By Avi Deutsch

January 10, 2025 – Few began 2024 feeling optimistic about the US economy. The year that began shortly after fighting in the Middle East erupted, joining the Ukraine War as a source of geopolitical uncertainty; the year after the Fed rate hit its highest level since 2000; the year that promised a contentious general election.

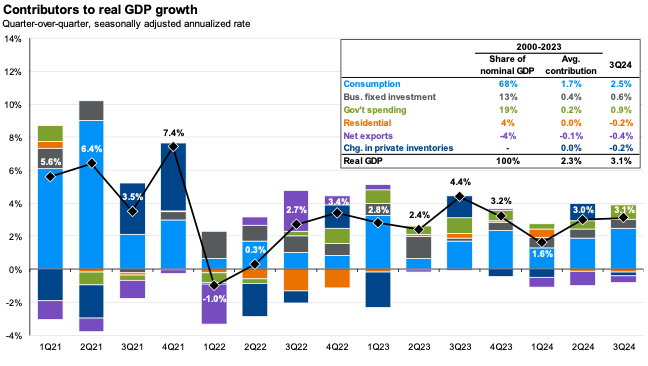

However, none of these forces proved a formidable challenge to the US economy, or more precisely, to the US consumer. GDP grew 3.1% in Q3, with personal consumption accounting for 80% of the growth (see Chart 1), and indications of holiday spending suggest a strong Q4. Soft landing achieved.

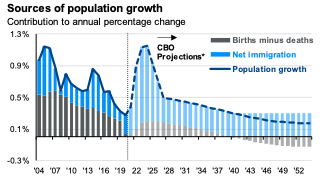

The growth in consumer spending is closely tied to the strength of the labor market, which, despite some signs of weakness, proved resilient to higher interest rates. Unemployment remained low at 4.2% in November, real wages continued to grow, and employers added an average of 183,000 new jobs per month. Importantly, much of the increase in the working population came from immigration, as the native-born US population, especially those of working age, continues to shrink.

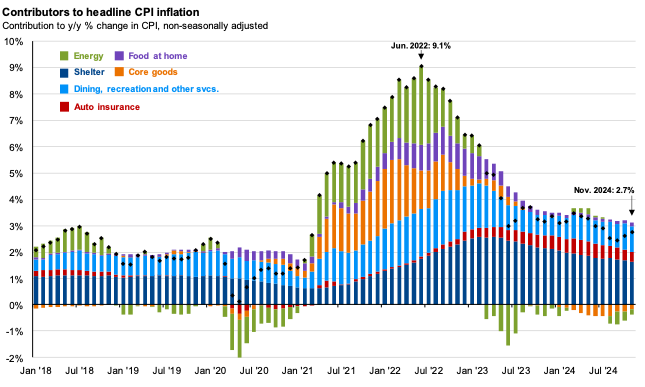

The strong job market did not prevent inflation from continuing to cool, bucking the traditional relationship economists hypothesize between inflation and employment via the Phillips curve. The Consumer Price Index (CPI) hit 2.7% in November, still well above the Fed’s 2% target, but well below the 2022 peak of 9.1% and continuing to trend downwards. As seen in Chart 3, the largest contributor to inflation was housing, followed by the service industry, and car insurance. Because of delayed reporting on housing, and a stabilization in the auto insurance industry, there is hope inflation will continue to decline. However, there’s reason to believe it will remain above 2021 levels due to stronger economic growth and tariffs if these are implemented.

In all, the US economy is wrapping up a year of remarkable economic growth, especially in light of the weak economic performance in Europe and China. Europe faces structural issues that challenge its ability to continue growing without radical policy changes (more on this in my piece with our Chief Economist, Jeanette Garretty, Europe Has a Growth Problem, Should you Care). China’s economic woes suggest an end to a period of extraordinary growth driven by market reforms, manufacturing growth, and warm relations with the US. Today’s China features more state control over businesses and capital, an aging population with low consumption rates, and a tense relationship with the US. How the leaders of these two economic blocks, Europe and China, respond to these challenges, will shape the global economic and geopolitical landscape for years to come.

The strength of the US economy also sets it on different monetary policy paths than much of the world. While Europe and China are poised to continue lowering interest rates and easing monetary conditions, the path of US rates is increasingly called into question by the stronger economy. While the Fed has said it expects to continue cutting rates through 2027, investors are betting the Fed will stop cutting rates after this year due to strong growth or the return of higher inflation.

