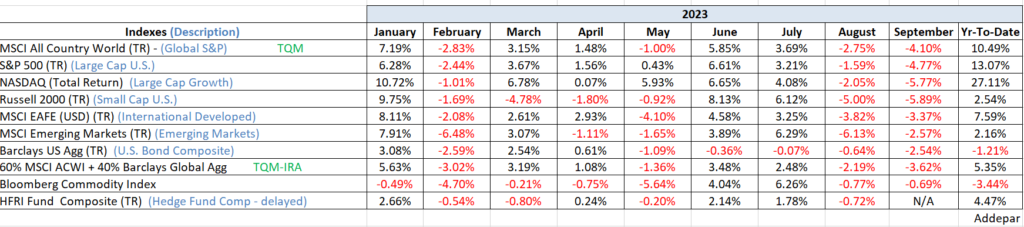

The month of September lived up to its dark reputation as the historically worst month of the year. As you can see on the performance chart below, it was the worst month so far this year by more than double. And when combined with August, following a robust first half of the year, it turned Q3 into somewhat of a reality check. Investors seemed to sense that a market rally driven higher by 7-8 large cap tech stocks, may not last forever.

At the end of the first week of October (when I’m writing this), the stock market is well into its second correction of the year (see 1yr SPX chart). The Feb/Mar pullback associated with the regional bank crisis took the S&P 500 Index (SPX) down -7.75%, before the rally resumed. The current correction began on August 1st. So far, peak to trough, the SPX is down -8.5%. As we have written in August and in

September, the current market decline is a garden variety market pullback unless it crosses the major support level of 4200 – our line-in-the-sand that if violated, would characterize our pullback as something worse. So far, so good.

Labels are not applied to markets in the moment – only in retrospect. The Feb/Mar pullback was driven by the regional bank scare (not really a crisis looking back). The current market decline may end up being labeled a pullback driven by a significant rise in yields in the bond market. Yields have likely been driven higher recently by investors finally accepting that the Fed’s tightening cycle is not yet over. It has taken a while for “Higher For Longer” to be discounted into securities pricing. This all presupposes that price support levels on the major market indexes hold in the weeks ahead. If support is violated, it is because prices have not held up and different labels will be applied to the current period – “correction” (declines >10%), “start of bear market”. We’ll cross that bridge if we get there.

It is axiomatic that the economy drives market pricing. It is enigmatic that market pricing precedes economic reporting. The study of the economy, macroeconomics, offers little in the way of timing tools of market analysis. But it so important to watch to changes in the economy against the message the market is sending (recent Morning Notes) to try to discern changes in market trend.

I believe the economy is on a knife edge between growth and contraction over the near term (weeks). If it falls to the growth side (scenario A), the Fed will raise, yields will rise, the economy will ultimately feel that, and recession will likely ensue – call it second half 2024. If the economy falls to the contraction side of the knife’s edge (scenario B), I think it means the tightening over the past 18 months is having its lag effect and recession early in 2024. There is macro evidence for both scenarios but overall, the macro evidence does lean toward scenario A.

Let’s connect the market message to the macro scenarios. Simply put, a market rally off of support would dovetail nicely with scenario A. If support fails – scenario B. Both scenarios end in recession and I don’t think I’m a good enough risk manager to finesse the near term rally of scenario A. We stay cautious then with the expectation of looking foolish in any year end rally.

Sources: Addepar, BCA Research, Bloomberg, Ned Davis Research

Disclosures

Investment advisory services offered through Robertson Stephens Wealth Management, LLC (“Robertson Stephens”), an SEC-registered investment advisor. Registration does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. This material is for general informational purposes only and should not be construed as investment, tax or legal advice. It does not constitute a recommendation or offer to buy or sell any security, has not been tailored to the needs of any specific investor, and should not provide the basis for any investment decision. Please consult with your Advisor prior to making any investment decisions. The information contained herein was compiled from sources believed to be reliable, but Robertson Stephens does not guarantee its accuracy or completeness. Information, views and opinions are current as of the date of this presentation, are based on the information available at the time, and are subject to change based on market and other conditions. Robertson Stephens assumes no duty to update this information. Unless otherwise noted, any individual opinions presented are those of the author and not necessarily those of Robertson Stephens. Performance may be compared to several indices. Indices are unmanaged and reflect the reinvestment of all income or dividends but do not reflect the deduction of any fees or expenses which would reduce returns. A complete list of Robertson Stephens Investment Office recommendations over the previous 12 months is available upon request. Past performance does not guarantee future results. Forward-looking performance objectives, targets or estimates are not guaranteed and may not be achieved. Investing entails risks, including possible loss of principal. Alternative investments are speculative and involve substantial risks including significant loss of principal, high illiquidity, long time horizons, uneven growth rates, high fees, onerous tax consequences, limited transparency and limited regulation. Alternative investments are not suitable for all investors and are only available to qualified investors. Please refer to the private placement memorandum for a complete listing and description of terms and risks. This material is an investment advisory publication intended for investment advisory clients and prospective clients only. Robertson Stephens only transacts business in states in which it is properly registered or is excluded or exempted from registration. A copy of Robertson Stephens’ current written disclosure brochure filed with the SEC which discusses, among other things, Robertson Stephens’ business practices, services and fees, is available through the SEC’s website at: www.adviserinfo.sec.gov. © 2024 Robertson Stephens Wealth Management, LLC. All rights reserved. Robertson Stephens is a registered trademark of Robertson Stephens Wealth Management, LLC in the United States and elsewhere.