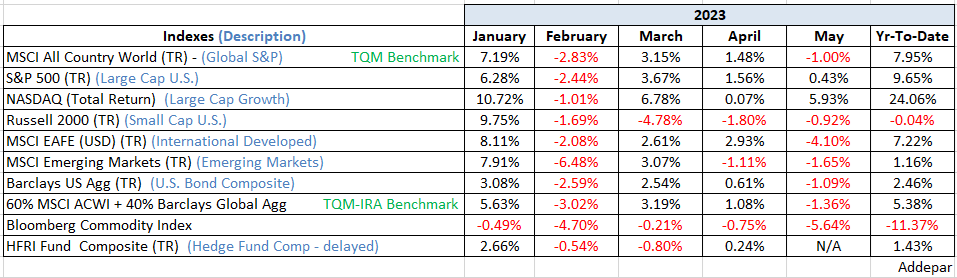

Except for 5 U.S. companies, May would have looked just like February in the chart below – a column of red. Except for what is now called the AI complex: the five companies with leading edge artificial intelligence software and hardware (Apple, Microsoft, NVIDIA, Meta Platforms and Alphabet), May was a difficult month. It is possible, likely even, that AI will be one of the biggest transformative technological developments in history. If so, it is equally likely that much of the AI complex is over-valued today but undervalued long term. Will the AI complex continue its skyward trajectory – probably not. But, as I wrote in a Morning Note a few days ago; forecasting when it will happen is a lot harder than saying if it will happen.

From an economics perspective, the divergence between the service and manufacturing sectors widened in May, in developed markets around the world. It is painting a mixed picture of the global economy. Manufacturing PMI’s (Purchasing Manager’s Index) across the board are well below 50, signaling contraction. Contrarily, services PMI’s came in just above 50 across the board, signaling expansion. It is confusing. Core inflation has remained stubbornly high and the prospect of sustained wage growth has fueled concerns that central banks could tighten further, leaving peak policy rates higher than recently expected.

The debt ceiling impasse generated negative headlines all month. Despite the drama and because of the AI complex, equities were relatively resilient with the S&P 500 rising by 0.4%. Commodities had their worst month of the year so far, which has to be good for the inflation picture. Bonds also had a tough month having to adjust to the possibility of higher peak cycle rates.

Looking ahead, I think the biggest risk to stock prices is not a recession. It is inflation. The Fed has said as much, as well. The stock market seems to be in Missouri mode – show me. It looks like it will remain buoyant until it sees higher rates and/or the teeth of an actual recession and its commensurate earnings contraction. Since the evidence of a recession continues to slowly grow month by month, we’ll just have to wait to be rewarded for our cautious posture. Let’s hope its name is not Godot.

Be well,

Mike

Disclosures

Investment advisory services offered through Robertson Stephens Wealth Management, LLC (“Robertson Stephens”), an SEC-registered investment advisor. Registration does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. This material is for general informational purposes only and should not be construed as investment, tax or legal advice. It does not constitute a recommendation or offer to buy or sell any security, has not been tailored to the needs of any specific investor, and should not provide the basis for any investment decision. Please consult with your Advisor prior to making any investment decisions. The information contained herein was compiled from sources believed to be reliable, but Robertson Stephens does not guarantee its accuracy or completeness. Information, views and opinions are current as of the date of this presentation, are based on the information available at the time, and are subject to change based on market and other conditions. Robertson Stephens assumes no duty to update this information. Unless otherwise noted, any individual opinions presented are those of the author and not necessarily those of Robertson Stephens. Performance may be compared to several indices. Indices are unmanaged and reflect the reinvestment of all income or dividends but do not reflect the deduction of any fees or expenses which would reduce returns. A complete list of Robertson Stephens Investment Office recommendations over the previous 12 months is available upon request. Past performance does not guarantee future results. Forward-looking performance objectives, targets or estimates are not guaranteed and may not be achieved. Investing entails risks, including possible loss of principal. Alternative investments are speculative and involve substantial risks including significant loss of principal, high illiquidity, long time horizons, uneven growth rates, high fees, onerous tax consequences, limited transparency and limited regulation. Alternative investments are not suitable for all investors and are only available to qualified investors. Please refer to the private placement memorandum for a complete listing and description of terms and risks. This material is an investment advisory publication intended for investment advisory clients and prospective clients only. Robertson Stephens only transacts business in states in which it is properly registered or is excluded or exempted from registration. A copy of Robertson Stephens’ current written disclosure brochure filed with the SEC which discusses, among other things, Robertson Stephens’ business practices, services and fees, is available through the SEC’s website at: www.adviserinfo.sec.gov. © 2024 Robertson Stephens Wealth Management, LLC. All rights reserved. Robertson Stephens is a registered trademark of Robertson Stephens Wealth Management, LLC in the United States and elsewhere.