Since this is your June report, let’s depart from the usual monthly view and look back and ahead by halves of the year. The year began with almost record pessimism and consensus expectations for a late year recession, a decline in corporate earnings, and lower S&P 500 year-end targets. All of this against the backdrop of global central banks (led by the U.S. Fed), deep into their respective tightening cycles, resolute on bringing spiking inflation back down to more manageable levels.

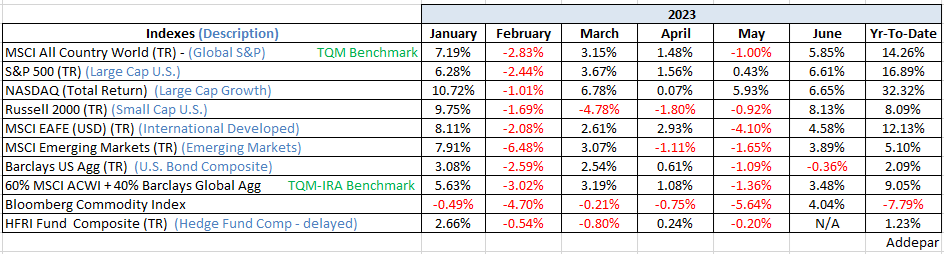

As you can see below on the index returns chart for the first 6-mos of the year, there must have been a few surprises vs. last December’s negative consensus. For the U.S., the first surprise was how resilient the economy was following 500 basis points of rate tightening by the Fed. Employment stayed firm and GDP growth stayed positive. Recession expectations got pushed out to year-end at the earliest.

Another miss was the arrival of Artificial Intelligence into investor’s psyche. After years of being told that AI would be transformational someday, for investors, that day arrived early in the first half of this year. The following 3 of the 11 sectors constituting the S&P 500 Index, followed by the largest companies and collectively over 50% of the weighting of their respective sectors, followed by their 6-mo gain, accounted for all the gains of the S&P 500 for the first half. The other 493 stocks in the Index were collectively flat for the period. The Technology sector (AAPL +49.3%, MSFT +42.0%, NVDA +189.5%), the Communications sector (GOOG +36.4%, META +138%), and the Consumer Durables sector (AMZN +55.2%, TSLA +112.5%).

Lastly, for our little retrospective, look at the June column of returns. It looks a little capitulative with a large dose of FOMO inside the numbers (institutional investor competition that drives the Fear Of Missing Out).

What might the next half look like? To start, from a technical analysis perspective, there are no signs calling for an immediate end to the current rally – no signs of a top. The market is overbought however – a condition that likely leads to profit-taking and minor corrections. The most likely path over the coming weeks is probably one of corrections followed by upside probes (making new and/or testing high water marks of indexes).

Real interest rates have been climbing steadily since mid-2022’s peak of inflation. The risk premium for stocks (the investment return stocks are expected to yield in excess of the risk-free rate of return) is now negative. Historically, a negative risk premium for the stock market has had a dampening effect on returns (low single-digit annual returns at best). This is a valuation issue.

Based on the strength of the most recent economic data, and the Fed signaling the likelihood of two more rate hikes before year end, it does appear that the most anticipated recession is getting pushed out again and may not develop until later next year. Stocks are usually very weak at the start of recessions. So that may be getting pushed out on the calendar as well.

Recessions can be delayed but are rarely denied. A Fed resolute on breaking down inflation to its 2% target (a long way from where it is now) against a resilient economy, suggests higher for longer rates. I think legendary investor Stanley Druckenmiller said it best at Bloomberg’s recent investor conference in June, “the longer the economy takes to contract, the longer inflation remains elevated, the higher rates will ultimately have to go, the deeper the recession will be that follows.”

We remain cautious – if a little early.

Be well,

Mike

Sources: Addepar, Bloomberg, Ned Davis Research

Disclosures

Investment advisory services offered through Robertson Stephens Wealth Management, LLC (“Robertson Stephens”), an SEC-registered investment advisor. Registration does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. This material is for general informational purposes only and should not be construed as investment, tax or legal advice. It does not constitute a recommendation or offer to buy or sell any security, has not been tailored to the needs of any specific investor, and should not provide the basis for any investment decision. Please consult with your Advisor prior to making any investment decisions. The information contained herein was compiled from sources believed to be reliable, but Robertson Stephens does not guarantee its accuracy or completeness. Information, views and opinions are current as of the date of this presentation, are based on the information available at the time, and are subject to change based on market and other conditions. Robertson Stephens assumes no duty to update this information. Unless otherwise noted, any individual opinions presented are those of the author and not necessarily those of Robertson Stephens. Performance may be compared to several indices. Indices are unmanaged and reflect the reinvestment of all income or dividends but do not reflect the deduction of any fees or expenses which would reduce returns. A complete list of Robertson Stephens Investment Office recommendations over the previous 12 months is available upon request. Past performance does not guarantee future results. Forward-looking performance objectives, targets or estimates are not guaranteed and may not be achieved. Investing entails risks, including possible loss of principal. Alternative investments are speculative and involve substantial risks including significant loss of principal, high illiquidity, long time horizons, uneven growth rates, high fees, onerous tax consequences, limited transparency and limited regulation. Alternative investments are not suitable for all investors and are only available to qualified investors. Please refer to the private placement memorandum for a complete listing and description of terms and risks. This material is an investment advisory publication intended for investment advisory clients and prospective clients only. Robertson Stephens only transacts business in states in which it is properly registered or is excluded or exempted from registration. A copy of Robertson Stephens’ current written disclosure brochure filed with the SEC which discusses, among other things, Robertson Stephens’ business practices, services and fees, is available through the SEC’s website at: www.adviserinfo.sec.gov. © 2024 Robertson Stephens Wealth Management, LLC. All rights reserved. Robertson Stephens is a registered trademark of Robertson Stephens Wealth Management, LLC in the United States and elsewhere.