February 16, 2024 – Data released on Tuesday showed that consumer prices increased by 3.1% in January from a year earlier.[1] Though a decrease from December’s 3.4% number, January’s reading was above the economists’ consensus projection of 2.9%.[2] Investors reacted strongly, sending stocks lower and bond yields higher, though by Wednesday, both markets saw a modest recovery. A deeper dive into the inflation report suggests that the battle against inflation continues to progress well, but also validates the Fed’s messaging that more data is needed before they begin to cut rates.

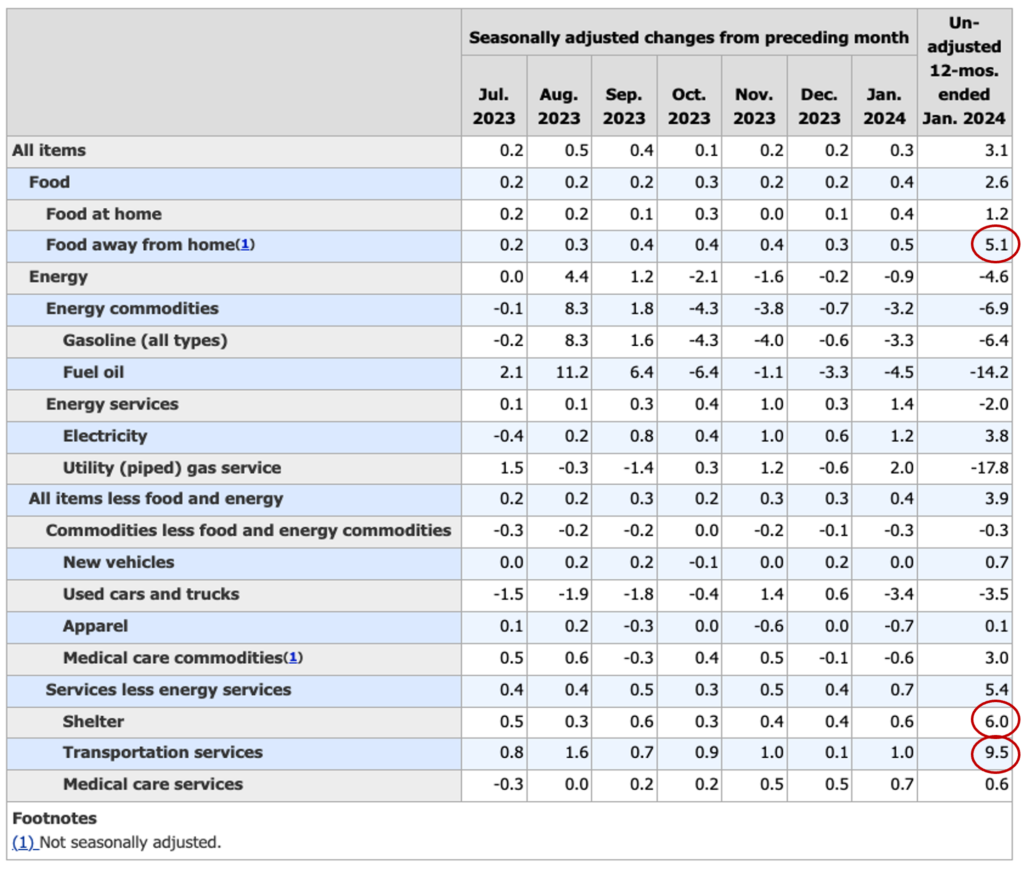

Despite the higher-than-expected topline inflation number, only a small number of sectors contributed to the annual increase, chief among them restaurants, housing, and transportation (see chart 1). This first won’t surprise anyone who has eaten out in the past year and is likely due to increases in labor costs. Higher transportation costs result mostly from increases in car insurance and auto repair costs. Here, too, a shortage in car mechanics and the increased cost and complexity of cars seems to be driving insurance rates higher.

