The following is your October 2024 Robertson Stephens Monthly Performance Report.

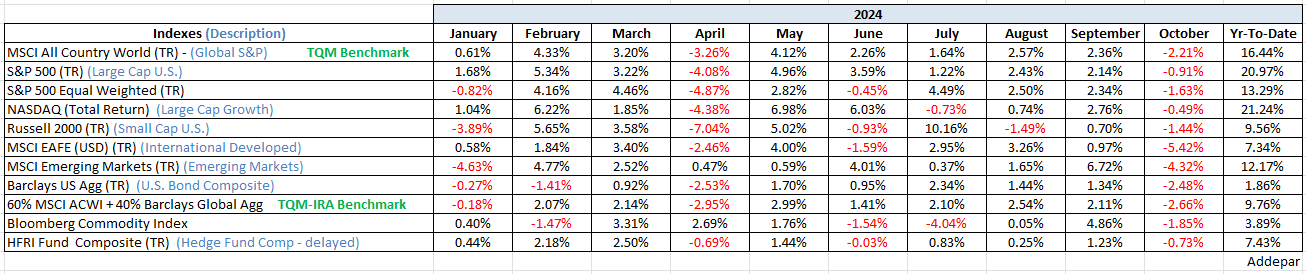

Given that it is already mid-November as I write this note and the likelihood (let’s hope so) that the event of the year just happened (and is still happening), reviewing the month of October is of little value. I will leave October with this; it was an anomalous 10th month of a U.S. presidential election year. That every index was in the red (chart below) was not unusual for the historically worst month of the calendar year, but it was inverted this year. Normally, U.S. equity indices lead the way down globally during a U.S. election year, primarily due to uncertainty. In another example of the markets forecasting the election results correctly, it was the international equity indices (tariffs) and U.S. fixed income (inflation) that suffered out-sized losses.

In a Morning Note earlier this week, we talked about the path of least resistance for the market into year-end as being upward. Maybe not gangbusters up, but the likelihood of a new high to two into year-end is high. Data suggests much of the money on the sidelines ahead of the election has likely been put to work, however, that has usually not prevented the rally from continuing through the end of the year. We also cited two significant divergences (warning signs) inside the current Trump rally and pointed out that they are early signs and normally lead any kind of market top by months. Should the warning signs hold up, the concerns over them are of a Q1-2025 nature.

Every look into a new year has its concerns. I don’t even want to write the R-word, given that I spent much of this year waiting for it to even begin to materialize and was dead wrong. But as a manager of risk, every yearly forecast has to start with the probability of recession (they are called the markets’ widow-maker for a reason) and the chances of one next year appear to be a non-zero probability. The rise in bond yields over the past two months is the most disconcerting, considering the Fed is easing rates. With record national debt, higher bond yields cost more in interest payments to carry that debt. Those interest payments are a direct lag on economic growth, and it is not a linear relationship – it is parabolic. The prospect of a new trade war more than offset the other pro-business parts of Trump’s agenda. With the labor market already weakening going into the election, the odds of a recession have risen for next year.

Even without a recession, valuations are high by any standard of measurement and Warren Buffet is a seller (not to be dismissed imho) – how much upside is there?

Be well,

Mike

Sources: Addepar, BCA Research, Bloomberg, and Ned Davis Research

Disclosures

Investment advisory services offered through Robertson Stephens Wealth Management, LLC (“Robertson Stephens”), an SEC-registered investment advisor. Registration does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. This material is for general informational purposes only and should not be construed as investment, tax or legal advice. It does not constitute a recommendation or offer to buy or sell any security, has not been tailored to the needs of any specific investor, and should not provide the basis for any investment decision. Please consult with your Advisor prior to making any Investment decisions. The information contained herein was compiled from sources believed to be reliable, but Robertson Stephens does not guarantee its accuracy or completeness. Information, views and opinions are current as of the date of this presentation, are based on the information available at the time, and are subject to change based on market and other conditions. Robertson Stephens assumes no duty to update this information. Unless otherwise noted, any individual opinions presented are those of the author and not necessarily those of Robertson Stephens. Performance may be compared to several indices. Indices are unmanaged and reflect the reinvestment of all income or dividends but do not reflect the deduction of any fees or expenses which would reduce returns. A complete list of Robertson Stephens Investment Office recommendations over the previous 12 months is available upon request. Past performance does not guarantee future results. Forward-looking performance targets or estimates are not guaranteed and may not be achieved. Investing entails risks, including possible loss of principal. Alternative investments are only available to qualified investors and are not suitable for all investors. Alternative investments include risks such as illiquidity, long time horizons, reduced transparency, and significant loss of principal. This material is an investment advisory publication intended for investment advisory clients and prospective clients only. Robertson Stephens only transacts business in states in which it is properly registered or is excluded or exempted from registration. A copy of Robertson Stephens’ current written disclosure brochure filed with the SEC which discusses, among other things, Robertson Stephens’ business practices, services and fees, is available through the SEC’s website at: www.adviserinfo.sec.gov. © 2024 Robertson Stephens Wealth Management, LLC. All rights reserved. Robertson Stephens is a registered trademark of Robertson Stephens Wealth Management, LLC in the United States and elsewhere.