The following is your August 2024 Robertson Stephens Monthly Performance Report.

August was unusually eventful for investors right from the start and dashed any hopes of a late summer lull. Disappointing U.S. economic data, together with a surprise interest rate hike by the Bank of Japan, sparked a sharp sell-off across the global equity markets. Panic selling is loosely defined as investors of all kinds hitting the sell button on their computers simultaneously without fundamentally knowing why – just that everyone is doing it. There was panic selling of equities around the world in U.S. pre-market trading, early the first Monday of the month – the Japanese equity market was down 12% in their trading session. Fortunately, investors were able to solve the puzzle – now known as the carry-trade unwind – and apply rational price discovery to their buy and sell orders once again. At the end of that day, the S&P 500 Index (SPX) finished down -3.0 %, a minor victory considering the early morning “look”. The SPX finished the week virtually unchanged – a major victory for the bulls.

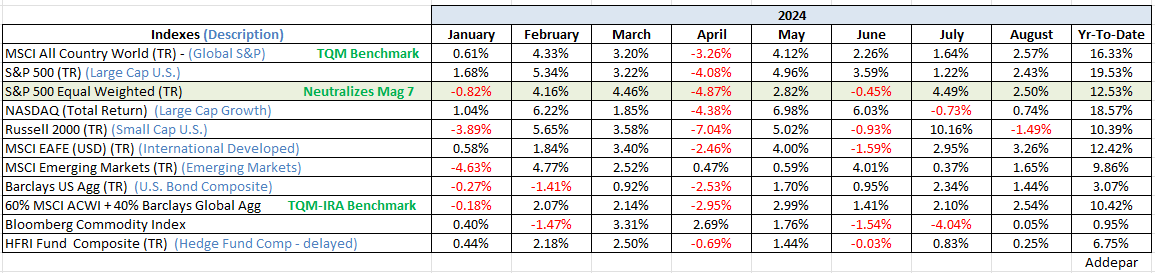

The carry-trade notwithstanding, weaker-than-expected U.S. economic data throughout the month led to a modest growth scare giving investors confidence that the Fed would cut interest rates more than the Fed had already been hinting at. Aggressive rate cut expectations also led investors to believe that the Fed would stick a soft-landing for the economy. The second half of the month was essentially an all-asset (stock, bond, commodity, currency) rally based on the soft-landing narrative. See monthly performance chart below.

As we enter September, as you may have gleaned from recent Morning Notes, I’m not sanguine on equities, and remain bullish on fixed income. My concern is that while the bond market seems to be pricing in a recession, the stock market seems to be pricing in a no-landing and remains within a stone’s throw of its all-time highs.

Be well,

Mike

Sources: Addepar, BCA Research, Bloomberg, and Ned Davis Research

Disclosures

Investment advisory services offered through Robertson Stephens Wealth Management, LLC (“Robertson Stephens”), an SEC-registered investment advisor. Registration does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. This material is for general informational purposes only and should not be construed as investment, tax or legal advice. It does not constitute a recommendation or offer to buy or sell any security, has not been tailored to the needs of any specific investor, and should not provide the basis for any investment decision. Please consult with your Advisor prior to making any Investment decisions. The information contained herein was compiled from sources believed to be reliable, but Robertson Stephens does not guarantee its accuracy or completeness. Information, views and opinions are current as of the date of this presentation, are based on the information available at the time, and are subject to change based on market and other conditions. Robertson Stephens assumes no duty to update this information. Unless otherwise noted, any individual opinions presented are those of the author and not necessarily those of Robertson Stephens. Performance may be compared to several indices. Indices are unmanaged and reflect the reinvestment of all income or dividends but do not reflect the deduction of any fees or expenses which would reduce returns. A complete list of Robertson Stephens Investment Office recommendations over the previous 12 months is available upon request. Past performance does not guarantee future results. Forward-looking performance targets or estimates are not guaranteed and may not be achieved. Investing entails risks, including possible loss of principal. Alternative investments are only available to qualified investors and are not suitable for all investors. Alternative investments include risks such as illiquidity, long time horizons, reduced transparency, and significant loss of principal. This material is an investment advisory publication intended for investment advisory clients and prospective clients only. Robertson Stephens only transacts business in states in which it is properly registered or is excluded or exempted from registration. A copy of Robertson Stephens’ current written disclosure brochure filed with the SEC which discusses, among other things, Robertson Stephens’ business practices, services and fees, is available through the SEC’s website at: www.adviserinfo.sec.gov. © 2024 Robertson Stephens Wealth Management, LLC. All rights reserved. Robertson Stephens is a registered trademark of Robertson Stephens Wealth Management, LLC in the United States and elsewhere.