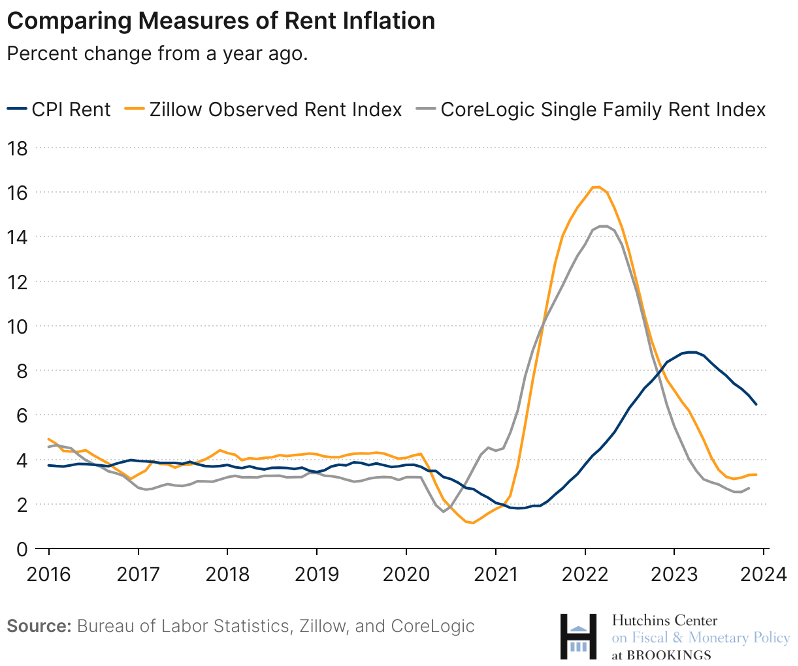

That brings us to housing, which, at 36% of the total weight of the CPI, is one of the largest contributors to January’s reading and is also one of the hardest items to measure. The Bureau of Labor Statistics (BLS) collects data on rents and owners’-equivalent-rent from a large sample in which households are visited every six months.[3] Beyond the challenge of establishing rent equivalency, this methodology results in a significant reporting lag. As can be seen in Chart 2, an analysis conducted by the Brookings Institute shows that CPI rent has been lagging other rent indexes like the Zillow Observed Rent Index and the CoreLogic Single Family Rent Index since early 2022, both on the way up and on the way down.

Housing and other reporting lags are likely why the Fed is insisting that more data is needed before they begin to lower rates. The Fed is undoubtfully disappointed that the inflation number did not begin with a 2, but then again, it’s been consistently messaging that inflation can be persistent. The vast majority of investors now agree that the Fed is unlikely to cut rates in March, although over 80% still expect a rate cut by June of this year.[4] If his recent history is a guide, this prediction, too, is likely optimistic.

In all, nothing in Tuesday’s report is cause for immediate concern, though it emphasizes the difficulties both in lowering and measuring inflation. Importantly, the likely direction of interest rates is still downward, if at a slower pace than investors would like. Still, rates could come down in a hurry if the economy hits an unexpected speed bump, so now is a good time to lock in these higher rates.

— AMD

[1] https://www.bls.gov/cpi/#:~:text=In%20January%2C%20the%20Consumer%20Price,over%20the%20year%20(NSA)

[2] https://insight.factset.com/consumer-price-index-cpi-for-january-2024-is-projected-to-rise-2.9-year-over-year

[3] https://www.brookings.edu/articles/how-does-the-consumer-price-index-account-for-the-cost-of-housing/

[4] https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html, retrieved 2/14/24

Disclosures

Investment advisory services offered through Robertson Stephens Wealth Management, LLC (“Robertson Stephens”), an SEC-registered investment advisor. Registration does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. This material is for general informational purposes only and should not be construed as investment, tax or legal advice. It does not constitute a recommendation or offer to buy or sell any security, has not been tailored to the needs of any specific investor, and should not provide the basis for any investment decision. Please consult with your Advisor prior to making any investment decisions. The information contained herein was compiled from sources believed to be reliable, but Robertson Stephens does not guarantee its accuracy or completeness. Information, views and opinions are current as of the date of this presentation, are based on the information available at the time, and are subject to change based on market and other conditions. Robertson Stephens assumes no duty to update this information. Unless otherwise noted, any individual opinions presented are those of the author and not necessarily those of Robertson Stephens. Performance may be compared to several indices. Indices are unmanaged and reflect the reinvestment of all income or dividends but do not reflect the deduction of any fees or expenses which would reduce returns. A complete list of Robertson Stephens Investment Office recommendations over the previous 12 months is available upon request. Past performance does not guarantee future results. Forward-looking performance objectives, targets or estimates are not guaranteed and may not be achieved. Investing entails risks, including possible loss of principal. Alternative investments are speculative and involve substantial risks including significant loss of principal, high illiquidity, long time horizons, uneven growth rates, high fees, onerous tax consequences, limited transparency and limited regulation. Alternative investments are not suitable for all investors and are only available to qualified investors. Please refer to the private placement memorandum for a complete listing and description of terms and risks. This material is an investment advisory publication intended for investment advisory clients and prospective clients only. Robertson Stephens only transacts business in states in which it is properly registered or is excluded or exempted from registration. A copy of Robertson Stephens’ current written disclosure brochure filed with the SEC which discusses, among other things, Robertson Stephens’ business practices, services and fees, is available through the SEC’s website at: www.adviserinfo.sec.gov. © 2024 Robertson Stephens Wealth Management, LLC. All rights reserved. Robertson Stephens is a registered trademark of Robertson Stephens Wealth Management, LLC in the United States and elsewhere.