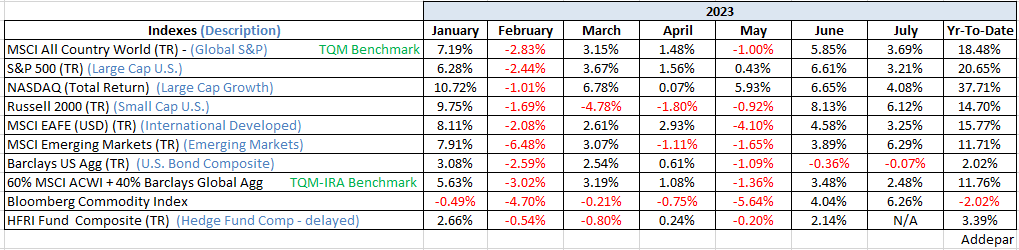

Investors’ feelings toward stocks (market sentiment) remained positive in July. A drop in inflation and resilient GDP data buoyed those feelings – maybe overly so. Stocks did well across styles and around the world. The 3.21% gain in the S&P 500 Index was beaten by large and small caps domestically, and International Developed and Emerging Markets abroad. Bond prices ended the month mostly unchanged – small gains internationally and small losses domestically. Commodity prices reversed some of their year-to-date losses with the broad Bloomberg Commodity Index rising 6.3% for the month, which is raising concerns about inflation popping back up in the weeks ahead.

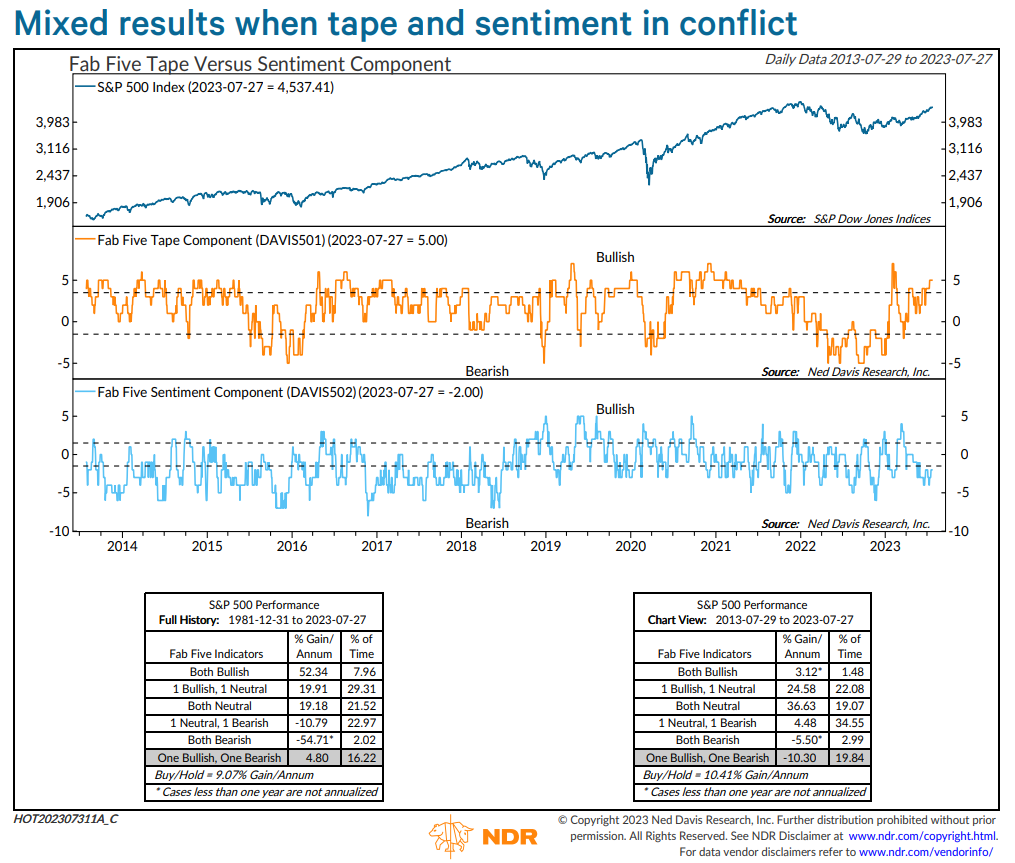

The amount of time an investor spends thinking about how the market “should be” acting rather than the way it “actually is acting” accounts for most of the anxiety in an investor’s lifetime. Technical analysis is the study of how the market is acting, and that is why it is one of only four analytical tools in our Technical/Quantitative Analysis methodology. The other three are Fundamental, Macro-economic, and Behavioral analytical methodologies. “Don’t Fight The Tape” is the cardinal rule of technical analysis but by degree that rule is influenced by the message from the other three methodologies. For example, following large declines in stock prices before a recession, when the Tape turns positive mid-way through a recession and the Fed begins to cut rates and investors are swearing off stocks for good (ultra bearish sentiment is a bullish signal for stock prices) – it has historically been the best time in an economic cycle to buy stocks.

But what has happened historically when one of these indicators is opposite of the other. Today the tape is understandably positive (see Y-T-D column above) but sentiment is ebullient (bearish indicator for stocks). The results have been very mixed and choppy.

