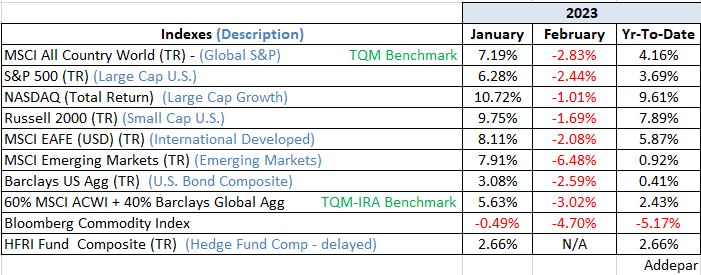

Helped by falling inflation and hopes of an imminent end to the global monetary tightening cycle, the year got off to a strong start in January. However, resilient economic data in February led to a move higher in bond yields and a decline in equity markets.

Markets have been infatuated with the Fed’s plan for monetary policy for many months. At the February 1st FOMC meeting, the Fed voted unanimously to raise rate by 25 basis points (bps) to 4.75%. Fed Chair Powell warned that the process of disinflation is expected to have a long way to go, and further rate hikes are likely needed, especially if macro data continues to come in stronger than expected. Markets, both bonds and stocks, were forced to re-evaluate their rather optimistic pricing vs Powell’s higher-for-longer rate narrative for the future.

It seems that the U.S. economy is stronger, and inflation is more resilient today than what investors expected six months ago when they were discounting future expectations into market prices back then. Said more plainly, investors seemed to get ahead of themselves expecting a recession mid-way through this year and over-discounted. Economists have been lowering their probability of a recession this year for weeks, going back to the start of the year. This is probably the best explanation for the strength stocks have displayed thus far this year. But I do not think it is the beginning of a lasting bull market.

We have a Fed Chair who appears resolute on breaking Inflation back to target (2-3%). I believe that as the probability of recession this year falls, it raises the probability of one next year. That is unless the Fed flips. As a manager of risk, I’m not counting on that.

Source: Addepar, Bloomberg