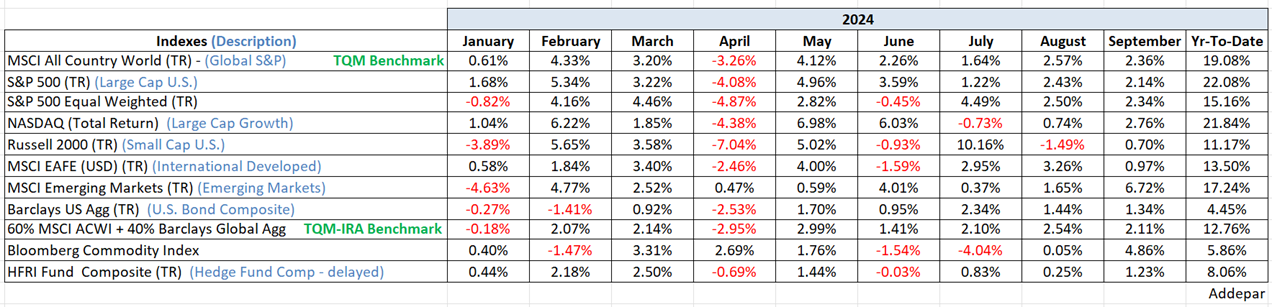

The following is your September 2024 Robertson Stephens Monthly Performance Report.

The chart above has many investors (including me) nervous about valuation and too much of a good thing. History makes a good argument for us to reach for the Prilosec and to stay invested. The S&P 500 Index rose 2.14% in September, bringing its monthly winning streak to five. Stretches like this are rare but not unheard of. This is the 39th case since 1900 and the 30th since 1950.

The question after such a long run is whether the rally has left the market dangerously overbought or will the positive momentum lead to future gains. Consistent with most analyses of the price action of the stock market, history sides with the latter. One month later, the S&P 500 has risen 77% of the time by an average of 1.4%. Six months later, the index rose 85% of the time by an average of 7.1%. One year later, the stats are 84% of the time by an average of 11.7%.

Needless to say, one data set (5 month winning streak) is not enough to overcome investor acrophobia. Bullish trendlines (50 day above 200 day since 2/2023) and leading indicator models (8 out of 10 LEI’s are positive) also confirm that the S&P remains in an uptrend. And it’s important to note that historically, easing cycles into soft landings have been bullish for stocks.

The runway North, and possibly the runaway North (climatic end of cycle melt-up) for stocks into year end continues to look all-clear.

We’ll begin looking at 2025 in Morning Notes next week.

Be well,

Mike

Sources: Addepar, BCA Research, Bloomberg, and Ned Davis Research

Disclosures

Investment advisory services offered through Robertson Stephens Wealth Management, LLC (“Robertson Stephens”), an SEC-registered investment advisor. Registration does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. This material is for general informational purposes only and should not be construed as investment, tax or legal advice. It does not constitute a recommendation or offer to buy or sell any security, has not been tailored to the needs of any specific investor, and should not provide the basis for any investment decision. Please consult with your Advisor prior to making any Investment decisions. The information contained herein was compiled from sources believed to be reliable, but Robertson Stephens does not guarantee its accuracy or completeness. Information, views and opinions are current as of the date of this presentation, are based on the information available at the time, and are subject to change based on market and other conditions. Robertson Stephens assumes no duty to update this information. Unless otherwise noted, any individual opinions presented are those of the author and not necessarily those of Robertson Stephens. Performance may be compared to several indices. Indices are unmanaged and reflect the reinvestment of all income or dividends but do not reflect the deduction of any fees or expenses which would reduce returns. A complete list of Robertson Stephens Investment Office recommendations over the previous 12 months is available upon request. Past performance does not guarantee future results. Forward-looking performance targets or estimates are not guaranteed and may not be achieved. Investing entails risks, including possible loss of principal. Alternative investments are only available to qualified investors and are not suitable for all investors. Alternative investments include risks such as illiquidity, long time horizons, reduced transparency, and significant loss of principal. This material is an investment advisory publication intended for investment advisory clients and prospective clients only. Robertson Stephens only transacts business in states in which it is properly registered or is excluded or exempted from registration. A copy of Robertson Stephens’ current written disclosure brochure filed with the SEC which discusses, among other things, Robertson Stephens’ business practices, services and fees, is available through the SEC’s website at: www.adviserinfo.sec.gov. © 2024 Robertson Stephens Wealth Management, LLC. All rights reserved. Robertson Stephens is a registered trademark of Robertson Stephens Wealth Management, LLC in the United States and elsewhere.