The following is your April 2024 Robertson Stephens Monthly Performance Report.

With the benefit of seeing the first 4 days of trading in May, I can suggest that April was simply a correction for stocks and bonds. By definition, a correction is a pause in the prevailing bullish or bearish market trend. In the current case, the Oct ’23 through Mar ’24 rally suffered what is likely now to be labeled a correction of almost 6% in April as measured by the S&P 500 Index (SPX). Confirming a completed correction requires the market to resume its bullish ways, leading to higher highs on the Index. Following one of the worst days of the month of April and, disconcertingly, the last day of the month, the SPX has rallied over 4.5% in the first 4 trading days of May. Market technicians often note that corrections are two-step A-B-C type declines where segment AB is a false first rally (first 4 days of May?) and segment BC is a decline to new correction lows below point A. That could unfold in May, which is why there has been no flying of the all-clear flag just yet. Either way, we’re still talking about a correction and the bullish consequences following one.

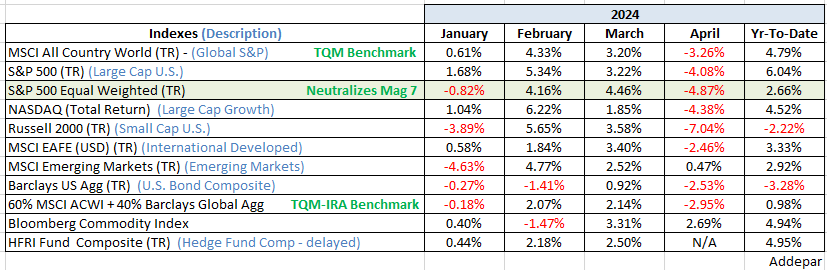

Does the resumption of its bullish ways for the market fit with what’s going on outside the market in terms of economic growth and the Fed? In the near term (weeks/months), I think it does. April was difficult for markets due to a combination of hot inflation data and a first quarter GDP print showing resilient private demand. This combo fueled fears that the Fed will not ease monetary policy as quickly as previously hoped for. See the chart below for the extent of the market’s April dissent.

For most indices (except EM), April saw a greater than 50% retracement of the strong Q1 gains. Expectations have been reset. Any data ahead that shows the slightest softening of the economy and or cooler inflation will likely drive the market to price in more than the one rate cut priced in currently, and lift risk assets in the process.

Last year, I began dividing market forecasts into two time frames; the 6-8 month span that markets typically discount, and beyond that – inside the market’s purview and beyond the market’s purview. Market forecast reliability is almost perfectly correlated with time. The further out on the calendar, the less reliable the forecast. Hence, we try to align portfolios with shorter-term forecasts. However, it is useful to keep tabs on the longer-term forecast, look for deviations between the two, and perhaps anticipate a trend change ahead.

We may be coming up on such a trend change later this year. The technical signals from the market remain on solid footing today. The correction so far (if it isn’t finished) has caused little technical damage. That should be interpreted as the bull market remains in force until further notice. However, the messaging from BCA research, my primary source for longer term forecasts, is getting more cautious. They believe the odds of a recession going into next year are increasing. And rates being higher for longer probably adds reliability to their forecast.

This notion of “forecasts at odds” came up for me again while reading the highlights from Warren Buffet’s conference last week. Berkshire Hathaway’s ever-growing cash pile may be a warning for those who are a little overexuberant on stocks. Berkshire’s cash stockpile surged to a record $189 billion at the end of the first quarter, and Mr. Buffett told shareholders over the weekend that he expects the pile will rise to $200 billion soon: “We’d love to spend it, but we won’t spend it unless we think we’re doing something that has very little risk and can make us a lot of money.”

Source: Addepar, BCA Research, Bloomberg, Ned Davis Research.

Be well,

Mike

Disclosures

Investment advisory services offered through Robertson Stephens Wealth Management, LLC (“Robertson Stephens”), an SEC-registered investment advisor. Registration does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. This material is for general informational purposes only and should not be construed as investment, tax or legal advice. It does not constitute a recommendation or offer to buy or sell any security, has not been tailored to the needs of any specific investor, and should not provide the basis for any investment decision. Please consult with your Advisor prior to making any Investment decisions. The information contained herein was compiled from sources believed to be reliable, but Robertson Stephens does not guarantee its accuracy or completeness. Information, views and opinions are current as of the date of this presentation, are based on the information available at the time, and are subject to change based on market and other conditions. Robertson Stephens assumes no duty to update this information. Unless otherwise noted, any individual opinions presented are those of the author and not necessarily those of Robertson Stephens. Performance may be compared to several indices. Indices are unmanaged and reflect the reinvestment of all income or dividends but do not reflect the deduction of any fees or expenses which would reduce returns. A complete list of Robertson Stephens Investment Office recommendations over the previous 12 months is available upon request. Past performance does not guarantee future results. Forward-looking performance targets or estimates are not guaranteed and may not be achieved. Investing entails risks, including possible loss of principal. Alternative investments are only available to qualified investors and are not suitable for all investors. Alternative investments include risks such as illiquidity, long time horizons, reduced transparency, and significant loss of principal. This material is an investment advisory publication intended for investment advisory clients and prospective clients only. Robertson Stephens only transacts business in states in which it is properly registered or is excluded or exempted from registration. A copy of Robertson Stephens’ current written disclosure brochure filed with the SEC which discusses, among other things, Robertson Stephens’ business practices, services and fees, is available through the SEC’s website at: www.adviserinfo.sec.gov. © 2024 Robertson Stephens Wealth Management, LLC. All rights reserved. Robertson Stephens is a registered trademark of Robertson Stephens Wealth Management, LLC in the United States and elsewhere.