The following is your December 2024 Robertson Stephens Monthly Performance Report.

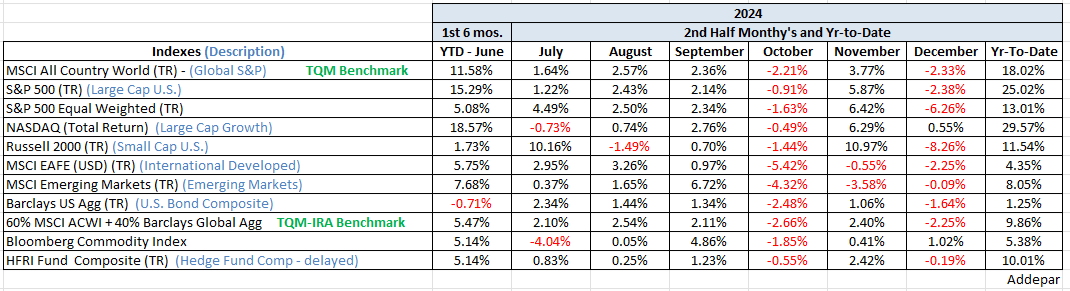

2024 was another impressive year for risk assets. Again, like last year, U.S. mega cap tech stocks dominated global markets. The tech-heavy, cap-weighted S&P 500 Index, and the tech-heavier NASQAQ led all other equity indices by a wide margin. Continued U.S. strength helped globally developed markets in equities deliver a +18.02% return. A late in the year rally in Chinese equities, along with strong results in India and Taiwan, helped emerging markets deliver +8.05%. International Developed markets, by contrast, were up only half that (+4.35%). Commodities were held back by weak demand in China and the broad commodity index delivered +5.4%. However, concern over the U.S. fiscal direction led to a strong performance from gold, which ended the year with returns of 27.1%. Central banks started normalizing policy in 2024. This would usually provide a boost to bond prices and lower yields. However, resilient economic growth and sticky inflation reduced expectations for how quickly rate cuts would be delivered. Rising yields late in the year meant the U.S. bond market returns would be just above breakeven at +1.25%. Overall, positive but unequally distributed returns on the year … again.

How unequal? The top 10 stocks in the S&P 500 account for a record high 39% of the cap weighted index. The late in the year rotation back into mega-cap Growth stocks rekindled the debate over market concentration and its side effects. The good news for holders of cap-weighted ETFs (which are in client portfolios) is that the strength has produced fantastic returns. The bad news is that it is difficult to outperform an all-equity index benchmark like the S&P 500 Index. A wealth manager would have to abandon all principles of diversification just to keep up. 2024 set another record low for the number of stocks beating the S&P 500 Index; the previous record was 2023. The average stock in 2024 was up 8%, which looks great against the historical average return for stocks of 6%. But against the S&P return of +25.02%?

Look at the return of the 60/40 benchmark below. Was it relatively easy to beat the less than +10% return bogey of the benchmark; yes, and we beat it by a few 100 basis points. But +11-12% looks like a failure compared to 25% for the S&P. It is not a failure; it is risk management. Some investors will no doubt grow frustrated, abandon their strategy of diversification, and load up on Apple and Nvidia. I don’t know what the outcome of that decision would be. I do know that with valuations at all-time record highs, that there has never been a worse time to consider it.

Be well,

Mike

Sources: Addepar, BCA Research, Bloomberg, and Ned Davis Research

Disclosures

Investment advisory services offered through Robertson Stephens Wealth Management, LLC (“Robertson Stephens”), an SEC-registered investment advisor. Registration does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. This material is for general informational purposes only and should not be construed as investment, tax or legal advice. It does not constitute a recommendation or offer to buy or sell any security, has not been tailored to the needs of any specific investor, and should not provide the basis for any investment decision. Please consult with your Advisor prior to making any Investment decisions. The information contained herein was compiled from sources believed to be reliable, but Robertson Stephens does not guarantee its accuracy or completeness. Information, views and opinions are current as of the date of this presentation, are based on the information available at the time, and are subject to change based on market and other conditions. Robertson Stephens assumes no duty to update this information. Unless otherwise noted, any individual opinions presented are those of the author and not necessarily those of Robertson Stephens. Performance may be compared to several indices. Indices are unmanaged and reflect the reinvestment of all income or dividends but do not reflect the deduction of any fees or expenses which would reduce returns. A complete list of Robertson Stephens Investment Office recommendations over the previous 12 months is available upon request. Past performance does not guarantee future results. Forward-looking performance targets or estimates are not guaranteed and may not be achieved. Investing entails risks, including possible loss of principal. Alternative investments are only available to qualified investors and are not suitable for all investors. Alternative investments include risks such as illiquidity, long time horizons, reduced transparency, and significant loss of principal. This material is an investment advisory publication intended for investment advisory clients and prospective clients only. Robertson Stephens only transacts business in states in which it is properly registered or is excluded or exempted from registration. A copy of Robertson Stephens’ current written disclosure brochure filed with the SEC which discusses, among other things, Robertson Stephens’ business practices, services and fees, is available through the SEC’s website at: www.adviserinfo.sec.gov. © 2024 Robertson Stephens Wealth Management, LLC. All rights reserved. Robertson Stephens is a registered trademark of Robertson Stephens Wealth Management, LLC in the United States and elsewhere.