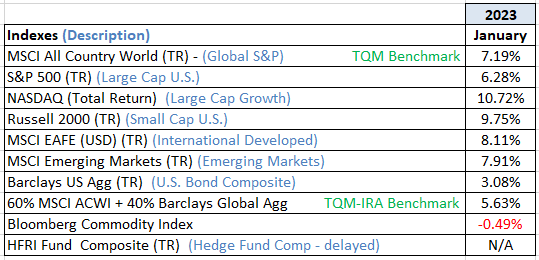

As this month’s report is a little later than usual (with apologies), there isn’t too much to write that has not already gotten to you through my Morning Notes. January’s black in the chart below says all you need to know about the start of the new year and its stark departure from last year’s consistently red performance. One exception to the departure notion, is that the correlation between equities and bonds remained positive, like last year, but the asset classes moved together in a much more pleasing direction for investors.

January was unambiguously better than any 2023 Outlook or Survey I read. Technically, the market trend officially moved from bear market to bull market last week in the first days of February. I suspect much of the good macro news that may develop this year as far as soft landings, and late year interest rate cuts has been pulled forward into current pricing. There would seem to be some not so good news ahead of a high probability recession of some kind, that still needs to be priced in.

Last month we postulated that the market may move, in the next six months, within the boundaries of the last six months. It appears that the upper boundary (S&P 500 at about 4300) will be tested first.

Source: Addepar, Bloomberg, JPMorgan Asset Management, Ned Davis Research