September 12, 2024 – As the first turning leaves herald cooler days, another much-anticipated transition appears imminent—for the first time since March 2020, the Fed is on track to cut interest rates at its September meeting taking place next week. The moment investors and borrowers have long waited for has arrived. But with it comes increasing evidence of an economic slowdown, at once the catalyst for the desired cuts and a growing source of concern for investors. Like all transitions, this shift in monetary policy brings with it uncertainty, and with a US election looming, this fall promises to be anything but dull.

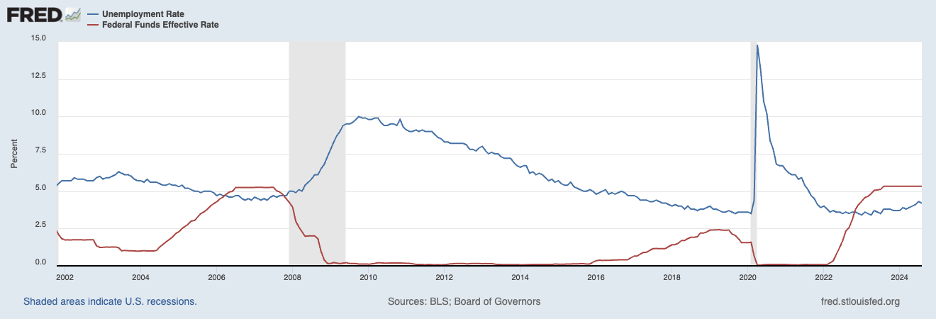

A shift in the interest rate regime marks a turning point in the economic cycle and an opportunity to reflect on how we got here and where we might be going. The US is in the late stage of the economic cycle that began in 2020 with the drastic Covid-19 contraction. Following peak unemployment of almost 15% in April 2020, the US economy saw a strong recovery driven by unprecedented amounts of fiscal and monetary stimulus. These, combined with snarled supply chains and other macro events like the Russia-Ukraine war, fuel a spike in inflation, forcing the Fed to raise interest rates to cool down the economy. This effort finally appears to be bearing fruit, and a growing number of indicators suggest the US economy is gradually slowing down.

An economic slowdown is not yet a recession. To paraphrase Harry Truman, if a recession is when your neighbor loses his job, and a depression is when you lose your job, then a slowdown is when friends of friends lose their jobs. Still, unemployment has been ticking up since July 2023, and with inflation seemingly under control, the Fed is ready to release the monetary reins and allow economic growth to accelerate.

Seemingly overnight, investors have gone from obsessing over when the Fed will begin to cut rates to how steep the cuts will be. Often missing in this conversation is what economic conditions would lead to rapid interest rate cuts. As long as the US economy continues to grow, we expect the Fed to gradually cut rates until it reaches the neutral interest rate— the rate at which it is neither slowing down nor stimulating the economy. This would mean that the economic cycle continues, and rates could even rise again if inflation becomes a problem.

In a darker scenario, the Fed is underestimating the depth of the slowdown, and the US economy is nearing a recession that will not be halted by paltry 25 basis point interest rate cuts. As the magnitude of the slowdown becomes apparent, the Fed will need to increase the pace and size of its cuts in an attempt to stimulate the economy. The Fed will inevitably be accused of waiting ‘too long’ to cut rates. Alternatively, the Fed may be right about the current state of the economy, but an external event like a financial collapse or a geo-political development could push it into a recession.

It is these very uncertainties that have caused the recent stock market fluctuations. As investors try to assess the depth of the slowdown, markets are reacting strongly to every data release and every comment made by Fed officials. Historically, September is the worst month of the year for stocks, and so far, this year is proving to be no exception. As Americans return to their desks to cooler days and fresh reminders of the economic storm clouds forming over the horizon, the impulse to harvest the summer gains is hard to resist.

And yet, data released earlier this month shows that the US economy added 142,000 jobs in August, consistent with an economy that is still growing, albeit at a slower rate than in the past 3.5 years. A recession may be coming, but it is not here yet. What is here is volatility, and that is unlikely to go away anytime soon, especially as the election draws near.

Rather than focus on the exact timing and size of interest rate cuts, investors should focus on the likely direction of interest rates—downward. For those sitting on cash, now is a good time to review upcoming cash needs and consider putting the excess into longer-dated fixed income. Those with existing fixed income portfolios should consider what duration best matches their needs. And all investors should confirm that their portfolios are designed to meet their financial and emotional needs, especially in times of uncertainty.

Wishing everyone a happy and cool return to work and school!

— AMD

Disclosures

Investment advisory services offered through Robertson Stephens Wealth Management, LLC (“Robertson Stephens”), an SEC-registered investment advisor. Registration does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. This material is for general informational purposes only and should not be construed as investment, tax or legal advice. It does not constitute a recommendation or offer to buy or sell any security, has not been tailored to the needs of any specific investor, and should not provide the basis for any investment decision. Please consult with your Advisor prior to making any Investment decisions. The information contained herein was carefully compiled from sources believed to be reliable, but Robertson Stephens cannot guarantee its accuracy or completeness. Information, views and opinions are current as of the date of this presentation, are based on the information available at the time, and are subject to change based on market and other conditions. Robertson Stephens assumes no duty to update this information. Unless otherwise noted, any individual opinions presented are those of the author and not necessarily those of Robertson Stephens. Indices are unmanaged and reflect the reinvestment of all income or dividends but do not reflect the deduction of any fees or expenses which would reduce returns. Past performance does not guarantee future results. Forward-looking performance targets or estimates are not guaranteed and may not be achieved. Investing entails risks, including possible loss of principal. Alternative investments are only available to qualified investors and are not suitable for all investors. Alternative investments include risks such as illiquidity, long time horizons, reduced transparency, and significant loss of principal. This material is an investment advisory publication intended for investment advisory clients and prospective clients only. Robertson Stephens only transacts business in states in which it is properly registered or is excluded or exempted from registration. A copy of Robertson Stephens’ current written disclosure brochure filed with the SEC which discusses, among other things, Robertson Stephens’ business practices, services and fees, is available through the SEC’s website at: www.adviserinfo.sec.gov. © 2024 Robertson Stephens Wealth Management, LLC. All rights reserved. Robertson Stephens is a registered trademark of Robertson Stephens Wealth Management, LLC in the United States and elsewhere.