The following is your March 2024 Robertson Stephens Monthly Performance Report.

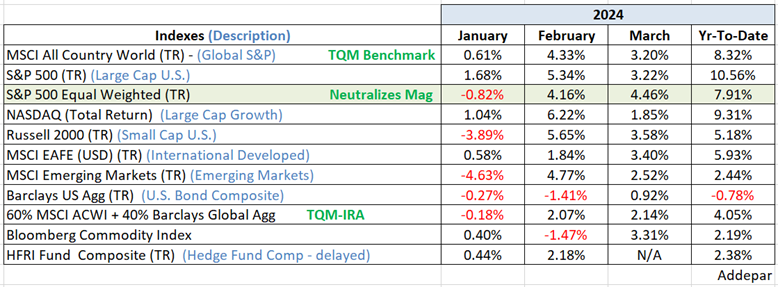

As you can see below, March put a nice closing touch on the first quarter of the year (YTD column). As mentioned, the prevailing sentiment among market strategists is now one of surprise. It was the rare strategist (none that I saw) who called for the S&P 500 Index to lead all others to a double-digit gain in Q1. Most did not expect that kind of return for 12 months, let alone 3. I am not throwing stones or judging. I knew early on in this business that I was not smarter than any strategist. However, I was lucky to learn early on that the best prognosticator of the market’s future performance is the market itself. As a mechanism that discounts time, “Don’t Fight the Tape”, may be the four most valuable words in market analysis.

Clients and long-term readers of mine know that I try to keep my opinions of where the market is going out of the money management decisions made in their portfolios. It is why I started using a model investing methodology almost 10 years ago. Taxable portfolios, I have a model for that. Non-taxable portfolios – another model for that too. It is the Q1’s of this year, where everyone seemed to get it wrong, including me, that I thank my lucky stars for the models. I thought Q1 would be choppy and sideways at best, but being wrong did not dimmish the returns on either taxable or non-taxable portfolios. However, an area of investing where I believe it is important to look out beyond the market’s normal discounted time horizon (6 months on average) is putting new money to work.

Cash returns are the highest in years, a recession that did not materialize last year is expected by many at the end of this year. There are few factors more important to the long term returns on an investment than initial prices paid. When the word recession shows up in many of the long-term forecasts of strategists whom I respect, I tend to tread lightly in putting cash to work in the public markets. That didn’t look very smart of me in Q1.

Looking ahead, I am still going to deploy cash into the markets slowly and at regular intervals. Contrary to popular perception, the odds of a global recession over the next 12 months seem to be rising, not falling. I think BCA Research puts the long-term outlook succinctly:

The US economy remains on a knife-edge. A reacceleration of demand (20% odds in our view) could trigger a second wave of inflation, while further cooling could trigger a recession (70% odds). We only assign 10% odds to a soft landing. Our best guess is that the next global recession will start towards the end of 2024 or early 2025.

Note – this view is beyond the market message window (6-ish months) and will not effect models or the near term view that the market’s path of least resistance remains upward with initially modest corrections along the way. But I do not want to plow a pile of new money into the market now, even if the recession call in 12 months is not a sure thing.

Source: Addepar, BCA Research, Bloomberg, Ned Davis Research.

Be well,

Mike

Investment advisory services offered through Robertson Stephens Wealth Management, LLC (“Robertson Stephens”), an SEC-registered investment advisor. Registration does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. This material is for general informational purposes only and should not be construed as investment, tax or legal advice. It does not constitute a recommendation or offer to buy or sell any security, has not been tailored to the needs of any specific investor, and should not provide the basis for any investment decision. Please consult with your Advisor prior to making any Investment decisions. The information contained herein was compiled from sources believed to be reliable, but Robertson Stephens does not guarantee its accuracy or completeness. Information, views and opinions are current as of the date of this presentation, are based on the information available at the time, and are subject to change based on market and other conditions. Robertson Stephens assumes no duty to update this information. Unless otherwise noted, any individual opinions presented are those of the author and not necessarily those of Robertson Stephens. Performance may be compared to several indices. Indices are unmanaged and reflect the reinvestment of all income or dividends but do not reflect the deduction of any fees or expenses which would reduce returns. A complete list of Robertson Stephens Investment Office recommendations over the previous 12 months is available upon request. Past performance does not guarantee future results. Forward-looking performance targets or estimates are not guaranteed and may not be achieved. Investing entails risks, including possible loss of principal. Alternative investments are only available to qualified investors and are not suitable for all investors. Alternative investments include risks such as illiquidity, long time horizons, reduced transparency, and significant loss of principal. This material is an investment advisory publication intended for investment advisory clients and prospective clients only. Robertson Stephens only transacts business in states in which it is properly registered or is excluded or exempted from registration. A copy of Robertson Stephens’ current written disclosure brochure filed with the SEC which discusses, among other things, Robertson Stephens’ business practices, services and fees, is available through the SEC’s website at: www.adviserinfo.sec.gov. © 2024 Robertson Stephens Wealth Management, LLC. All rights reserved. Robertson Stephens is a registered trademark of Robertson Stephens Wealth Management, LLC in the United States and elsewhere.