The Markets

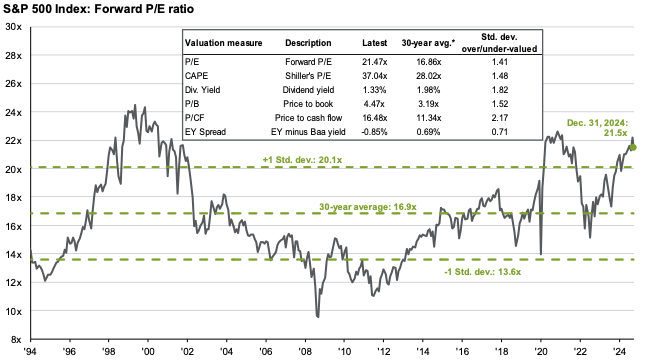

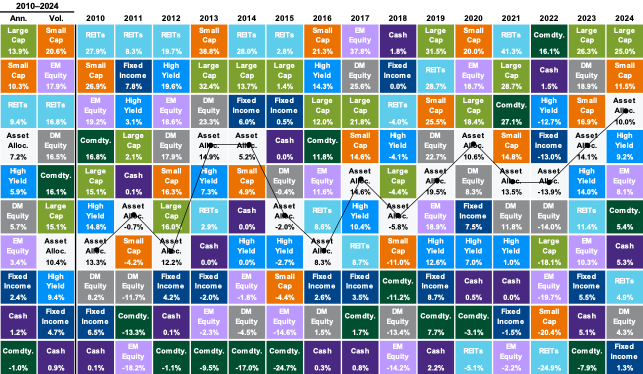

This past year marked another excellent year for US equities, particularly large-cap stocks. The S&P 500 rose an impressive 25% in 2024, while US small-cap stocks, represented by the Russell 2000, grew 11.5%. Though corporate earnings have been strong, the S&P 500 is now priced at a 21.5x multiple of future earnings, or roughly 1.5 standard deviations away from its historical average of 17x (see Chart 4). While forward PE ratios are a poor indicator of stock market performance in the immediate future, they are more strongly correlated with performance over the next five years, suggesting that US stocks will struggle to replicate the outstanding performance of the past years.

International stocks did not fare as well in 2024. Non-US development markets, namely Europe and Japan, returned only 4.3% for the year while emerging markets delivered an 8.1% return. These results reflect the differing economic trajectories described above, as well as investor sentiment favoring the US as an outlier of economic and stock market performance. While P/E ratios are more attractive outside the US, without a catalyst to change investors’ sentiment, performance may continue to lag.

While stock market investors had many reasons to rejoice in 2024, bond market investors faced another challenging year. Even as the Fed lowered its benchmark rate, longer term rates rose across the yield curve in expectation of higher government deficits and inflationary pressures. The result was a modest gain of 1.3% in the Bloomberg US Agg. High yield bonds performed better, delivering an 9.2% return. Despite the uneven performance, higher yields present investors with opportunities not seen since pre-2008, especially by holding individual bonds in separately managed accounts.

The Outlook

With 2024 now firmly in the rear-view mirror, attention turns to the future. Top of mind for many investors and economies is the new-old Trump administration and the range of campaign promises it carries into office including, tax cuts, deportations, and tariffs. How many of these policies become a reality remains to be seen, and Republican’s narrow majority in the House has already proved challenging. Economists have warned of the potential negative impact of some proposed policies, but the US economy’s strong starting position offers some reassurance.

