted for 100% of the markets gains for the first 10 months of the year. There was Fed Chairperson Powell’s surprise move from hawkish to neutral followed be a more surprising market interpretation that Powell had pivoted beyond neutral to uber-dove and would be cutting rates post-haste. Stocks and bonds turned on the flip of a switch from 10 months of dreck (except for 7 stocks) to 2 months of glory. See performance chart below.

With all the challenges last year presented, it was another year where I thanked my lucky stars that I adopted a model investing methodology in Q1 of 2015. As you’ll see in your report that follows, both models, TQM for taxable accounts and TQM-IRA for non-taxable accounts, matched or beat their respective benchmarks, putting them both in rarefied air for the year against other investment methodologies. And that’s for the public markets, thanking more stars, Stuart Katz and his/our RS Investment Office for the over-all stellar performance of your private investments this year. I’m looking forward to reviewing all this with you on a review call in the coming weeks.

Near term, I suspect markets pulled some of 2024’s gains forward into year-end 2023, and markets are ahead of themselves. That is usually a recipe for correction, and it seems one has started as I write (Friday, 1/5). Normally, the first correction following an unusually correlated stock and bond barn-burning 9 weeks is not too deep and doesn’t last very long. That said, I do expect a choppy market through the first quarter as the gap between the Fed Chair’s pivot to neutral and the markets more bullish discount to “dove” tends to narrow.

I still believe there is a good chance for a recession in the end of this year. And it may appear as a soft-landing initially, but it is unlikely to be maintained for long. When an economy reaches full employment, the central bank needs to calibrate monetary policy almost perfectly to keep it there. If it does not cut rates fast enough, unemployment will increase; if it cuts rates too fast, inflation will rise. If no recession, then the chances of a second wave of inflation go up. Neither a recession nor a second inflation wave would be good for equities.

The bad news is that I’m not a roaring bull for the coming year – maybe markets are choppy and flat-ish at best. The good news, the models should have you covered.

Be well,

Mike

Source: Addepar, BCA Research, Bloomberg, Ned Davis Research

Disclosures

Investment advisory services offered through Robertson Stephens Wealth Management, LLC (“Robertson Stephens”), an SEC-registered investment advisor. Registration does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. This material is for general informational purposes only and should not be construed as investment, tax or legal advice. It does not constitute a recommendation or offer to buy or sell any security, has not been tailored to the needs of any specific investor, and should not provide the basis for any investment decision. Please consult with your Advisor prior to making any investment decisions. The information contained herein was compiled from sources believed to be reliable, but Robertson Stephens does not guarantee its accuracy or completeness. Information, views and opinions are current as of the date of this presentation, are based on the information available at the time, and are subject to change based on market and other conditions. Robertson Stephens assumes no duty to update this information. Unless otherwise noted, any individual opinions presented are those of the author and not necessarily those of Robertson Stephens. Performance may be compared to several indices. Indices are unmanaged and reflect the reinvestment of all income or dividends but do not reflect the deduction of any fees or expenses which would reduce returns. A complete list of Robertson Stephens Investment Office recommendations over the previous 12 months is available upon request. Past performance does not guarantee future results. Forward-looking performance objectives, targets or estimates are not guaranteed and may not be achieved. Investing entails risks, including possible loss of principal. Alternative investments are speculative and involve substantial risks including significant loss of principal, high illiquidity, long time horizons, uneven growth rates, high fees, onerous tax consequences, limited transparency and limited regulation. Alternative investments are not suitable for all investors and are only available to qualified investors. Please refer to the private placement memorandum for a complete listing and description of terms and risks. This material is an investment advisory publication intended for investment advisory clients and prospective clients only. Robertson Stephens only transacts business in states in which it is properly registered or is excluded or exempted from registration. A copy of Robertson Stephens’ current written disclosure brochure filed with the SEC which discusses, among other things, Robertson Stephens’ business practices, services and fees, is available through the SEC’s website at: www.adviserinfo.sec.gov. © 2024 Robertson Stephens Wealth Management, LLC. All rights reserved. Robertson Stephens is a registered trademark of Robertson Stephens Wealth Management, LLC in the United States and elsewhere.