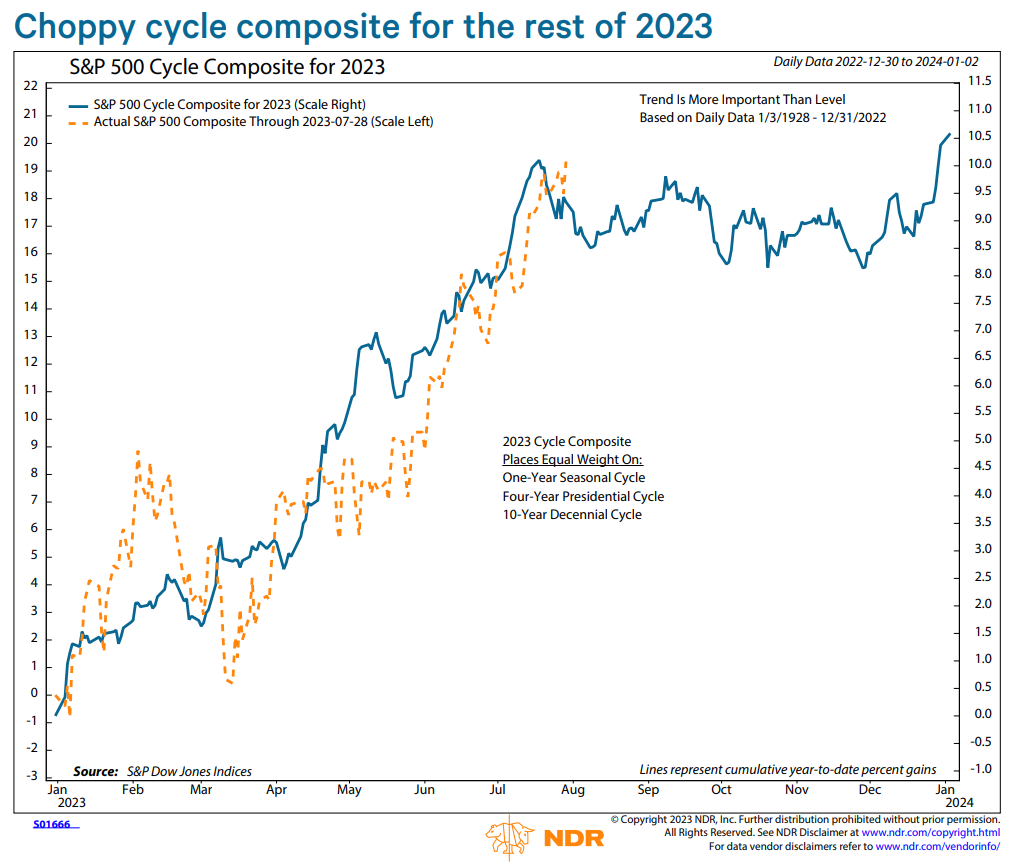

This is exactly what is implied by the cycle composite below.

Be well,

Mike

Sources: Addepar, Bloomberg, JP Morgan Asset Management, Ned Davis Research

Disclosures

Investment advisory services offered through Robertson Stephens Wealth Management, LLC (“Robertson Stephens”), an SEC-registered investment advisor. Registration does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. This material is for general informational purposes only and should not be construed as investment, tax or legal advice. It does not constitute a recommendation or offer to buy or sell any security, has not been tailored to the needs of any specific investor, and should not provide the basis for any investment decision. Please consult with your Advisor prior to making any investment decisions. The information contained herein was compiled from sources believed to be reliable, but Robertson Stephens does not guarantee its accuracy or completeness. Information, views and opinions are current as of the date of this presentation, are based on the information available at the time, and are subject to change based on market and other conditions. Robertson Stephens assumes no duty to update this information. Unless otherwise noted, any individual opinions presented are those of the author and not necessarily those of Robertson Stephens. Performance may be compared to several indices. Indices are unmanaged and reflect the reinvestment of all income or dividends but do not reflect the deduction of any fees or expenses which would reduce returns. A complete list of Robertson Stephens Investment Office recommendations over the previous 12 months is available upon request. Past performance does not guarantee future results. Forward-looking performance objectives, targets or estimates are not guaranteed and may not be achieved. Investing entails risks, including possible loss of principal. Alternative investments are speculative and involve substantial risks including significant loss of principal, high illiquidity, long time horizons, uneven growth rates, high fees, onerous tax consequences, limited transparency and limited regulation. Alternative investments are not suitable for all investors and are only available to qualified investors. Please refer to the private placement memorandum for a complete listing and description of terms and risks. This material is an investment advisory publication intended for investment advisory clients and prospective clients only. Robertson Stephens only transacts business in states in which it is properly registered or is excluded or exempted from registration. A copy of Robertson Stephens’ current written disclosure brochure filed with the SEC which discusses, among other things, Robertson Stephens’ business practices, services and fees, is available through the SEC’s website at: www.adviserinfo.sec.gov. © 2024 Robertson Stephens Wealth Management, LLC. All rights reserved. Robertson Stephens is a registered trademark of Robertson Stephens Wealth Management, LLC in the United States and elsewhere.