By Joe Delaney

In the world of finance, the efficient frontier represents a set of optimal portfolios that operate the highest expected return for a defined level of risk. Modern portfolio theory suggests that rational investors will choose a portfolio that lies on this frontier since it provides the best risk-reward trade-off. However, traditional investment strategies primarily focus on liquid assets, such as stocks and bonds, overlooking less liquid investment opportunities like private equity and alternative lending. This essay explores the benefits of venturing into less liquid investments to achieve a superior risk-return profile and enhance the efficiency investing frontier.

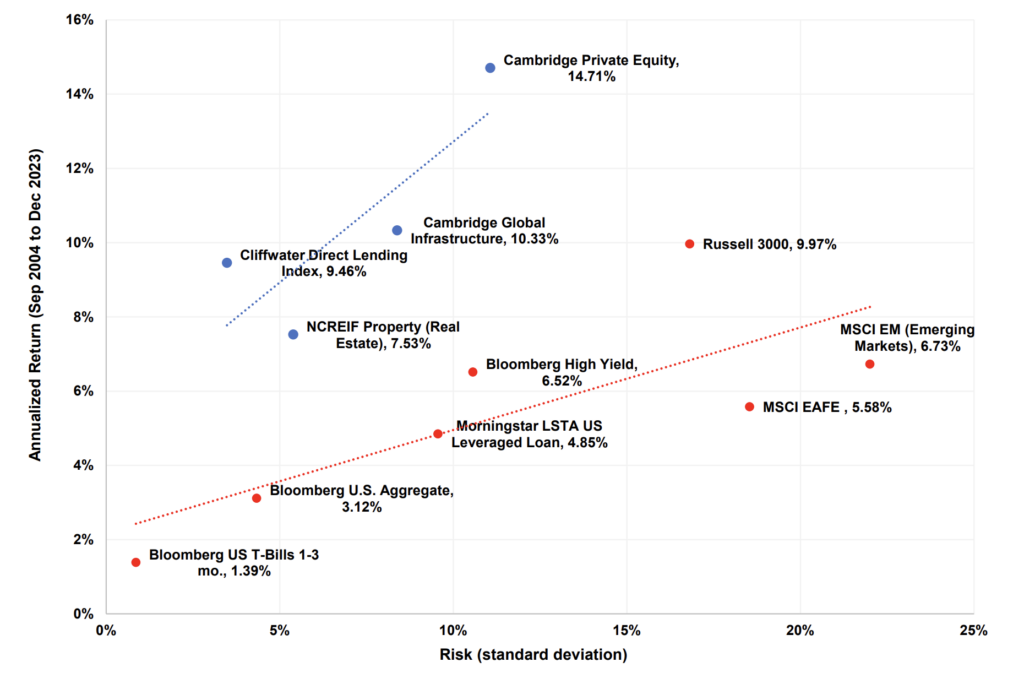

The chart below displays the return and risk for seven traditional public asset classes (red dots) and four private asset classes (blue dots) considered “alternative” by most investors over the last 20 years (September 2004 to December 2023).

Private Equity: The Untapped Potential

Private Equity (PE) investments involve acquiring stakes in privately held companies or public companies with the intention of delisting them from stock exchanges. Despite their illiquid nature, these investments over significant advantages that can improve the overall risk-return characteristics of a portfolio.

- Enhanced Returns: PE investments often target undervalued or underperforming companies, aiming to restructure and improve their operations before exiting at a profit. This value creation approach can yield substantial returns upon successful exits, outperforming traditional public equity markets.

- Diversification Benefits: As PE investments are less correlated with public equity markets, they offer diversification benefits, reducing the overall portfolio risk. Additionally, PE investments span various industries, geographies, and company life cycles, further enhancing the diversification potential.

- Long-Term Investment Horizon: Private equity investments generally have a longer lock-up period, fostering a patient, long-term investment approach that aligns with the interests of the portfolio companies. This long-term focus can help investors capture the full potential of their investments.

