April 22, 2024 – It was again another quarter in which the markets were zooming ahead – economic prosperity is all around us, peace is throughout the world, and we have finally gotten the climate under control. And pigs fly.

At least that is my feeling as I look at the figures from the past quarter. Some of you know about my graduate studies in Hebrew Bible Interpretation where I studied the various ways in which the original text of the Bible could be translated in the context of ancient linguistics. My favorite course in the program was Cognitive Dissonance in the Bible, a study of a range of Bible stories that challenge the reader’s assumptions about good and bad and the meaning of God. One such story is the Book of Job in which God destroys the life of a good and pious man all because of a bet with the angel Gabriel. It isn’t a kind story, and introduces an entire range of challenging questions such as, why would God need to make a bet in the first place and then kill dozens of innocent people to win the bet?

The irony of the story is that the translation we accepted all these generations is probably wrong. There is a wonderful essay written in 2000 by Edward L. Greenstein[1] that points out that the only way the conventional translation could work, in which Job repents to God in the end, is to assume that Job is a pious man. In fact, The Book of Job is likely a dark allegory in which Job calls out God for his bad behavior. It is a lovely example of cognitive dissonance that has survived for dozens of generations… the belief that God can do no wrong. Once you adhere to that belief, then you find all sorts of ways to look past the obvious to support one’s beliefs.

I feel like we are there with this market. We have two wars raging already, neither of which have a clear solution and both of which will likely escalate to further regional conflict. Climate change is rapidly changing every aspect of our lives with little reason to see an abatement, and our government is spending at levels unthinkable just a decade ago. And let’s not forget that we are seeing the rise of totalitarian speech in our politics that almost rivals pre-WWII doctrine. When will it all come to a head, and once again become grounded in reality?

I don’t know the trigger, nor do I have any sense of how long this will last. But at some point reality will hit on all of the above points, let’s just hope not at the same time. A Black Swan event, which would put the market into a tailspin, is impossible to predict by definition. We would have to have a lot of unlucky timing for such a situation to arise. What I do think is much more likely, however, is a general market malaise that we saw in the 1970s where markets go sideways for an extended period while these issues get resolved. It isn’t a single moment that bring us to a halt, but rather the lack of an engine to justify the lofty valuations we see today.

Middle East

World events are spiraling forward this morning as I ponder the world we live in. The escalation in the Middle East is not trivial, nor will it go away anytime soon. Even if Israel eventually withdraws from Gaza and a mildly competent organization is assembled to govern the region, it will not be the end of the hornet’s nest of anger and vitriol that is being stewed by Iran.

The attack by Iran this past weekend was fully communicated by Iran in advance, the complete opposite of a surprise attack. The reasons are relatively simple. Iran does not want a war on their soil under any circumstances, a war that they would likely lose in a spectacular fashion. Their strategy of using proxies is well-honed and entirely effective, but to a point. With Israel targeting Iran officials outside of Iran, and doing so effectively, it was only a matter of time until Iran’s bluster led them to this point of outright attack against Israel, which is exactly what Israel was hoping for. It shifts the narrative on Gaza, unites Iran’s enemies, and provides the Saudis with an excuse to culminate the peace process which was scuttled by the October 7th attack. In short, we are seeing some signs of an endgame in the current crisis.

This would not solve the underlying issues of the region, which the Muslim Brotherhood (parent of Hamas) embodies. The authoritarian governments of the region need their respective populations to embrace the status quo, otherwise, those in power literally risk losing their heads. It is the stark reality that power is in the people, up to a point. Keep them happy and you keep your power. Let them suffer, stew, and revolt and you are replaceable. In the end, ideas are tough to kill once they take seed. It can be done, but it is a very, very risky proposition as Israel is now facing.

The region’s future depends on economic vitality for all. Only in that situation will there be a reason for some not to destroy all that which is around them. The challenge is the religious radicalism that has been layered on top of generations of corruption, wealth accumulation, and sheer power.

U.S. Election

April 15th marked a historic moment — the first time that a former U.S. President stood trial on criminal charges. I am not a legal expert, but everything that I have read points to a relatively easy conviction if the trial goes according to plan. With Donald Trump, that is a major “if”. The implications for the election, however, appear to point to a shift in the electorate that would cost him the election. He might lose irrespective, but he would likely lose with a conviction.

The stakes are enormous. Mr. Trump’s first term had a significant influence on the judicial make-up all the way to the Supreme Court. A similar impact on trade, regional security, immigration, or NATO in a second term, may have long-lasting effects on the ability for the U.S. to maintain its status in the world and the preeminence of our economy, potentially destabilizing the role of the dollar as the world’s base currency and risking an economic contraction.

Inflation

I am impressed by the stickiness of inflation. Having missed the last time that inflation was actually a problem in the U.S., I’m not surprised to learn that I am surprised. The math is rather straightforward — once prices rise, they stay risen unless you have deflation. That may seem obvious in hindsight, but the impact is being felt across the board. Rents are very high and staying there, as is the same for food, car insurance, and transportation. All the basics of living are taking an enormous bite out of the discretionary spending of the middle class. For those less fortunate, it makes for some very sad choices.

