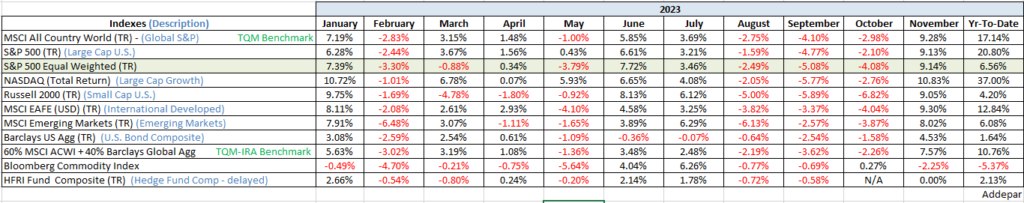

Nines across the board! November delivered in spades this year and saved almost every money manager’s skin in the process. The November column below is a stack of 9’s for equity indexes – an unusually high correlation. And +4.5% for the bond composite is arguably stronger than the equity moves on a relative risk basis. It was an amazing month where several factors aligned like the moon creating King Tides. Stocks and bonds were severely oversold following 3mo of red (see below) leading into November. In addition, November is the start of the strongest season of the year for stocks. Those two elements got the ball rolling in the early days of the month. But some okay inflation data, some soft-ish economic data and a no-action Fed meeting interpreted as dovish, formed a narrative that produced the most bullish run for stocks and bonds in almost two years since the Fed began its tightening cycle.

With only a month to go, it has been another difficult year for stock-pickers. Public markets are becoming more indexed and more correlated to interest rates and money flows. So far this year 80% of all equity volume has been in the S&P 500 stocks. 60% of public market capitalization is now in ETF’s. So far this year, 100% of the gains have come from 10 stocks, which now represent 35% of the S&P 500 Index by market capitalization. Those 10 stocks trade at an average PE multiple of 50. Imagine how many money managers are adding 50 multiple PE companies to their portfolio. 85% of money managers have not kept pace with their respective benchmark indexes for the past 15yrs – a trend that now seems to be accelerating. The trend in public markets is the corollary to why private investments (equity, debt, real and hedged) are gaining currency. As many of you know, private investments saved portfolios from absorbing the full brunt of last year’s 100 year storm in the public markets.

Stare at the 2022 and YTD columns below and you’ll observe that, except for Commodities, cash has outperformed every other asset class and style over the past two years. If forecasters are right, cash will likely drop to the middle of the pack next year.

I don’t know if there is much utility in all the annual forecasts Wall Street produces at this time of year. But it has become a pro sport and is hard to avert your eyes from. There are two annual outlooks that catch my eye each year; Ned Davis Research (no surprise there) and BCA Research (formerly the Bank Credit Analyst from Toronto). NDR does not put much stock in forecasting. Their whole analytical philosophy is rooted in “Being Right or Making Money” – the title of their founder’s famous book. It means, there is no point in being right about a forecast if the market changes course. Better to change directions with the market, make money and throw out the forecast. That has always made sense to me. But in the independent research world, forecasts are table stakes and NDR produces them – they just acknowledge that the forecast does not inform their real-time investment decisions.

Having said all that, NDR’s 2024 Outlook is summarized as follows:

They project real GDP growth of 1-1.5%, with a 70% chance of a soft landing. Inflation should moderate, but at a slower pace than the past year, ending around 2.5-3%. Lower inflation should allow the Fed to cut rates and the 10-year Treasury to fall toward 3.5%. Their year-end 2024 S&P 500 target is 4900, or 7% above current levels. Risks include a hard landing, fiscal tightening, political uncertainty, and an earnings slowdown. A choppy first half and stronger second half could allow defensive Value to rebound early and cyclicals and small-caps to outperform later in the year.

BCA is a different breed from NDR. NDR’s line of sight is 4-8 months on the theory that the market discounts events about 6 months into the future. BCA looks out much farther, putting heavy emphasis on economic, and geopolitical cycles. The two firms’ views complement one another, and act as a verifying mechanism when they are on the same page, which as it turns out is often. Condensing a 55-page Tome that is their 2024 Outlook is no easy task, but here goes:

The easy money era that prevailed from 2009-2021 is over. Neither a prolonged zero interest rate policy, nor the sustained use of quantitative easing as a monetary policy tool, are likely to emerge during the next recession. A recession in the US and euro area was delayed this year but not avoided. Developed markets(DM) remain on a recessionary path unless monetary policy eases very significantly. As such, the risk/reward balance is quite unfavorable for stocks. On a 12-month time horizon, we recommend an underweight position toward equities within a global multi-asset portfolio. While the US consumer has demonstrated resilience this year, excess US household savings will be exhausted at some point next year based on their recent trajectory. That supports the view that the US economy is on a path to recession so long as monetary policy remains tight. We remain in the disinflationary camp, but expect that inflation will not slow quickly enough for the Fed and the ECB to cut rates in time to prevent a significant rise in unemployment. Unless a recession occurs imminently or inflation completely collapses, the Fed is unlikely to cut rates before next summer. We do not expect any further rate hikes in the US over the coming year unless inflation significantly picks up. However, investors are pricing in too much easing before a recession arrives, and too little once it does. Equities are likely to decline significantly in response to a recession. In the US, the S&P 500 will fall to between 3300-3700.

Looking forward to a chat with you soon.

Sources: Addepar, Apollo Capital, BCA Research, Bloomberg, Ned Davis Research

Disclosures

Investment advisory services offered through Robertson Stephens Wealth Management, LLC (“Robertson Stephens”), an SEC-registered investment advisor. Registration does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. This material is for general informational purposes only and should not be construed as investment, tax or legal advice. It does not constitute a recommendation or offer to buy or sell any security, has not been tailored to the needs of any specific investor, and should not provide the basis for any investment decision. Please consult with your Advisor prior to making any investment decisions. The information contained herein was compiled from sources believed to be reliable, but Robertson Stephens does not guarantee its accuracy or completeness. Information, views and opinions are current as of the date of this presentation, are based on the information available at the time, and are subject to change based on market and other conditions. Robertson Stephens assumes no duty to update this information. Unless otherwise noted, any individual opinions presented are those of the author and not necessarily those of Robertson Stephens. Performance may be compared to several indices. Indices are unmanaged and reflect the reinvestment of all income or dividends but do not reflect the deduction of any fees or expenses which would reduce returns. A complete list of Robertson Stephens Investment Office recommendations over the previous 12 months is available upon request. Past performance does not guarantee future results. Forward-looking performance objectives, targets or estimates are not guaranteed and may not be achieved. Investing entails risks, including possible loss of principal. Alternative investments are speculative and involve substantial risks including significant loss of principal, high illiquidity, long time horizons, uneven growth rates, high fees, onerous tax consequences, limited transparency and limited regulation. Alternative investments are not suitable for all investors and are only available to qualified investors. Please refer to the private placement memorandum for a complete listing and description of terms and risks. This material is an investment advisory publication intended for investment advisory clients and prospective clients only. Robertson Stephens only transacts business in states in which it is properly registered or is excluded or exempted from registration. A copy of Robertson Stephens’ current written disclosure brochure filed with the SEC which discusses, among other things, Robertson Stephens’ business practices, services and fees, is available through the SEC’s website at: www.adviserinfo.sec.gov. © 2024 Robertson Stephens Wealth Management, LLC. All rights reserved. Robertson Stephens is a registered trademark of Robertson Stephens Wealth Management, LLC in the United States and elsewhere.