Alternative Lending: Opportunities Beyond Traditional Financing

Alternative lending refers to non-traditional financing channels, such as peer-to-peer lending, crowdfunding, and direct lending, which connect borrowers and lenders outside the conventional banking system. Investing in alternative lending offers several advantages over more liquid fixed-income instruments.

- Attractive Yields: By directly connecting borrowers with investors, alternative lending platforms bypass intermediaries, enabling investors to earn higher yields than those offered by traditional fixed-income securities.

- Risk Management: Most alternative lending platforms employ sophisticated risk assessment tools and provide transparency in borrower information, allowing investors to choose their desired risk-return levels. Moreover, diversifying investments across multiple loans can mitigate default risks.

- Access to Untapped Markets: Alternative lending expands access to financing for borrowers who may not qualify for traditional bank loans, enabling investors to tap into previously inaccessible market segments and potentially earn superior returns.

Challenges and Considerations

As the chart above visually demonstrates, less liquid investments such as private equity and alternative lending can improve the risk-return profile of a portfolio. However, they also present the following specific challenges that investors must consider.

1. Liquidity Risk: Investors must be prepared to hold these investments for extended periods, as they often require longer lock-up periods and may be difficult to sell before the investment horizon ends.

2. Limited Information: Compared to public markets, information on private companies and alternative lending platforms may be limited, making it challenging for investors to conduct thorough due diligence.

3. High Minimum Investment: Private equity funds often require significant capital commitments, which may be prohibitive for individual investors.

4. Expenses: Typically, private investments come with higher fees and performance incentives, which must be considered before investing.

Despite these challenges, incorporating less liquid investments like private equity and alternative lending into a diversified portfolio can unlock substantial benefits, ultimately enhancing the efficient investing frontier. By carefully considering risk tolerance, investment goals, costs, and liquidity needs, investors can harness the potential of these alternative asset classes and optimize their risk-adjusted returns.

Disclosures

Investment advisory services offered through Robertson Stephens Wealth Management, LLC (“Robertson Stephens”), an SEC-registered investment advisor. Registration does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. This material is for general informational purposes only and should not be construed as investment, tax or legal advice. It does not constitute a recommendation or offer to buy or sell any security, has not been tailored to the needs of any specific investor, and should not provide the basis for any investment decision. Please consult with your Advisor prior to making any investment decisions. The information contained herein was compiled from sources believed to be reliable, but Robertson Stephens does not guarantee its accuracy or completeness. Information, views and opinions are current as of the date of this presentation, are based on the information available at the time, and are subject to change based on market and other conditions. Robertson Stephens assumes no duty to update this information. Unless otherwise noted, any individual opinions presented are those of the author and not necessarily those of Robertson Stephens. Performance may be compared to several indices. Indices are unmanaged and reflect the reinvestment of all income or dividends but do not reflect the deduction of any fees or expenses which would reduce returns. A complete list of Robertson Stephens Investment Office recommendations over the previous 12 months is available upon request. Past performance does not guarantee future results. Forward-looking performance objectives, targets or estimates are not guaranteed and may not be achieved. Investing entails risks, including possible loss of principal. Alternative investments are speculative and involve substantial risks including significant loss of principal, high illiquidity, long time horizons, uneven growth rates, high fees, onerous tax consequences, limited transparency and limited regulation. Alternative investments are not suitable for all investors and are only available to qualified investors. Please refer to the private placement memorandum for a complete listing and description of terms and risks. This material is an investment advisory publication intended for investment advisory clients and prospective clients only. Robertson Stephens only transacts business in states in which it is properly registered or is excluded or exempted from registration. A copy of Robertson Stephens’ current written disclosure brochure filed with the SEC which discusses, among other things, Robertson Stephens’ business practices, services and fees, is available through the SEC’s website at: www.adviserinfo.sec.gov. © 2024 Robertson Stephens Wealth Management, LLC. All rights reserved. Robertson Stephens is a registered trademark of Robertson Stephens Wealth Management, LLC in the United States and elsewhere.