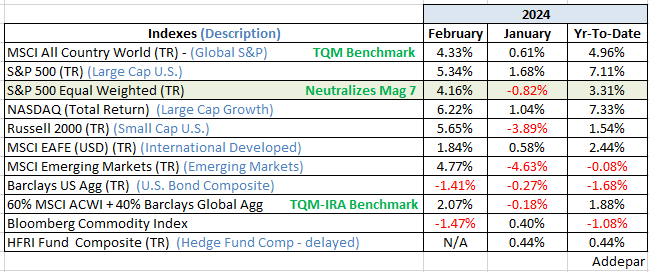

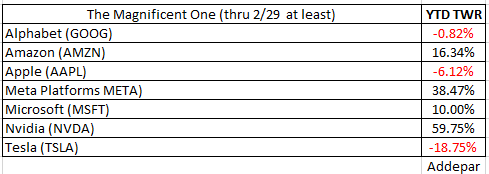

February’s overarching market message: There’s a new sheriff in town, and his name is not Reggie Hammond or Jerome Powell – it is Nvidia. “New” may be arguable to some, after all, NVDA was one of the Magnificent 7 that accounted for all the equity market gains over the first 10 months of last year. So far this year, however, it is the More Magnificent One – and that is new. See chart 2 and note that 3 of the 7 Mags are down so far this year, 3 others offset those losses, and what’s left is Nvidia (META is no slouch, but NVDA is almost twice META’s market cap – twice the influence).

What might history say about NVDA’s record-breaking reporting day in February? The explosive rally to new all-time highs that day in the S&P 500 (SPX) and NASDAQ Comp (NDX) represented behavior that we have not seen for a long time. Not since the peak of the dot-com bubble. One of the most notable features of the stock market rally since the start of last year has been the relative narrowness of the participation. It is no secret that the top end of the market is driving most of the index-level gains. We’ve been comparing the equal weighted to cap weighted S&P’s since Q2 of last year. And yet, it has been a remarkably persistent trend. Another reason NVDA day (the trading day after they reported) compares favorably to the dot-com era: Since the inception of the S&P 500 equal weighted index, it has gained over 1% on a day when the cap-weighted gained twice that only 14 times. The most recent was NVDA day. 10 of the other 13 observations came in 1999 or 2000. Yet another interesting feature of NVDA day; it was the first time that the SPX had rallied at least 2% to close at an all-time high since March of 2000. The same is true for NDX using a 3% rally criterion. I believe the better takeaway than the “Oh, this happened in 1929 and again in 2000 – it’s all over!” fear mongering, is that these volatility extremes tend to cluster. They are not one and done’s, at least not historically. It would be abnormal for the market to roll over just when one of these explosive highs is registered. Even if we are reliving the 1999-2000 top, history suggests that we are much closer to the beginning of that topping process, than the end.

What does the past two months of market behavior do to my concerns for a recession beginning in the second half of this year accompanied by lower market yields? At a minimum, it pushes all that out on a timeline to early 2025, if at all. Over at NDR (Ned Davis Research), their macroeconomic team sees no recession this year. They freely admit that short to intermediate (weeks/months) term sentiment and longer-term valuations are consistent with modest consolidations (pullbacks), but that none of their longer-term cyclical/macro sentiment indicators are showing signs consistent with a major market peak. At BCA Research (the old Bank Credit Analyst out of Montreal), perhaps the least bullish on 2024 of the independent research firms 2 months ago, they still believe the recession can be delayed but not denied (translation: not this year, maybe next).

If a recession does materialize in 2025, markets won’t begin to discount it until the second half of this year anyway. So for now, at least, it is onward and upward, with perhaps the usual modest pullbacks along the way.

Be well,

Mike

Sources: Addepar, BCA Research, Bloomberg, Dorsey Wright & Associates, Ned Davis Research

Disclosures

Investment advisory services offered through Robertson Stephens Wealth Management, LLC (“Robertson Stephens”), an SEC-registered investment advisor. Registration does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. This material is for general informational purposes only and should not be construed as investment, tax or legal advice. It does not constitute a recommendation or offer to buy or sell any security, has not been tailored to the needs of any specific investor, and should not provide the basis for any investment decision. Please consult with your Advisor prior to making any investment decisions. The information contained herein was compiled from sources believed to be reliable, but Robertson Stephens does not guarantee its accuracy or completeness. Information, views and opinions are current as of the date of this presentation, are based on the information available at the time, and are subject to change based on market and other conditions. Robertson Stephens assumes no duty to update this information. Unless otherwise noted, any individual opinions presented are those of the author and not necessarily those of Robertson Stephens. Performance may be compared to several indices. Indices are unmanaged and reflect the reinvestment of all income or dividends but do not reflect the deduction of any fees or expenses which would reduce returns. A complete list of Robertson Stephens Investment Office recommendations over the previous 12 months is available upon request. Past performance does not guarantee future results. Forward-looking performance objectives, targets or estimates are not guaranteed and may not be achieved. Investing entails risks, including possible loss of principal. Alternative investments are speculative and involve substantial risks including significant loss of principal, high illiquidity, long time horizons, uneven growth rates, high fees, onerous tax consequences, limited transparency and limited regulation. Alternative investments are not suitable for all investors and are only available to qualified investors. Please refer to the private placement memorandum for a complete listing and description of terms and risks. This material is an investment advisory publication intended for investment advisory clients and prospective clients only. Robertson Stephens only transacts business in states in which it is properly registered or is excluded or exempted from registration. A copy of Robertson Stephens’ current written disclosure brochure filed with the SEC which discusses, among other things, Robertson Stephens’ business practices, services and fees, is available through the SEC’s website at: www.adviserinfo.sec.gov. © 2024 Robertson Stephens Wealth Management, LLC. All rights reserved. Robertson Stephens is a registered trademark of Robertson Stephens Wealth Management, LLC in the United States and elsewhere.