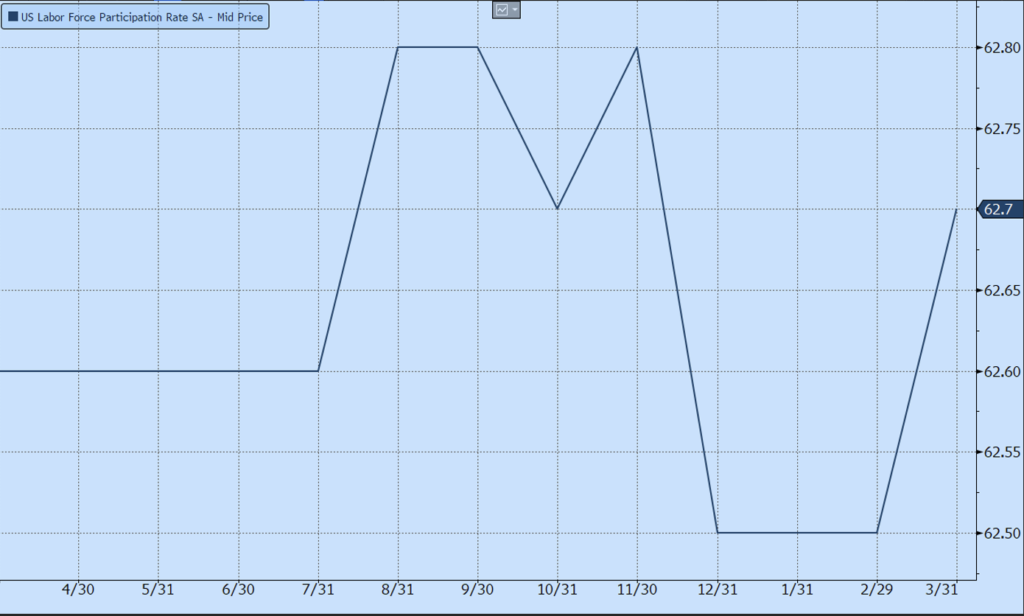

It will be several months and quarters until we fully understand the current economic data. We saw a significant rise in the labor participation last month which is one sign. We are seeing rising delinquencies in consumer credit of fixed-rate, older loans. We are seeing significant erosion in Chinese growth, an export economy. These are by no means definitive indications that we are struggling, but they point to the dichotomy of a growing U.S. economy with the hangover of high inflation. Add in the uncertainty in global events and the election, and for me, it points to a potential for dysfunction in ways that we have not seen before nor have the ability to fully comprehend.

U.S. Debt

On April 2nd, Bloomberg[2] had a piece on the U.S. debt simulation. As a percentage of the GPDPP, we currently sit at 98% of debt to GDP. That figure doesn’t mean much to most people, but it does give a relative sense of size and burden when compared against history. Economies typically go into crisis as this figure gets much above 100%. Given Bloomberg’s simulations, we could get as high as 180% by 2050. Put another way, we will soon be spending more on interest expense than we do on Social Security.

The only thing standing between this scenario and an existential financial crisis is the U.S. Dollar. In short, there is no other place to go. For stability of trade, there is no other currency that can easily replace it, although there are those who are trying. The Euro suffers from years of bad actor countries in their system who risk the breaking of that union. The Yuan is so deeply manipulated that it cannot be trusted to act as a market mechanism. The only reasonable, and likely, substitute is a hybrid cryptocurrency that has some aspects of both crypto and fiat. That said, I am not aware of one today but it doesn’t mean it cannot be created.

But this is just one looming cliff. Bloomberg also put together a strong piece on the cost of climate resilience[3]. They estimate it will run in the tens of trillions of dollars, and higher. By way of reference, our entire U.S. debt is $34 trillion. So double that and keep on going. And then add growing consumer debt, the explosion of corporate debt that now needs to be refinanced, and you have an uncomfortable recipe for the future. At the very least, entitlements will be cut. At worst, we will be faced with some very hard choices like fixing broken bridges or paying the interest bill for just one day.

So why is the stock market zooming ahead? Maybe that was a pig flying past my window…

– DBM

[1] Greenstein, E. L. (2019). Job: A New Translation. Yale University Press.

[2] https://www.bloomberg.com/news/articles/2024-04-01/us-government-debt-risk-a-million-simulations-show-danger-ahead?srnd=homepage-americas

[3] https://www.bloomberg.com/opinion/articles/2023-11-13/climate-change-266-trillion-to-fight-global-warming-is-a-no-brainer

Disclosures

Investment advisory services offered through Robertson Stephens Wealth Management, LLC (“Robertson Stephens”), an SEC-registered investment advisor. Registration does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. This material is for general informational purposes only and should not be construed as investment, tax or legal advice. It does not constitute a recommendation or offer to buy or sell any security, has not been tailored to the needs of any specific investor, and should not provide the basis for any investment decision. Please consult with your Advisor prior to making any Investment decisions. The information contained herein was carefully compiled from sources believed to be reliable, but Robertson Stephens cannot guarantee its accuracy or completeness. Information, views and opinions are current as of the date of this presentation, are based on the information available at the time, and are subject to change based on market and other conditions. Robertson Stephens assumes no duty to update this information. Unless otherwise noted, any individual opinions presented are those of the author and not necessarily those of Robertson Stephens. Indices are unmanaged and reflect the reinvestment of all income or dividends but do not reflect the deduction of any fees or expenses which would reduce returns. Past performance does not guarantee future results. Forward-looking performance targets or estimates are not guaranteed and may not be achieved. Investing entails risks, including possible loss of principal. Alternative investments are only available to qualified investors and are not suitable for all investors. Alternative investments include risks such as illiquidity, long time horizons, reduced transparency, and significant loss of principal. This material is an investment advisory publication intended for investment advisory clients and prospective clients only. Robertson Stephens only transacts business in states in which it is properly registered or is excluded or exempted from registration. A copy of Robertson Stephens’ current written disclosure brochure filed with the SEC which discusses, among other things, Robertson Stephens’ business practices, services and fees, is available through the SEC’s website at: www.adviserinfo.sec.gov. © 2024 Robertson Stephens Wealth Management, LLC. All rights reserved. Robertson Stephens is a registered trademark of Robertson Stephens Wealth Management, LLC in the United States and elsewhere.