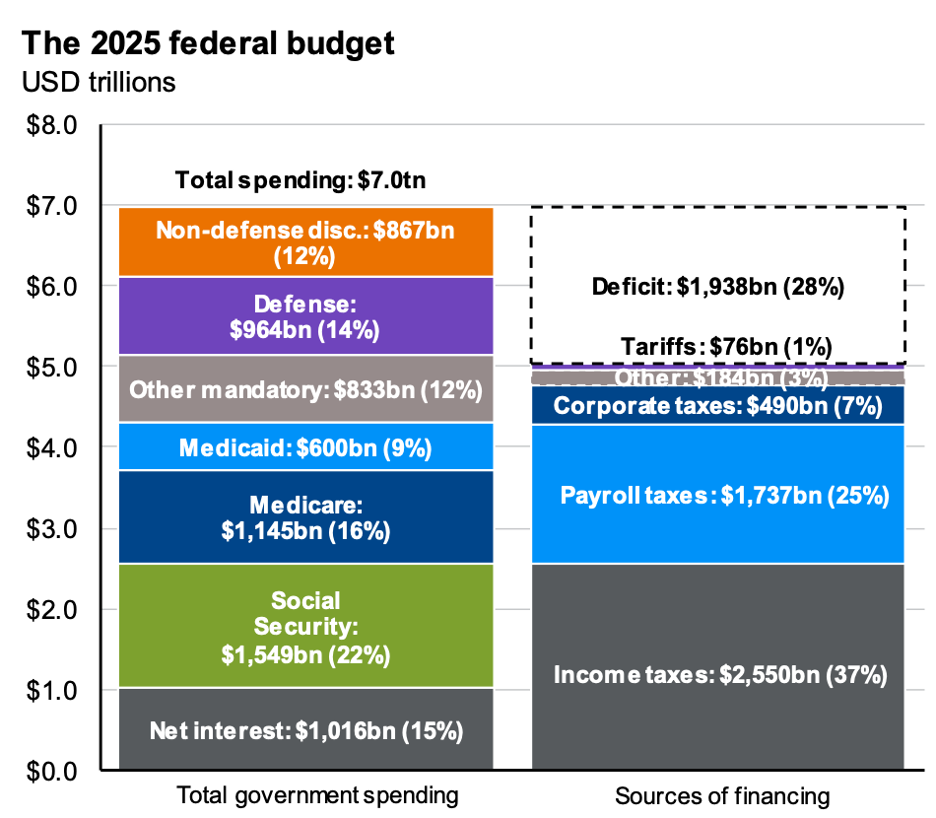

In addition to the challenges on Capitol Hill, the new administration inherits a debt-laden and a deficit-producing federal government in a time of strong economic growth. It remains to be seen whether this admin will choose or be forced by investors to deal with this challenge. And what a challenge it is. With Medicare, Medicaid, Social Security, debt servicing, defense, and other mandatory spending accounting for 88% of the Federal budget, it’s hard to see many paths forward that don’t include higher taxes.

Finally, geopolitical risks continue to hang over the ‘long peace’ that has reigned (unevenly) since the end of World War II. The economic weakening of Europe and China presents challenges to the current world order, with rouge states like Iran and Russia standing ready and able to exploit the power vacuum. Joining the fray is a US president with an untraditional leadership style and independent notions of allies and foes. How these assets (liabilities) will serve the Trump 2.0 administration remains to be seen. One thing is certain: it won’t be boring.

With that, I wish you all a cozy winter and a happy and peaceful 2025!

— AMD

Sources: J.P. Morgan Guide to the Markets – U.S. Data are as of December 31, 2024, Robertson Stephens Investment Office, Bureau of Labor Statistics

Disclosures

Investment advisory services offered through Robertson Stephens Wealth Management, LLC (“Robertson Stephens”), an SEC-registered investment advisor. Registration does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. This material is for general informational purposes only and should not be construed as investment, tax or legal advice. It does not constitute a recommendation or offer to buy or sell any security, has not been tailored to the needs of any specific investor, and should not provide the basis for any investment decision. Please consult with your Advisor prior to making any Investment decisions. The information contained herein was carefully compiled from sources believed to be reliable, but Robertson Stephens cannot guarantee its accuracy or completeness. Information, views and opinions are current as of the date of this presentation, are based on the information available at the time, and are subject to change based on market and other conditions. Robertson Stephens assumes no duty to update this information. Unless otherwise noted, any individual opinions presented are those of the author and not necessarily those of Robertson Stephens. Indices are unmanaged and reflect the reinvestment of all income or dividends but do not reflect the deduction of any fees or expenses which would reduce returns. Past performance does not guarantee future results. Forward-looking performance targets or estimates are not guaranteed and may not be achieved. Investing entails risks, including possible loss of principal. Alternative investments are only available to qualified investors and are not suitable for all investors. Alternative investments include risks such as illiquidity, long time horizons, reduced transparency, and significant loss of principal. This material is an investment advisory publication intended for investment advisory clients and prospective clients only. Robertson Stephens only transacts business in states in which it is properly registered or is excluded or exempted from registration. A copy of Robertson Stephens’ current written disclosure brochure filed with the SEC which discusses, among other things, Robertson Stephens’ business practices, services and fees, is available through the SEC’s website at: www.adviserinfo.sec.gov. © 2025 Robertson Stephens Wealth Management, LLC. All rights reserved. Robertson Stephens is a registered trademark of Robertson Stephens Wealth Management, LLC in the United States and elsewhere.