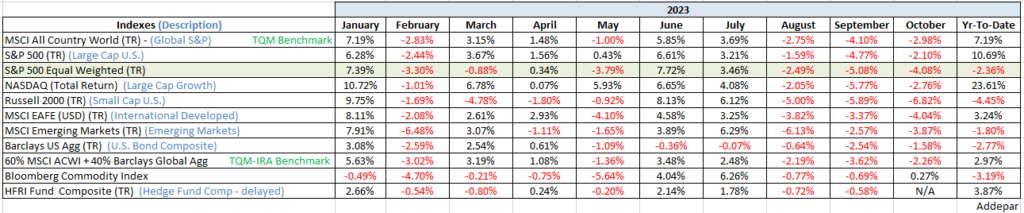

While normally placed at the end of the monthly letters, let’s flip the script this month and start out staring at the performance chart below. We’ll stare not in any contemplative way but rather to absorb the unadulterated message that 2023 has been a year of the few – 7 magnificent winners and 493 not named winners, to be exact. Rarely in history has there been such dichotomy between winners and losers. In market cap and style: large cap growth +23.62% ytd vs -4.45% for the Russell 2000’s small cap value constituents. This dichotomy is lasting too, it would seem. This month, the green line-item ,“S&P 500 Equal Weighted (Total Return) Index Returns was added to the chart, for illustrative purposes. The magnificent 7 represents about 27% of the S&P 500 Index by (market cap). In the equal weighted index, each component contributes 1/500th to the index’s makeup. Notice the comparison between the two below; the dichotomy really got going in March for 3 months when AI dominated financial headlines. It resumed this fall in the market sell-off the past 3 mo. when the spread between the two widened.

This is not the first time a market has been led by a few stocks – the generals leading the troops is the common trope. This month, the green line-item ,“S&P 500 Equal Weighted (Total Return) Index Returns was added to the chart, for illustrative purposes.. The difference today is magnitude and duration. AI does seem to be every bit as revolutionary as fire, the wheel, the PC, and the internet. Maybe even more so, as some pundits contend. Even if they are half right, AI is likely charting the common valuation path of a bona-fide phenomenon – overvalued short term, undervalued in the long term. The message here I think, AI is here to stay and the dichotomy it has created is likely to stay as well.

In last Monday’s Morning Note (10/29), I suggested that the 10%+ correction in the S&P 500 in three months had produced an oversold market and that the market would likely benefit from the kind of year-end strength that makes Nov-Dec the best two months of the year historically. In other words, a bounce rally following a correction. Bounce rallies following a correction are either the resumption of the bull market that corrected, or pressure relief rallies before a selloff resumes. With what I believe is a recession looming in 2024, I lean toward this rally being the pressure relief kind. We’ll know soon enough.

Let’s turn our focus to the long-term and examine how the “Everything Bubble” of 2021 is progressing. Two years ago, zero percent interest rates and Quantitative Easing had created a situation where cash felt like “trash”, and investors were reaching for yield anywhere they could find it creating an “everything bubble” in terms of stocks, bonds, and housing. Also, several speculative vehicles like SPACs, Meme stocks, Cryptocurrencies, NFTs, etc. caught fire – bubblelicious! Let’s look to see how much of the overall bubble has been corrected in the past two year. Stocks are about half as overvalued as they were then but still overvalued and in a zone where they have performed below historical levels. Similarly, homes are still overvalued comparing median home prices to median family income. Also, housing affordability is at a multi-decade low. However, looking at a Fed 10-year Fair Value Model, as well as nominal GDP growth, suggest the fair value for the U.S. Treasury 10-year yield is near 5%. A massive 50% plus decline in the price of long-term bonds has taken interest rates from just above zero to around 5%. It does not mean bonds can’t overshoot fair value but they sure look better today than stocks and housing. This will no doubt play a role in our allocations in the coming quarters. Maybe 60/40 should be 40/60 for a while and be de-risked in the process.

Sources: Addepar, BCA Research, Bloomberg, Ned Davis Research, Robertson Stephens Investment Office

Disclosures

Investment advisory services offered through Robertson Stephens Wealth Management, LLC (“Robertson Stephens”), an SEC-registered investment advisor. Registration does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. This material is for general informational purposes only and should not be construed as investment, tax or legal advice. It does not constitute a recommendation or offer to buy or sell any security, has not been tailored to the needs of any specific investor, and should not provide the basis for any investment decision. Please consult with your Advisor prior to making any investment decisions. The information contained herein was compiled from sources believed to be reliable, but Robertson Stephens does not guarantee its accuracy or completeness. Information, views and opinions are current as of the date of this presentation, are based on the information available at the time, and are subject to change based on market and other conditions. Robertson Stephens assumes no duty to update this information. Unless otherwise noted, any individual opinions presented are those of the author and not necessarily those of Robertson Stephens. Performance may be compared to several indices. Indices are unmanaged and reflect the reinvestment of all income or dividends but do not reflect the deduction of any fees or expenses which would reduce returns. A complete list of Robertson Stephens Investment Office recommendations over the previous 12 months is available upon request. Past performance does not guarantee future results. Forward-looking performance objectives, targets or estimates are not guaranteed and may not be achieved. Investing entails risks, including possible loss of principal. Alternative investments are speculative and involve substantial risks including significant loss of principal, high illiquidity, long time horizons, uneven growth rates, high fees, onerous tax consequences, limited transparency and limited regulation. Alternative investments are not suitable for all investors and are only available to qualified investors. Please refer to the private placement memorandum for a complete listing and description of terms and risks. This material is an investment advisory publication intended for investment advisory clients and prospective clients only. Robertson Stephens only transacts business in states in which it is properly registered or is excluded or exempted from registration. A copy of Robertson Stephens’ current written disclosure brochure filed with the SEC which discusses, among other things, Robertson Stephens’ business practices, services and fees, is available through the SEC’s website at: www.adviserinfo.sec.gov. © 2024 Robertson Stephens Wealth Management, LLC. All rights reserved. Robertson Stephens is a registered trademark of Robertson Stephens Wealth Management, LLC in the United States and elsewhere.